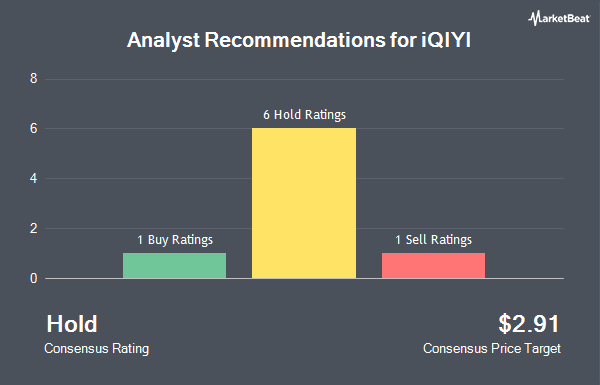

Shares of iQIYI, Inc. (NASDAQ:IQ - Get Free Report) have been assigned an average rating of "Reduce" from the five analysts that are currently covering the company, MarketBeat reports. One research analyst has rated the stock with a sell rating and four have assigned a hold rating to the company. The average 1-year price objective among brokers that have updated their coverage on the stock in the last year is $3.45.

Several research analysts recently commented on the stock. Nomura Securities upgraded shares of iQIYI to a "hold" rating in a report on Monday, August 26th. HSBC cut iQIYI from a "hold" rating to a "reduce" rating and cut their price objective for the stock from $4.70 to $3.00 in a research report on Tuesday, July 23rd. Benchmark lowered shares of iQIYI from a "buy" rating to a "hold" rating in a research report on Friday, August 23rd. The Goldman Sachs Group downgraded shares of iQIYI from a "buy" rating to a "neutral" rating and set a $2.80 price target for the company. in a report on Tuesday, August 27th. Finally, Hsbc Global Res cut iQIYI from a "hold" rating to a "moderate sell" rating in a report on Tuesday, July 23rd.

Read Our Latest Research Report on iQIYI

Institutional Trading of iQIYI

A number of institutional investors and hedge funds have recently modified their holdings of the stock. Genesis Investment Management LLP raised its position in shares of iQIYI by 112.1% during the third quarter. Genesis Investment Management LLP now owns 16,582,183 shares of the company's stock worth $47,425,000 after purchasing an additional 8,765,711 shares during the period. Quarry LP bought a new position in iQIYI in the second quarter valued at approximately $18,075,000. Maple Rock Capital Partners Inc. lifted its stake in iQIYI by 65.4% in the first quarter. Maple Rock Capital Partners Inc. now owns 10,320,000 shares of the company's stock valued at $43,654,000 after buying an additional 4,080,000 shares in the last quarter. Federated Hermes Inc. boosted its holdings in shares of iQIYI by 18.9% in the second quarter. Federated Hermes Inc. now owns 16,057,035 shares of the company's stock valued at $58,929,000 after buying an additional 2,549,287 shares during the period. Finally, The Manufacturers Life Insurance Company increased its position in shares of iQIYI by 185.4% during the second quarter. The Manufacturers Life Insurance Company now owns 2,126,099 shares of the company's stock worth $7,803,000 after acquiring an additional 1,381,265 shares in the last quarter. 52.69% of the stock is owned by institutional investors.

iQIYI Stock Down 6.9 %

iQIYI stock traded down $0.18 during trading hours on Friday, hitting $2.43. The company had a trading volume of 14,764,927 shares, compared to its average volume of 11,505,864. iQIYI has a fifty-two week low of $1.92 and a fifty-two week high of $5.80. The company has a debt-to-equity ratio of 0.67, a current ratio of 0.53 and a quick ratio of 0.53. The firm has a market capitalization of $2.33 billion, a P/E ratio of 10.17, a price-to-earnings-growth ratio of 0.73 and a beta of 0.07. The firm's fifty day moving average is $2.42 and its 200-day moving average is $3.49.

iQIYI (NASDAQ:IQ - Get Free Report) last announced its quarterly earnings results on Thursday, August 22nd. The company reported $0.01 EPS for the quarter, missing the consensus estimate of $0.06 by ($0.05). The firm had revenue of $1.03 billion during the quarter, compared to the consensus estimate of $1.02 billion. iQIYI had a net margin of 5.37% and a return on equity of 14.57%. During the same period in the previous year, the firm posted $0.05 EPS. On average, research analysts forecast that iQIYI will post 0.16 earnings per share for the current year.

iQIYI Company Profile

(

Get Free ReportiQIYI, Inc, together with its subsidiaries, provides online entertainment video services in the People's Republic of China. It offers various products and services, including online video, online games, online literature, animations, and other products. The company operates a platform that provides a collection of internet video content, such as professionally produced content licensed from professional content providers and self-produced content.

Featured Articles

Before you consider iQIYI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iQIYI wasn't on the list.

While iQIYI currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.