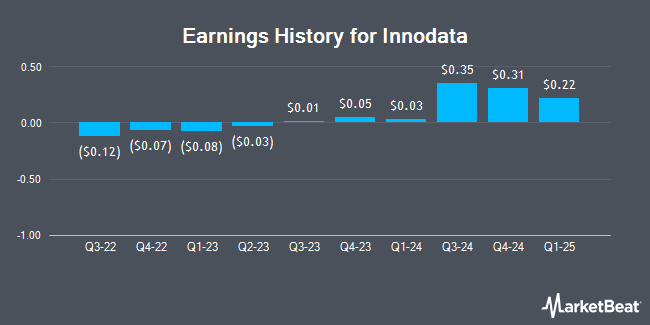

Innodata (NASDAQ:INOD - Get Free Report) is set to announce its earnings results after the market closes on Thursday, November 7th. Analysts expect the company to announce earnings of $0.07 per share for the quarter. Investors interested in registering for the company's conference call can do so using this link.

Innodata Price Performance

INOD stock traded down $1.32 during mid-day trading on Thursday, hitting $20.11. 807,923 shares of the stock were exchanged, compared to its average volume of 612,450. The company has a debt-to-equity ratio of 0.24, a current ratio of 1.45 and a quick ratio of 1.45. The business has a fifty day moving average price of $16.80 and a 200 day moving average price of $14.83. Innodata has a 12 month low of $5.46 and a 12 month high of $21.90. The stock has a market capitalization of $582.97 million, a price-to-earnings ratio of 223.44 and a beta of 2.31.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on INOD shares. Maxim Group started coverage on Innodata in a research note on Monday, July 15th. They set a "buy" rating and a $30.00 price target for the company. StockNews.com raised Innodata to a "sell" rating in a research note on Wednesday, October 23rd. BWS Financial boosted their target price on Innodata from $24.00 to $30.00 and gave the company a "buy" rating in a research note on Friday, August 9th. Finally, Craig Hallum began coverage on Innodata in a research note on Tuesday, September 17th. They issued a "buy" rating and a $23.00 target price for the company. One research analyst has rated the stock with a sell rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, Innodata currently has an average rating of "Moderate Buy" and an average price target of $27.67.

View Our Latest Research Report on INOD

Innodata Company Profile

(

Get Free Report)

Innodata Inc operates as a global data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally. The company operates through three segments: Digital Data Solutions (DDS), Synodex, and Agility. The DDS segment engages in the provision of artificial intelligence (AI) data preparation services; collecting or creating training data; annotating training data; and training AI algorithms for its customers, as well as AI model deployment and integration services.

Featured Articles

Before you consider Innodata, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innodata wasn't on the list.

While Innodata currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.