State of Alaska Department of Revenue lifted its holdings in Integra LifeSciences Holdings Co. (NASDAQ:IART - Free Report) by 144.3% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 131,751 shares of the life sciences company's stock after buying an additional 77,825 shares during the quarter. State of Alaska Department of Revenue owned approximately 0.17% of Integra LifeSciences worth $2,393,000 at the end of the most recent quarter.

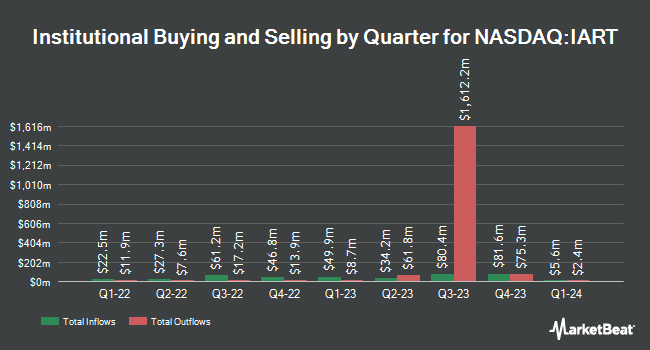

A number of other large investors also recently bought and sold shares of the business. State of Michigan Retirement System grew its stake in Integra LifeSciences by 2.5% in the 1st quarter. State of Michigan Retirement System now owns 16,690 shares of the life sciences company's stock worth $592,000 after acquiring an additional 400 shares in the last quarter. CWM LLC boosted its holdings in shares of Integra LifeSciences by 50.8% in the second quarter. CWM LLC now owns 1,262 shares of the life sciences company's stock valued at $37,000 after purchasing an additional 425 shares during the period. Blue Trust Inc. grew its stake in Integra LifeSciences by 100.5% in the second quarter. Blue Trust Inc. now owns 886 shares of the life sciences company's stock worth $26,000 after purchasing an additional 444 shares in the last quarter. CANADA LIFE ASSURANCE Co increased its holdings in Integra LifeSciences by 1.1% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 49,762 shares of the life sciences company's stock worth $1,764,000 after purchasing an additional 551 shares during the period. Finally, Texas Permanent School Fund Corp raised its position in Integra LifeSciences by 1.5% during the 1st quarter. Texas Permanent School Fund Corp now owns 59,524 shares of the life sciences company's stock valued at $2,110,000 after purchasing an additional 870 shares in the last quarter. Hedge funds and other institutional investors own 84.78% of the company's stock.

Integra LifeSciences Stock Up 2.8 %

Shares of IART stock traded up $0.52 during trading hours on Friday, reaching $19.28. 2,158,353 shares of the company's stock were exchanged, compared to its average volume of 1,086,783. The stock has a market cap of $1.50 billion, a PE ratio of 66.48, a PEG ratio of 0.66 and a beta of 1.09. The company has a current ratio of 3.39, a quick ratio of 2.10 and a debt-to-equity ratio of 1.17. The stock's fifty day moving average price is $18.62 and its two-hundred day moving average price is $24.57. Integra LifeSciences Holdings Co. has a 1 year low of $16.81 and a 1 year high of $45.42.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on IART. Bank of America dropped their price target on Integra LifeSciences from $26.00 to $18.00 and set an "underperform" rating on the stock in a research report on Monday, October 7th. Truist Financial cut their target price on shares of Integra LifeSciences from $26.00 to $21.00 and set a "hold" rating on the stock in a research report on Monday, October 14th. Citigroup lowered their price target on shares of Integra LifeSciences from $20.00 to $16.00 and set a "sell" rating for the company in a research report on Tuesday, October 1st. BTIG Research raised shares of Integra LifeSciences from a "sell" rating to a "neutral" rating in a report on Monday, October 7th. Finally, Morgan Stanley lifted their price target on Integra LifeSciences from $24.00 to $27.00 and gave the company an "underweight" rating in a report on Monday, July 15th. Three analysts have rated the stock with a sell rating, five have issued a hold rating and two have given a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $26.50.

View Our Latest Analysis on IART

Integra LifeSciences Profile

(

Free Report)

Integra LifeSciences Holdings Corporation manufactures and sells surgical instruments, neurosurgical products, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology. It operates in two segments, Codman Specialty Surgical and Tissue Technologies. The company offers neurosurgery and neuro critical care products, including tissue ablation equipment, dural repair products, cerebral spinal fluid management devices, intracranial monitoring equipment, and cranial stabilization equipment; and surgical headlamps and instrumentation, as well as after-market services.

Featured Articles

Before you consider Integra LifeSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Integra LifeSciences wasn't on the list.

While Integra LifeSciences currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.