Luminar Technologies (NASDAQ:LAZR - Get Free Report) is scheduled to be releasing its earnings data after the market closes on Monday, November 11th. Analysts expect Luminar Technologies to post earnings of ($0.22) per share for the quarter. Persons that are interested in registering for the company's earnings conference call can do so using this link.

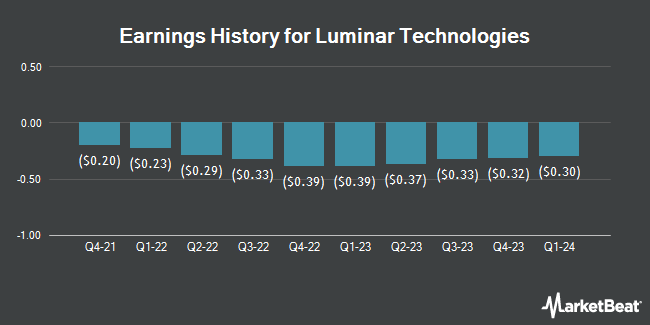

Luminar Technologies (NASDAQ:LAZR - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported ($0.18) EPS for the quarter, beating the consensus estimate of ($0.22) by $0.04. The firm had revenue of $16.50 million during the quarter, compared to analysts' expectations of $20.36 million. The company's quarterly revenue was up 1.9% on a year-over-year basis. During the same quarter last year, the business posted ($0.37) EPS. On average, analysts expect Luminar Technologies to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Luminar Technologies Stock Performance

NASDAQ:LAZR traded up $0.01 on Monday, hitting $0.81. The stock had a trading volume of 32,727,686 shares, compared to its average volume of 14,695,124. The stock has a market cap of $397.67 million, a P/E ratio of -0.62 and a beta of 1.61. Luminar Technologies has a 1 year low of $0.73 and a 1 year high of $3.99. The firm's fifty day simple moving average is $0.87 and its two-hundred day simple moving average is $1.27.

Analyst Upgrades and Downgrades

LAZR has been the subject of several analyst reports. Westpark Capital reiterated a "buy" rating and issued a $9.00 price objective on shares of Luminar Technologies in a research note on Tuesday, August 6th. The Goldman Sachs Group decreased their price target on shares of Luminar Technologies from $1.50 to $1.00 and set a "sell" rating for the company in a research note on Thursday, July 11th. Citigroup decreased their price target on shares of Luminar Technologies from $9.00 to $6.00 and set a "buy" rating for the company in a research note on Friday, August 16th. Deutsche Bank Aktiengesellschaft restated a "hold" rating and set a $1.00 price target on shares of Luminar Technologies in a research note on Tuesday, September 10th. Finally, JPMorgan Chase & Co. decreased their price target on shares of Luminar Technologies from $8.00 to $6.00 and set an "overweight" rating for the company in a research note on Monday, August 19th. Two analysts have rated the stock with a sell rating, two have assigned a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, Luminar Technologies presently has an average rating of "Hold" and an average target price of $3.74.

Get Our Latest Analysis on Luminar Technologies

About Luminar Technologies

(

Get Free Report)

Luminar Technologies, Inc, an automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East. It operates in two segments, Autonomy Solutions and Advanced Technologies and Services. The Autonomy Solutions segment designs, manufactures, and sells laser imaging, detection, and ranging sensors or lidars, as well as related perception and autonomy software solutions primarily for original equipment manufacturers in the automobile, commercial vehicle, robo-taxi, and adjacent industries.

Further Reading

Before you consider Luminar Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Luminar Technologies wasn't on the list.

While Luminar Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.