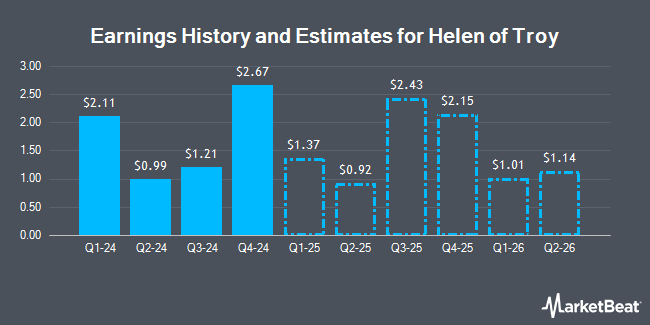

Helen of Troy Limited (NASDAQ:HELE - Free Report) - Equities research analysts at Zacks Research reduced their Q3 2025 earnings per share estimates for shares of Helen of Troy in a report issued on Wednesday, October 23rd. Zacks Research analyst R. Department now expects that the company will post earnings of $2.38 per share for the quarter, down from their prior estimate of $2.58. The consensus estimate for Helen of Troy's current full-year earnings is $6.39 per share. Zacks Research also issued estimates for Helen of Troy's Q1 2026 earnings at $1.07 EPS, Q2 2026 earnings at $1.18 EPS, Q4 2026 earnings at $1.89 EPS, FY2026 earnings at $6.77 EPS, Q1 2027 earnings at $1.02 EPS, Q2 2027 earnings at $1.12 EPS and FY2027 earnings at $6.86 EPS.

Helen of Troy (NASDAQ:HELE - Get Free Report) last posted its quarterly earnings data on Wednesday, October 9th. The company reported $1.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.05 by $0.16. Helen of Troy had a return on equity of 9.31% and a net margin of 7.35%. The company had revenue of $474.20 million during the quarter, compared to analysts' expectations of $458.85 million. During the same quarter in the previous year, the business earned $1.45 EPS. Helen of Troy's revenue was down 3.5% compared to the same quarter last year.

A number of other equities analysts have also recently issued reports on the company. Canaccord Genuity Group restated a "buy" rating and set a $84.00 price objective on shares of Helen of Troy in a report on Monday, October 7th. DA Davidson lifted their target price on Helen of Troy from $67.00 to $71.00 and gave the company a "neutral" rating in a research report on Thursday, October 10th. UBS Group decreased their target price on Helen of Troy from $100.00 to $72.00 and set a "neutral" rating for the company in a research report on Wednesday, July 10th. Finally, StockNews.com lowered Helen of Troy from a "buy" rating to a "hold" rating in a research report on Wednesday, July 10th.

View Our Latest Report on Helen of Troy

Helen of Troy Trading Up 2.3 %

HELE traded up $1.49 during trading hours on Monday, reaching $66.03. 315,020 shares of the company's stock traded hands, compared to its average volume of 449,621. The firm has a 50-day moving average price of $59.92 and a 200 day moving average price of $76.52. Helen of Troy has a 52-week low of $48.05 and a 52-week high of $127.83. The company has a quick ratio of 0.85, a current ratio of 1.77 and a debt-to-equity ratio of 0.45. The firm has a market capitalization of $1.51 billion, a PE ratio of 11.04, a PEG ratio of 1.26 and a beta of 0.86.

Helen of Troy declared that its Board of Directors has initiated a stock buyback plan on Thursday, September 5th that allows the company to buyback $500.00 million in outstanding shares. This buyback authorization allows the company to purchase up to 39.8% of its shares through open market purchases. Shares buyback plans are often a sign that the company's board of directors believes its stock is undervalued.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in the stock. State of Alaska Department of Revenue raised its position in shares of Helen of Troy by 395.5% in the 3rd quarter. State of Alaska Department of Revenue now owns 13,018 shares of the company's stock worth $805,000 after acquiring an additional 10,391 shares in the last quarter. Louisiana State Employees Retirement System raised its position in shares of Helen of Troy by 64.2% in the 3rd quarter. Louisiana State Employees Retirement System now owns 11,000 shares of the company's stock worth $680,000 after acquiring an additional 4,300 shares in the last quarter. Signaturefd LLC acquired a new position in Helen of Troy during the 3rd quarter valued at about $61,000. Evernest Financial Advisors LLC acquired a new position in Helen of Troy during the 3rd quarter valued at about $775,000. Finally, Net Worth Advisory Group acquired a new position in Helen of Troy during the 3rd quarter valued at about $413,000.

About Helen of Troy

(

Get Free Report)

Helen of Troy Limited provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates in two segments: Home & Outdoor and Beauty & Wellness. The Home & Outdoor segment offers food storage containers, kitchen utensils for cooking and preparing salads, fruits, vegetables and meats, graters, slicers and choppers, baking essentials, kitchen organization, bath, cleaning, infant and toddler products, and coffee preparation tools and electronics; and insulated beverageware, including bottles, travel tumblers, drinkware, mugs, food and lunch containers, insulated totes, soft coolers, outdoor kitchenware, and accessories.

Further Reading

Before you consider Helen of Troy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helen of Troy wasn't on the list.

While Helen of Troy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.