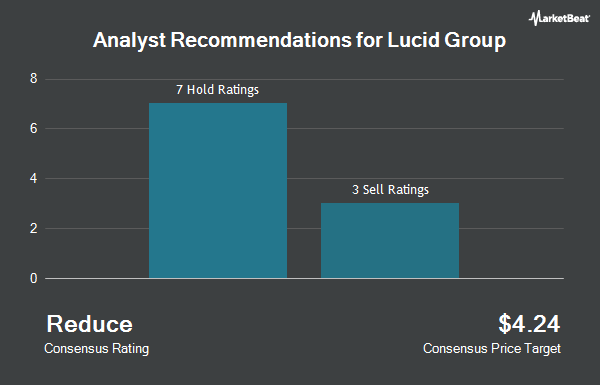

Lucid Group, Inc. (NASDAQ:LCID - Get Free Report) has been given a consensus rating of "Reduce" by the nine brokerages that are covering the company, Marketbeat Ratings reports. One research analyst has rated the stock with a sell recommendation and eight have given a hold recommendation to the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $3.71.

A number of research analysts recently commented on LCID shares. Needham & Company LLC reaffirmed a "hold" rating on shares of Lucid Group in a research report on Wednesday, September 11th. Royal Bank of Canada reiterated a "sector perform" rating and set a $3.00 target price on shares of Lucid Group in a research report on Thursday, September 12th. Robert W. Baird reaffirmed a "neutral" rating and set a $3.00 price target on shares of Lucid Group in a research report on Monday. Finally, Cantor Fitzgerald restated a "neutral" rating and set a $4.00 target price on shares of Lucid Group in a research report on Tuesday.

View Our Latest Stock Analysis on Lucid Group

Insiders Place Their Bets

In related news, SVP Eric Bach sold 89,959 shares of Lucid Group stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $3.14, for a total value of $282,471.26. Following the sale, the senior vice president now directly owns 2,028,268 shares in the company, valued at $6,368,761.52. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 61.26% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently added to or reduced their stakes in the stock. Frank Rimerman Advisors LLC boosted its stake in shares of Lucid Group by 925.0% during the 2nd quarter. Frank Rimerman Advisors LLC now owns 10,250 shares of the company's stock worth $27,000 after acquiring an additional 9,250 shares in the last quarter. Meeder Advisory Services Inc. acquired a new stake in Lucid Group in the first quarter valued at $29,000. Accredited Investors Inc. purchased a new position in shares of Lucid Group in the second quarter valued at $27,000. Sanctuary Advisors LLC purchased a new position in shares of Lucid Group in the second quarter valued at $26,000. Finally, HighPoint Advisor Group LLC acquired a new position in shares of Lucid Group during the 4th quarter worth $46,000. 75.17% of the stock is owned by hedge funds and other institutional investors.

Lucid Group Stock Down 1.8 %

Shares of LCID traded down $0.06 during midday trading on Thursday, reaching $3.33. The stock had a trading volume of 19,873,715 shares, compared to its average volume of 32,587,281. The company has a market cap of $7.68 billion, a price-to-earnings ratio of -2.63 and a beta of 1.04. The company's fifty day simple moving average is $3.52 and its two-hundred day simple moving average is $3.09. Lucid Group has a 1-year low of $2.29 and a 1-year high of $5.48. The company has a debt-to-equity ratio of 0.59, a current ratio of 3.96 and a quick ratio of 3.45.

Lucid Group (NASDAQ:LCID - Get Free Report) last posted its quarterly earnings results on Monday, August 5th. The company reported ($0.29) earnings per share for the quarter, missing analysts' consensus estimates of ($0.27) by ($0.02). The business had revenue of $200.58 million during the quarter, compared to analyst estimates of $190.30 million. Lucid Group had a negative net margin of 390.39% and a negative return on equity of 55.35%. The firm's quarterly revenue was up 32.9% on a year-over-year basis. During the same quarter in the prior year, the business earned ($0.40) earnings per share. Equities research analysts expect that Lucid Group will post -1.27 earnings per share for the current year.

Lucid Group Company Profile

(

Get Free ReportLucid Group, Inc a technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems. It also designs and develops proprietary software in-house for Lucid vehicles. The company sells vehicles directly to consumers through its retail sales network and direct online sales, including Lucid Financial Services.

Recommended Stories

Before you consider Lucid Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Group wasn't on the list.

While Lucid Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.