Harmonic (NASDAQ:HLIT - Get Free Report) had its price target dropped by analysts at Rosenblatt Securities from $18.00 to $16.00 in a research note issued to investors on Tuesday, Benzinga reports. The firm currently has a "buy" rating on the communications equipment provider's stock. Rosenblatt Securities' price objective suggests a potential upside of 44.14% from the stock's current price.

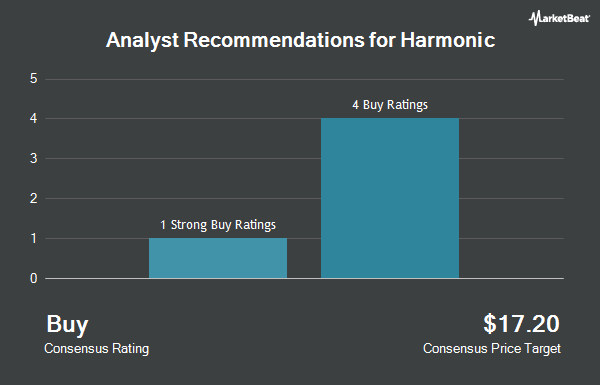

HLIT has been the topic of a number of other reports. Needham & Company LLC restated a "buy" rating and issued a $18.00 price target on shares of Harmonic in a report on Tuesday. Northland Securities dropped their price objective on Harmonic from $16.00 to $14.00 and set an "outperform" rating on the stock in a research note on Tuesday. Raymond James lowered Harmonic from a "strong-buy" rating to an "outperform" rating and dropped their price objective for the company from $17.00 to $14.00 in a research note on Tuesday. Finally, Barclays decreased their target price on Harmonic from $20.00 to $17.00 and set an "overweight" rating on the stock in a research report on Tuesday. Two analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $15.25.

Get Our Latest Stock Analysis on HLIT

Harmonic Price Performance

HLIT traded down $3.72 during trading on Tuesday, hitting $11.10. The company's stock had a trading volume of 7,260,338 shares, compared to its average volume of 1,523,462. The stock has a market capitalization of $1.25 billion, a price-to-earnings ratio of 18.50 and a beta of 0.87. Harmonic has a 12 month low of $9.10 and a 12 month high of $15.46. The company has a quick ratio of 1.32, a current ratio of 1.87 and a debt-to-equity ratio of 0.30. The firm's 50 day moving average price is $14.06 and its two-hundred day moving average price is $12.57.

Harmonic (NASDAQ:HLIT - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The communications equipment provider reported $0.26 EPS for the quarter, topping analysts' consensus estimates of $0.17 by $0.09. Harmonic had a return on equity of 0.27% and a net margin of 10.22%. The business had revenue of $195.80 million during the quarter, compared to analysts' expectations of $181.77 million. During the same period in the previous year, the firm earned ($0.05) earnings per share. The firm's quarterly revenue was up 53.9% compared to the same quarter last year. Sell-side analysts forecast that Harmonic will post 0.44 earnings per share for the current fiscal year.

Insider Transactions at Harmonic

In other news, SVP Neven Haltmayer sold 40,000 shares of the firm's stock in a transaction dated Wednesday, July 31st. The stock was sold at an average price of $14.41, for a total value of $576,400.00. Following the completion of the sale, the senior vice president now directly owns 122,211 shares in the company, valued at $1,761,060.51. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Corporate insiders own 2.20% of the company's stock.

Hedge Funds Weigh In On Harmonic

Several hedge funds have recently modified their holdings of HLIT. CWM LLC raised its holdings in shares of Harmonic by 780.9% in the 2nd quarter. CWM LLC now owns 2,255 shares of the communications equipment provider's stock worth $27,000 after purchasing an additional 1,999 shares during the period. GAMMA Investing LLC raised its holdings in Harmonic by 117.6% during the 3rd quarter. GAMMA Investing LLC now owns 2,448 shares of the communications equipment provider's stock valued at $36,000 after acquiring an additional 1,323 shares during the period. Innealta Capital LLC bought a new stake in Harmonic during the 2nd quarter valued at $47,000. SageView Advisory Group LLC bought a new stake in Harmonic during the 1st quarter valued at $114,000. Finally, Verdence Capital Advisors LLC bought a new stake in Harmonic during the 2nd quarter valued at $140,000. Institutional investors own 99.38% of the company's stock.

Harmonic Company Profile

(

Get Free Report)

Harmonic Inc, together with its subsidiaries, provides broadband solutions worldwide. The company operates through Broadband and Video segments. The Broadband segment sells broadband access solutions and related services, including cOS software-based broadband access solutions to broadband operators; and cOS central cloud services, a subscription service for cOS customers.

Featured Articles

Before you consider Harmonic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmonic wasn't on the list.

While Harmonic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.