Pinnacle Associates Ltd. decreased its holdings in IAC Inc. (NASDAQ:IAC - Free Report) by 32.1% in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 152,445 shares of the company's stock after selling 72,072 shares during the quarter. Pinnacle Associates Ltd. owned 0.19% of IAC worth $7,985,000 as of its most recent filing with the SEC.

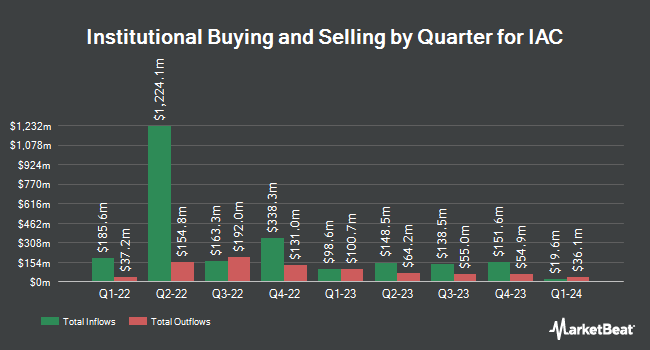

A number of other hedge funds and other institutional investors also recently made changes to their positions in IAC. Tandem Capital Management Corp ADV raised its position in IAC by 0.6% in the second quarter. Tandem Capital Management Corp ADV now owns 47,222 shares of the company's stock worth $2,192,000 after purchasing an additional 260 shares in the last quarter. Greenwich Wealth Management LLC raised its holdings in shares of IAC by 3.0% in the 2nd quarter. Greenwich Wealth Management LLC now owns 9,635 shares of the company's stock worth $451,000 after buying an additional 284 shares in the last quarter. Nisa Investment Advisors LLC grew its position in IAC by 2.7% in the third quarter. Nisa Investment Advisors LLC now owns 15,475 shares of the company's stock valued at $833,000 after acquiring an additional 405 shares during the period. CWM LLC raised its stake in IAC by 55.6% during the second quarter. CWM LLC now owns 1,142 shares of the company's stock worth $54,000 after acquiring an additional 408 shares in the last quarter. Finally, GAMMA Investing LLC lifted its holdings in shares of IAC by 98.8% during the third quarter. GAMMA Investing LLC now owns 990 shares of the company's stock valued at $53,000 after acquiring an additional 492 shares during the period. 88.90% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of brokerages recently issued reports on IAC. UBS Group upgraded shares of IAC to a "hold" rating in a research report on Monday. Citigroup cut their target price on shares of IAC from $70.00 to $66.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. KeyCorp decreased their price target on IAC from $67.00 to $66.00 and set an "overweight" rating on the stock in a research report on Friday, August 16th. Barclays cut their price objective on IAC from $73.00 to $70.00 and set an "overweight" rating for the company in a research report on Thursday, August 8th. Finally, Benchmark restated a "buy" rating and issued a $110.00 target price on shares of IAC in a research note on Tuesday, August 27th. Two analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, IAC has a consensus rating of "Moderate Buy" and an average price target of $76.40.

Read Our Latest Research Report on IAC

IAC Trading Down 6.0 %

IAC stock traded down $3.05 during midday trading on Thursday, reaching $47.95. The stock had a trading volume of 1,014,510 shares, compared to its average volume of 657,896. The firm has a market cap of $3.85 billion, a price-to-earnings ratio of -32.28 and a beta of 1.32. IAC Inc. has a twelve month low of $41.39 and a twelve month high of $58.29. The company has a quick ratio of 2.68, a current ratio of 2.68 and a debt-to-equity ratio of 0.29. The business has a fifty day simple moving average of $52.34 and a two-hundred day simple moving average of $50.72.

IAC (NASDAQ:IAC - Get Free Report) last issued its quarterly earnings results on Tuesday, August 6th. The company reported ($1.71) EPS for the quarter, missing the consensus estimate of ($0.32) by ($1.39). IAC had a negative return on equity of 2.35% and a negative net margin of 3.95%. The business had revenue of $949.50 million for the quarter, compared to analyst estimates of $942.77 million. During the same quarter in the prior year, the firm earned ($0.76) EPS. The firm's quarterly revenue was down 14.6% compared to the same quarter last year. As a group, research analysts expect that IAC Inc. will post -0.79 EPS for the current fiscal year.

IAC Profile

(

Free Report)

IAC Inc, together with its subsidiaries, operates as a media and internet company worldwide. The company publishes original and engaging digital content in the form of articles, illustrations, and videos and images across entertainment, food, home, beauty, travel, health, family, luxury, and fashion areas; and magazines related to women and lifestyle.

See Also

Before you consider IAC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAC wasn't on the list.

While IAC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.