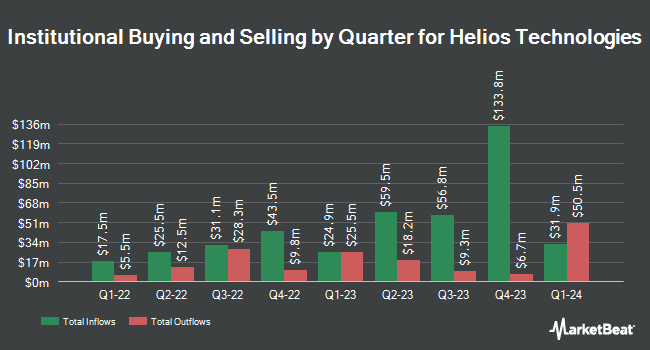

Raymond James & Associates boosted its position in shares of Helios Technologies, Inc. (NASDAQ:HLIO - Free Report) by 31.6% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 73,272 shares of the company's stock after acquiring an additional 17,611 shares during the period. Raymond James & Associates owned about 0.22% of Helios Technologies worth $3,495,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Isthmus Partners LLC grew its stake in shares of Helios Technologies by 1.1% during the second quarter. Isthmus Partners LLC now owns 63,669 shares of the company's stock worth $30,000 after purchasing an additional 670 shares in the last quarter. Innealta Capital LLC acquired a new position in shares of Helios Technologies during the 2nd quarter worth about $35,000. nVerses Capital LLC boosted its position in shares of Helios Technologies by 200.0% during the 3rd quarter. nVerses Capital LLC now owns 1,200 shares of the company's stock worth $57,000 after acquiring an additional 800 shares in the last quarter. Canada Pension Plan Investment Board purchased a new position in shares of Helios Technologies in the 2nd quarter valued at about $110,000. Finally, EntryPoint Capital LLC purchased a new stake in Helios Technologies during the first quarter worth approximately $133,000. Institutional investors and hedge funds own 94.72% of the company's stock.

Helios Technologies Stock Performance

NASDAQ:HLIO traded up $1.02 during mid-day trading on Monday, reaching $48.97. 204,879 shares of the stock were exchanged, compared to its average volume of 205,120. The stock has a market capitalization of $1.63 billion, a P/E ratio of 53.28 and a beta of 0.84. Helios Technologies, Inc. has a 1 year low of $37.50 and a 1 year high of $54.06. The company has a 50 day simple moving average of $45.42 and a 200-day simple moving average of $46.33. The company has a quick ratio of 1.49, a current ratio of 2.92 and a debt-to-equity ratio of 0.56.

Helios Technologies (NASDAQ:HLIO - Get Free Report) last announced its earnings results on Monday, August 5th. The company reported $0.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.61 by $0.03. The business had revenue of $219.90 million for the quarter, compared to analyst estimates of $215.80 million. Helios Technologies had a net margin of 3.58% and a return on equity of 7.71%. The company's revenue for the quarter was down 3.4% compared to the same quarter last year. During the same period last year, the firm posted $0.81 earnings per share. Analysts anticipate that Helios Technologies, Inc. will post 2.3 earnings per share for the current fiscal year.

Helios Technologies Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, October 21st. Shareholders of record on Friday, October 4th were paid a dividend of $0.09 per share. This represents a $0.36 annualized dividend and a yield of 0.74%. The ex-dividend date of this dividend was Friday, October 4th. Helios Technologies's dividend payout ratio is presently 40.00%.

Wall Street Analysts Forecast Growth

HLIO has been the subject of several recent analyst reports. KeyCorp downgraded shares of Helios Technologies from an "overweight" rating to a "sector weight" rating in a research report on Tuesday, July 9th. Stifel Nicolaus reduced their price target on shares of Helios Technologies from $64.00 to $63.00 and set a "buy" rating for the company in a research report on Wednesday, October 16th.

Get Our Latest Stock Analysis on Helios Technologies

Helios Technologies Profile

(

Free Report)

Helios Technologies, Inc, together with its subsidiaries, provides engineered motion control and electronic control technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Hydraulics and Electronics. The Hydraulics segment offers cartridge valve technology products to control rates and direction of fluid flow, and to regulate and control pressures for industrial and mobile applications; hydraulic quick release coupling solutions for the agriculture, construction equipment, and industrial markets; motion control technology and fluid conveyance technology; cartridge valve technology; engineered solutions for machine users, manufacturers, or designers.

Further Reading

Before you consider Helios Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helios Technologies wasn't on the list.

While Helios Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.