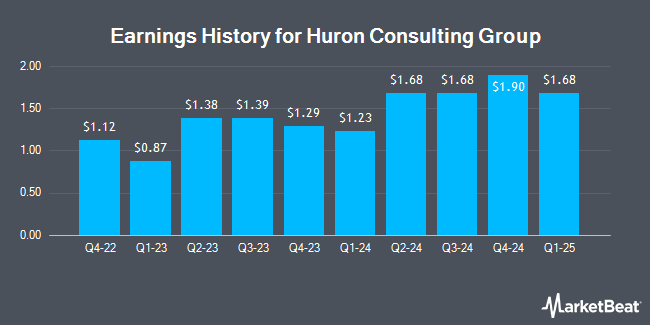

Huron Consulting Group (NASDAQ:HURN - Get Free Report) posted its quarterly earnings data on Tuesday. The business services provider reported $1.68 earnings per share for the quarter, beating the consensus estimate of $1.57 by $0.11, Briefing.com reports. Huron Consulting Group had a return on equity of 20.44% and a net margin of 5.46%. The business had revenue of $370.00 million during the quarter, compared to the consensus estimate of $377.63 million. During the same period in the prior year, the company earned $1.39 earnings per share. The company's revenue was up 3.3% compared to the same quarter last year. Huron Consulting Group updated its FY24 guidance to $6.00-$6.20 EPS and its FY 2024 guidance to 6.000-6.200 EPS.

Huron Consulting Group Price Performance

Shares of HURN traded up $11.16 during trading hours on Wednesday, reaching $116.15. The company had a trading volume of 168,654 shares, compared to its average volume of 124,687. The company has a market capitalization of $2.09 billion, a price-to-earnings ratio of 33.47 and a beta of 0.61. Huron Consulting Group has a 12-month low of $84.26 and a 12-month high of $118.10. The firm has a 50 day simple moving average of $107.06 and a 200-day simple moving average of $100.45. The company has a current ratio of 1.93, a quick ratio of 1.93 and a debt-to-equity ratio of 0.99.

Wall Street Analysts Forecast Growth

Several analysts have commented on the company. Benchmark reaffirmed a "buy" rating and set a $140.00 price objective on shares of Huron Consulting Group in a research note on Wednesday. StockNews.com raised shares of Huron Consulting Group from a "sell" rating to a "hold" rating in a research note on Saturday, August 3rd. Finally, Barrington Research reaffirmed an "outperform" rating and issued a $137.00 target price on shares of Huron Consulting Group in a report on Monday, September 9th. One investment analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, Huron Consulting Group has an average rating of "Moderate Buy" and a consensus price target of $131.75.

Check Out Our Latest Report on HURN

Insider Buying and Selling

In related news, CEO C. Mark Hussey sold 4,000 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The stock was sold at an average price of $103.13, for a total value of $412,520.00. Following the completion of the transaction, the chief executive officer now directly owns 81,081 shares of the company's stock, valued at $8,361,883.53. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other news, Director H Eugene Lockhart sold 1,042 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $109.48, for a total value of $114,078.16. Following the sale, the director now directly owns 29,882 shares in the company, valued at $3,271,481.36. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO C. Mark Hussey sold 4,000 shares of Huron Consulting Group stock in a transaction that occurred on Monday, August 12th. The stock was sold at an average price of $103.13, for a total value of $412,520.00. Following the transaction, the chief executive officer now owns 81,081 shares of the company's stock, valued at $8,361,883.53. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 11,168 shares of company stock valued at $1,170,515. Corporate insiders own 2.02% of the company's stock.

Huron Consulting Group Company Profile

(

Get Free Report)

Huron Consulting Group Inc, a professional services firm, provides consultancy services in the United States and internationally. It operates through three segments: Healthcare, Education, and Commercial. The Healthcare segment provides financial and operational performance improvement consulting services; digital offerings, spanning technology and analytic-related services; software products; organizational transformation services; revenue cycle managed and outsourcing services; financial and capital advisory consulting services; and strategy and innovation consulting services to national and regional health systems, academic and community health systems, federal health system, public, children's and critical access hospitals, physician practices and medical groups, payors, and long-term care or post-acute providers.

Further Reading

Before you consider Huron Consulting Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huron Consulting Group wasn't on the list.

While Huron Consulting Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.