Halozyme Therapeutics (NASDAQ:HALO - Get Free Report) had its price objective upped by investment analysts at JMP Securities from $72.00 to $73.00 in a research note issued to investors on Friday, Benzinga reports. The firm presently has a "market outperform" rating on the biopharmaceutical company's stock. JMP Securities' price objective indicates a potential upside of 27.73% from the company's previous close.

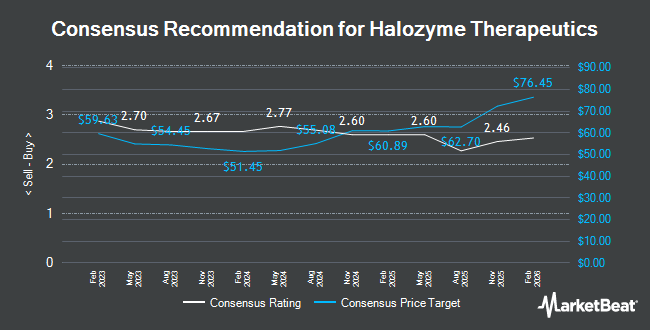

Several other research analysts have also recently issued reports on HALO. TD Cowen raised their target price on shares of Halozyme Therapeutics from $59.00 to $65.00 and gave the stock a "buy" rating in a report on Wednesday, August 7th. HC Wainwright boosted their price objective on Halozyme Therapeutics from $65.00 to $68.00 and gave the company a "buy" rating in a report on Friday. Morgan Stanley upped their target price on Halozyme Therapeutics from $59.00 to $64.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 7th. Cowen restated a "buy" rating on shares of Halozyme Therapeutics in a research report on Friday, October 18th. Finally, The Goldman Sachs Group lifted their target price on shares of Halozyme Therapeutics from $44.00 to $49.00 and gave the company a "neutral" rating in a report on Monday, July 22nd. Four analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, Halozyme Therapeutics has a consensus rating of "Moderate Buy" and a consensus target price of $61.00.

Read Our Latest Report on HALO

Halozyme Therapeutics Stock Performance

Shares of NASDAQ HALO traded up $6.58 during midday trading on Friday, reaching $57.15. The company had a trading volume of 3,403,967 shares, compared to its average volume of 1,285,522. The stock has a market cap of $7.24 billion, a P/E ratio of 21.40, a P/E/G ratio of 0.49 and a beta of 1.27. The company has a current ratio of 7.41, a quick ratio of 6.21 and a debt-to-equity ratio of 5.19. Halozyme Therapeutics has a 1 year low of $33.15 and a 1 year high of $65.53. The business's 50-day simple moving average is $57.10 and its 200 day simple moving average is $51.81.

Halozyme Therapeutics (NASDAQ:HALO - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The biopharmaceutical company reported $0.91 earnings per share for the quarter, beating analysts' consensus estimates of $0.73 by $0.18. The business had revenue of $231.40 million for the quarter, compared to analyst estimates of $204.94 million. Halozyme Therapeutics had a return on equity of 195.80% and a net margin of 38.62%. The company's revenue was up 4.7% on a year-over-year basis. During the same period in the prior year, the company earned $0.68 earnings per share. On average, analysts forecast that Halozyme Therapeutics will post 3.71 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, SVP Michael J. Labarre sold 10,000 shares of Halozyme Therapeutics stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $53.26, for a total value of $532,600.00. Following the sale, the senior vice president now directly owns 173,756 shares of the company's stock, valued at $9,254,244.56. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. In related news, SVP Michael J. Labarre sold 10,000 shares of the business's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $53.26, for a total transaction of $532,600.00. Following the transaction, the senior vice president now directly owns 173,756 shares in the company, valued at approximately $9,254,244.56. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, Director Matthew L. Posard sold 9,881 shares of the stock in a transaction dated Wednesday, August 14th. The shares were sold at an average price of $57.70, for a total transaction of $570,133.70. Following the completion of the sale, the director now owns 69,874 shares of the company's stock, valued at approximately $4,031,729.80. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 89,881 shares of company stock worth $5,169,834 in the last 90 days. Insiders own 2.40% of the company's stock.

Hedge Funds Weigh In On Halozyme Therapeutics

A number of institutional investors and hedge funds have recently added to or reduced their stakes in HALO. GAMMA Investing LLC raised its holdings in shares of Halozyme Therapeutics by 96.6% during the 2nd quarter. GAMMA Investing LLC now owns 517 shares of the biopharmaceutical company's stock worth $27,000 after acquiring an additional 254 shares during the period. International Assets Investment Management LLC acquired a new position in Halozyme Therapeutics in the 2nd quarter valued at about $33,000. Whittier Trust Co. acquired a new position in Halozyme Therapeutics in the 1st quarter valued at about $27,000. Skandinaviska Enskilda Banken AB publ acquired a new stake in shares of Halozyme Therapeutics during the 2nd quarter worth approximately $49,000. Finally, Toth Financial Advisory Corp purchased a new stake in shares of Halozyme Therapeutics during the 3rd quarter valued at approximately $57,000. Institutional investors and hedge funds own 97.79% of the company's stock.

About Halozyme Therapeutics

(

Get Free Report)

Halozyme Therapeutics, Inc, a biopharma technology platform company, researches, develops, and commercializes proprietary enzymes and devices in the United States, Switzerland, Belgium, Japan, and internationally. The company's products are based on the patented recombinant human hyaluronidase enzyme (rHuPH20) that enables delivery of injectable biologics, such as monoclonal antibodies and other therapeutic molecules, as well as small molecules and fluids.

Featured Articles

Before you consider Halozyme Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halozyme Therapeutics wasn't on the list.

While Halozyme Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.