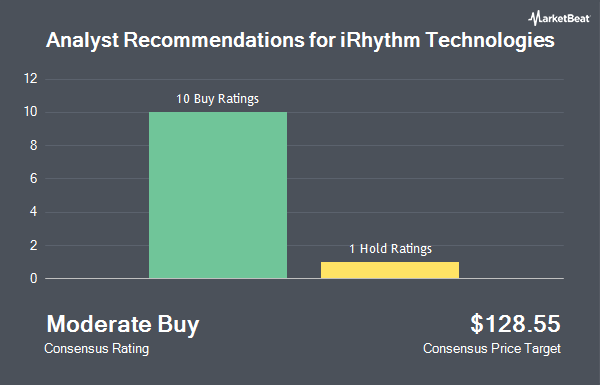

iRhythm Technologies, Inc. (NASDAQ:IRTC - Get Free Report) has received an average rating of "Moderate Buy" from the ten analysts that are presently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a hold rating and nine have issued a buy rating on the company. The average 1 year price target among brokerages that have issued a report on the stock in the last year is $111.60.

Several research analysts have weighed in on IRTC shares. Robert W. Baird decreased their price objective on shares of iRhythm Technologies from $120.00 to $110.00 and set an "outperform" rating for the company in a report on Friday, August 2nd. Morgan Stanley decreased their price objective on shares of iRhythm Technologies from $135.00 to $130.00 and set an "overweight" rating for the company in a report on Monday, July 15th. Needham & Company LLC decreased their price objective on shares of iRhythm Technologies from $119.00 to $96.00 and set a "buy" rating for the company in a report on Thursday. StockNews.com lowered shares of iRhythm Technologies from a "hold" rating to a "sell" rating in a report on Friday, September 27th. Finally, Citigroup reduced their price target on shares of iRhythm Technologies from $135.00 to $110.00 and set a "buy" rating on the stock in a research report on Thursday, August 22nd.

Read Our Latest Stock Analysis on iRhythm Technologies

iRhythm Technologies Stock Down 4.4 %

IRTC traded down $3.33 during trading hours on Thursday, reaching $72.44. 1,317,033 shares of the stock traded hands, compared to its average volume of 469,175. The firm's fifty day simple moving average is $69.09 and its two-hundred day simple moving average is $85.54. The company has a market cap of $2.25 billion, a price-to-earnings ratio of -15.92 and a beta of 1.22. iRhythm Technologies has a fifty-two week low of $55.92 and a fifty-two week high of $124.11. The company has a debt-to-equity ratio of 6.50, a current ratio of 6.92 and a quick ratio of 6.76.

iRhythm Technologies (NASDAQ:IRTC - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported ($1.26) earnings per share for the quarter, missing the consensus estimate of ($0.55) by ($0.71). The company had revenue of $147.54 million for the quarter, compared to analyst estimates of $146.69 million. iRhythm Technologies had a negative return on equity of 84.14% and a negative net margin of 24.50%. iRhythm Technologies's revenue was up 18.4% on a year-over-year basis. During the same period in the prior year, the business earned ($0.89) earnings per share. As a group, analysts forecast that iRhythm Technologies will post -2.66 earnings per share for the current fiscal year.

Insider Activity at iRhythm Technologies

In related news, EVP Mervin Smith sold 688 shares of iRhythm Technologies stock in a transaction dated Friday, August 2nd. The shares were sold at an average price of $74.66, for a total value of $51,366.08. Following the sale, the executive vice president now directly owns 10,360 shares in the company, valued at $773,477.60. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. In related news, EVP Mervin Smith sold 688 shares of iRhythm Technologies stock in a transaction dated Friday, August 2nd. The shares were sold at an average price of $74.66, for a total value of $51,366.08. Following the sale, the executive vice president now directly owns 10,360 shares in the company, valued at $773,477.60. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CFO Brice Bobzien sold 1,372 shares of the business's stock in a transaction dated Friday, August 9th. The stock was sold at an average price of $70.34, for a total transaction of $96,506.48. Following the sale, the chief financial officer now owns 24,428 shares in the company, valued at $1,718,265.52. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 5,072 shares of company stock worth $372,748 in the last ninety days. 0.68% of the stock is owned by insiders.

Institutional Trading of iRhythm Technologies

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Headlands Technologies LLC raised its position in shares of iRhythm Technologies by 10,650.0% during the 1st quarter. Headlands Technologies LLC now owns 430 shares of the company's stock worth $50,000 after buying an additional 426 shares in the last quarter. Nisa Investment Advisors LLC grew its stake in shares of iRhythm Technologies by 79.6% in the 2nd quarter. Nisa Investment Advisors LLC now owns 625 shares of the company's stock worth $67,000 after purchasing an additional 277 shares during the last quarter. SG Americas Securities LLC acquired a new position in shares of iRhythm Technologies in the 1st quarter worth approximately $126,000. Russell Investments Group Ltd. grew its stake in shares of iRhythm Technologies by 79,700.0% in the 1st quarter. Russell Investments Group Ltd. now owns 1,596 shares of the company's stock worth $185,000 after purchasing an additional 1,594 shares during the last quarter. Finally, nVerses Capital LLC grew its stake in shares of iRhythm Technologies by 400.0% in the 3rd quarter. nVerses Capital LLC now owns 2,000 shares of the company's stock worth $148,000 after purchasing an additional 1,600 shares during the last quarter.

iRhythm Technologies Company Profile

(

Get Free ReportiRhythm Technologies, Inc, a digital healthcare company, engages in the design, development, and commercialization of device-based technology to provide ambulatory cardiac monitoring services to diagnose arrhythmias in the United States. It offers Zio services, an ambulatory monitoring solution, including long-term and short-term continuous monitoring and mobile cardiac telemetry monitoring services.

Further Reading

Before you consider iRhythm Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iRhythm Technologies wasn't on the list.

While iRhythm Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.