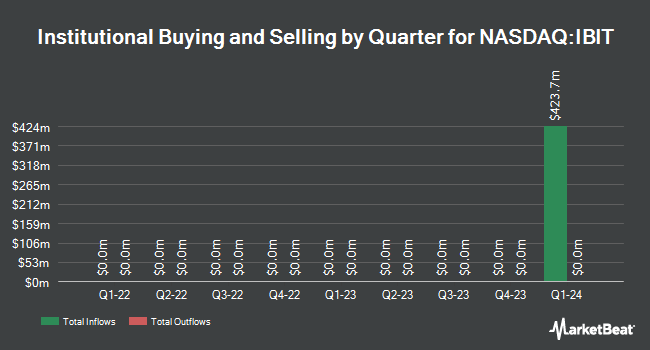

Yong Rong HK Asset Management Ltd trimmed its position in iShares Bitcoin Trust (NASDAQ:IBIT - Free Report) by 15.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 625,601 shares of the company's stock after selling 110,960 shares during the period. iShares Bitcoin Trust makes up approximately 6.5% of Yong Rong HK Asset Management Ltd's holdings, making the stock its 8th biggest holding. Yong Rong HK Asset Management Ltd owned 0.10% of iShares Bitcoin Trust worth $22,603,000 at the end of the most recent quarter.

Several other institutional investors also recently bought and sold shares of the company. Forte Asset Management LLC raised its holdings in shares of iShares Bitcoin Trust by 223.4% in the third quarter. Forte Asset Management LLC now owns 89,705 shares of the company's stock worth $3,241,000 after buying an additional 61,966 shares during the last quarter. Rosenberg Matthew Hamilton raised its holdings in shares of iShares Bitcoin Trust by 47.9% in the third quarter. Rosenberg Matthew Hamilton now owns 2,350 shares of the company's stock worth $85,000 after buying an additional 761 shares during the last quarter. US Bancorp DE raised its holdings in shares of iShares Bitcoin Trust by 19.0% in the third quarter. US Bancorp DE now owns 206,763 shares of the company's stock worth $7,470,000 after buying an additional 32,945 shares during the last quarter. Financial Advocates Investment Management purchased a new position in shares of iShares Bitcoin Trust in the third quarter worth $224,000. Finally, IMC Chicago LLC purchased a new position in shares of iShares Bitcoin Trust in the third quarter worth $323,337,000.

iShares Bitcoin Trust Trading Down 1.0 %

Shares of NASDAQ IBIT traded down $0.41 during midday trading on Friday, reaching $39.37. The company had a trading volume of 49,930,218 shares, compared to its average volume of 30,914,936. The business's 50-day simple moving average is $35.82 and its 200 day simple moving average is $36.06. iShares Bitcoin Trust has a 1 year low of $22.02 and a 1 year high of $41.99.

iShares Bitcoin Trust Profile

(

Free Report)

The IShares Bitcoin Trust Registered (IBIT) is an exchange-traded fund that mostly invests in long btc, short usd currency. The fund is a passively managed fund that seeks to track the spot price of Bitcoin. IBIT was launched on Jan 5, 2024 and is issued by BlackRock.

Further Reading

Before you consider iShares Bitcoin Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iShares Bitcoin Trust wasn't on the list.

While iShares Bitcoin Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.