Rosenblatt Securities restated their neutral rating on shares of Luminar Technologies (NASDAQ:LAZR - Free Report) in a report issued on Wednesday, Benzinga reports. The brokerage currently has a $2.00 target price on the stock.

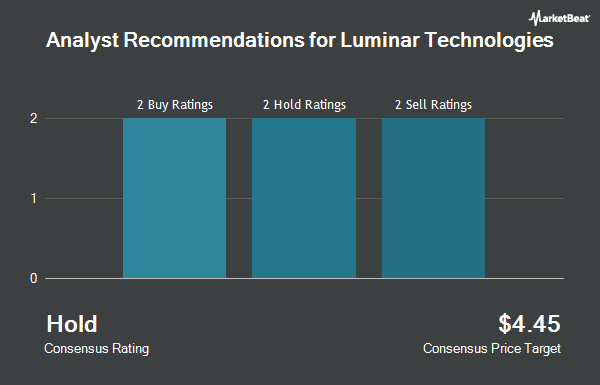

Other equities analysts have also recently issued reports about the stock. Deutsche Bank Aktiengesellschaft restated a hold rating and set a $1.00 price objective on shares of Luminar Technologies in a research report on Tuesday, September 10th. Citigroup reduced their price objective on shares of Luminar Technologies from $9.00 to $6.00 and set a buy rating for the company in a research report on Friday, August 16th. The Goldman Sachs Group reduced their target price on shares of Luminar Technologies from $1.50 to $1.00 and set a sell rating for the company in a research report on Thursday, July 11th. JPMorgan Chase & Co. reduced their target price on shares of Luminar Technologies from $8.00 to $6.00 and set an overweight rating for the company in a research report on Monday, August 19th. Finally, Westpark Capital reiterated a buy rating and issued a $9.00 target price on shares of Luminar Technologies in a research report on Tuesday, August 6th. Two research analysts have rated the stock with a sell rating, two have issued a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of Hold and an average price target of $3.74.

View Our Latest Research Report on Luminar Technologies

Luminar Technologies Stock Performance

NASDAQ LAZR traded up $0.03 during mid-day trading on Wednesday, reaching $0.85. 19,664,811 shares of the stock were exchanged, compared to its average volume of 11,742,643. The business's 50 day moving average is $1.04 and its 200-day moving average is $1.42. Luminar Technologies has a 1 year low of $0.73 and a 1 year high of $4.47. The company has a market capitalization of $376.82 million, a P/E ratio of -0.60 and a beta of 1.60.

Luminar Technologies (NASDAQ:LAZR - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported ($0.18) earnings per share for the quarter, topping analysts' consensus estimates of ($0.22) by $0.04. The company had revenue of $16.50 million for the quarter, compared to analyst estimates of $20.36 million. The business's revenue was up 1.9% on a year-over-year basis. During the same quarter in the prior year, the company posted ($0.37) earnings per share. Equities analysts predict that Luminar Technologies will post -0.97 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Luminar Technologies

Hedge funds and other institutional investors have recently bought and sold shares of the company. Caz Investments LP boosted its stake in shares of Luminar Technologies by 200.0% in the fourth quarter. Caz Investments LP now owns 120,000 shares of the company's stock valued at $404,000 after purchasing an additional 80,000 shares during the period. Vanguard Group Inc. increased its holdings in shares of Luminar Technologies by 7.0% in the 4th quarter. Vanguard Group Inc. now owns 25,705,363 shares of the company's stock valued at $86,627,000 after acquiring an additional 1,671,708 shares during the period. Leo Wealth LLC acquired a new position in shares of Luminar Technologies in the 4th quarter valued at $43,000. Quadrature Capital Ltd purchased a new position in Luminar Technologies in the 4th quarter valued at $67,000. Finally, Global Assets Advisory LLC grew its position in Luminar Technologies by 110.0% in the 1st quarter. Global Assets Advisory LLC now owns 42,000 shares of the company's stock valued at $83,000 after buying an additional 22,000 shares during the last quarter. 30.99% of the stock is currently owned by institutional investors and hedge funds.

Luminar Technologies Company Profile

(

Get Free Report)

Luminar Technologies, Inc, an automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East. It operates in two segments, Autonomy Solutions and Advanced Technologies and Services. The Autonomy Solutions segment designs, manufactures, and sells laser imaging, detection, and ranging sensors or lidars, as well as related perception and autonomy software solutions primarily for original equipment manufacturers in the automobile, commercial vehicle, robo-taxi, and adjacent industries.

See Also

Before you consider Luminar Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Luminar Technologies wasn't on the list.

While Luminar Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.