Huron Consulting Group (NASDAQ:HURN - Get Free Report) issued an update on its FY 2024 earnings guidance on Tuesday morning. The company provided earnings per share (EPS) guidance of 6.000-6.200 for the period, compared to the consensus estimate of 6.000. The company issued revenue guidance of $1.5 billion-$1.5 billion, compared to the consensus revenue estimate of $1.5 billion. Huron Consulting Group also updated its FY24 guidance to $6.00-$6.20 EPS.

Wall Street Analysts Forecast Growth

HURN has been the topic of several analyst reports. Barrington Research restated an "outperform" rating and issued a $137.00 target price on shares of Huron Consulting Group in a research report on Monday, September 9th. StockNews.com upgraded shares of Huron Consulting Group from a "sell" rating to a "hold" rating in a research note on Saturday, August 3rd. Finally, Benchmark reiterated a "buy" rating and issued a $140.00 target price on shares of Huron Consulting Group in a research report on Wednesday, July 31st. One research analyst has rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, Huron Consulting Group has a consensus rating of "Moderate Buy" and an average target price of $131.75.

View Our Latest Stock Analysis on Huron Consulting Group

Huron Consulting Group Stock Up 0.8 %

Huron Consulting Group stock traded up $0.85 during mid-day trading on Tuesday, hitting $104.99. The company's stock had a trading volume of 104,553 shares, compared to its average volume of 124,477. The company has a debt-to-equity ratio of 0.99, a current ratio of 1.93 and a quick ratio of 1.93. Huron Consulting Group has a 52-week low of $84.26 and a 52-week high of $115.65. The firm's 50 day moving average is $107.07 and its 200 day moving average is $100.37. The company has a market cap of $1.89 billion, a PE ratio of 30.26 and a beta of 0.61.

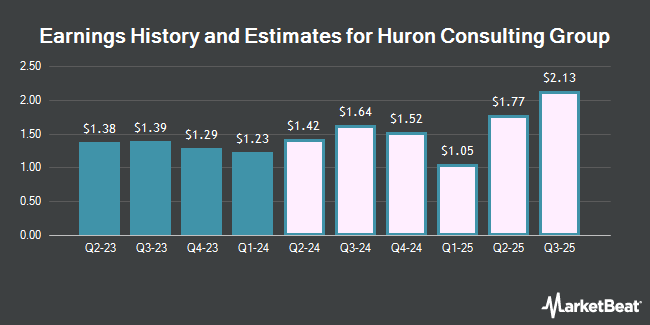

Huron Consulting Group (NASDAQ:HURN - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The business services provider reported $1.68 EPS for the quarter, topping the consensus estimate of $1.62 by $0.06. The business had revenue of $370.00 million during the quarter, compared to analysts' expectations of $377.63 million. Huron Consulting Group had a net margin of 5.46% and a return on equity of 20.44%. The firm's quarterly revenue was up 3.3% compared to the same quarter last year. During the same period last year, the company posted $1.39 earnings per share. On average, analysts anticipate that Huron Consulting Group will post 5.95 earnings per share for the current year.

Insider Transactions at Huron Consulting Group

In other news, Director H Eugene Lockhart sold 1,042 shares of the firm's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $108.27, for a total transaction of $112,817.34. Following the completion of the sale, the director now directly owns 28,840 shares of the company's stock, valued at $3,122,506.80. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. In other news, Director H Eugene Lockhart sold 1,042 shares of the stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $108.27, for a total transaction of $112,817.34. Following the transaction, the director now owns 28,840 shares in the company, valued at $3,122,506.80. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO C. Mark Hussey sold 4,000 shares of Huron Consulting Group stock in a transaction on Monday, August 12th. The shares were sold at an average price of $103.13, for a total transaction of $412,520.00. Following the completion of the sale, the chief executive officer now directly owns 81,081 shares of the company's stock, valued at approximately $8,361,883.53. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 11,168 shares of company stock valued at $1,170,515. 2.02% of the stock is owned by insiders.

Huron Consulting Group Company Profile

(

Get Free Report)

Huron Consulting Group Inc, a professional services firm, provides consultancy services in the United States and internationally. It operates through three segments: Healthcare, Education, and Commercial. The Healthcare segment provides financial and operational performance improvement consulting services; digital offerings, spanning technology and analytic-related services; software products; organizational transformation services; revenue cycle managed and outsourcing services; financial and capital advisory consulting services; and strategy and innovation consulting services to national and regional health systems, academic and community health systems, federal health system, public, children's and critical access hospitals, physician practices and medical groups, payors, and long-term care or post-acute providers.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Huron Consulting Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huron Consulting Group wasn't on the list.

While Huron Consulting Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.