SG Americas Securities LLC lessened its holdings in Independent Bank Corp. (NASDAQ:INDB - Free Report) by 64.8% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 5,343 shares of the bank's stock after selling 9,843 shares during the quarter. SG Americas Securities LLC's holdings in Independent Bank were worth $316,000 as of its most recent SEC filing.

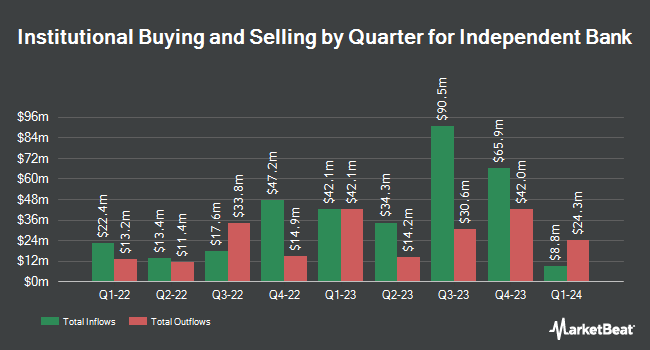

Several other large investors have also added to or reduced their stakes in the business. Goldman Sachs Group Inc. boosted its position in Independent Bank by 5.3% during the fourth quarter. Goldman Sachs Group Inc. now owns 509,236 shares of the bank's stock valued at $33,513,000 after purchasing an additional 25,664 shares during the last quarter. Quantbot Technologies LP acquired a new stake in shares of Independent Bank in the 1st quarter valued at approximately $1,169,000. BNP Paribas Financial Markets grew its stake in shares of Independent Bank by 89.8% in the first quarter. BNP Paribas Financial Markets now owns 23,769 shares of the bank's stock valued at $1,236,000 after buying an additional 11,244 shares in the last quarter. Edgestream Partners L.P. increased its holdings in Independent Bank by 462.0% during the first quarter. Edgestream Partners L.P. now owns 52,784 shares of the bank's stock worth $2,746,000 after buying an additional 43,391 shares during the last quarter. Finally, Virtu Financial LLC bought a new stake in Independent Bank during the first quarter worth $461,000. Institutional investors and hedge funds own 83.40% of the company's stock.

Independent Bank Stock Performance

INDB stock traded down $3.52 during midday trading on Friday, reaching $61.57. 588,907 shares of the company were exchanged, compared to its average volume of 279,765. The firm has a market capitalization of $2.61 billion, a price-to-earnings ratio of 11.89 and a beta of 0.74. The business has a 50-day moving average price of $60.26 and a two-hundred day moving average price of $54.99. Independent Bank Corp. has a one year low of $44.63 and a one year high of $68.75. The company has a debt-to-equity ratio of 0.24, a current ratio of 0.95 and a quick ratio of 0.95.

Independent Bank (NASDAQ:INDB - Get Free Report) last announced its quarterly earnings results on Thursday, October 17th. The bank reported $1.01 EPS for the quarter, beating analysts' consensus estimates of $0.99 by $0.02. The business had revenue of $250.07 million for the quarter, compared to analyst estimates of $173.24 million. Independent Bank had a net margin of 22.42% and a return on equity of 7.41%. During the same quarter in the prior year, the business earned $1.38 EPS. Equities research analysts forecast that Independent Bank Corp. will post 4.49 EPS for the current year.

Independent Bank Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, October 4th. Stockholders of record on Monday, September 30th were given a $0.57 dividend. This represents a $2.28 annualized dividend and a dividend yield of 3.70%. The ex-dividend date of this dividend was Monday, September 30th. Independent Bank's payout ratio is 44.02%.

Analysts Set New Price Targets

Several research firms have recently weighed in on INDB. StockNews.com lowered shares of Independent Bank from a "hold" rating to a "sell" rating in a research note on Tuesday, September 17th. Seaport Res Ptn upgraded Independent Bank from a "hold" rating to a "strong-buy" rating in a research note on Monday, July 22nd.

Check Out Our Latest Research Report on Independent Bank

Independent Bank Profile

(

Free Report)

Independent Bank Corp. operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States. The company provides interest checking, money market, and savings accounts, as well as demand deposits and time certificates of deposit.

Featured Stories

Before you consider Independent Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Independent Bank wasn't on the list.

While Independent Bank currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.