Lincoln Electric (NASDAQ:LECO - Get Free Report) is set to release its earnings data before the market opens on Thursday, October 31st. Analysts expect Lincoln Electric to post earnings of $2.18 per share for the quarter. Investors interested in registering for the company's conference call can do so using this link.

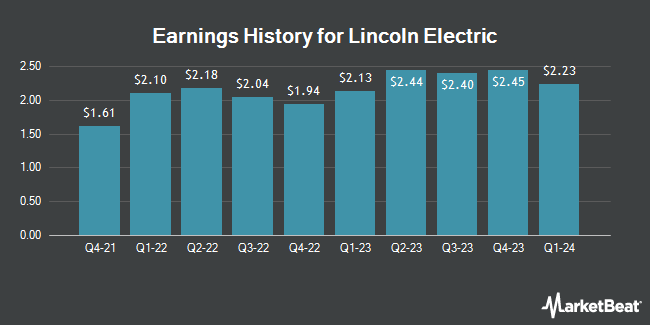

Lincoln Electric (NASDAQ:LECO - Get Free Report) last posted its quarterly earnings results on Wednesday, July 31st. The industrial products company reported $2.34 EPS for the quarter, topping analysts' consensus estimates of $2.30 by $0.04. Lincoln Electric had a net margin of 12.48% and a return on equity of 42.24%. The firm had revenue of $1.02 billion for the quarter, compared to analysts' expectations of $1.02 billion. During the same period in the prior year, the business posted $2.44 earnings per share. The business's revenue for the quarter was down 3.7% on a year-over-year basis. On average, analysts expect Lincoln Electric to post $9 EPS for the current fiscal year and $10 EPS for the next fiscal year.

Lincoln Electric Trading Down 0.0 %

LECO traded down $0.07 on Thursday, reaching $193.69. 150,449 shares of the company traded hands, compared to its average volume of 318,393. The company has a market cap of $11.02 billion, a P/E ratio of 20.56, a price-to-earnings-growth ratio of 1.43 and a beta of 1.14. The company has a quick ratio of 1.31, a current ratio of 2.06 and a debt-to-equity ratio of 0.84. Lincoln Electric has a one year low of $164.00 and a one year high of $261.13. The firm has a fifty day simple moving average of $189.66 and a two-hundred day simple moving average of $201.07.

Lincoln Electric Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be given a dividend of $0.75 per share. The ex-dividend date is Tuesday, December 31st. This is a positive change from Lincoln Electric's previous quarterly dividend of $0.71. This represents a $3.00 dividend on an annualized basis and a dividend yield of 1.55%. Lincoln Electric's dividend payout ratio (DPR) is 31.85%.

Insider Activity

In related news, SVP Michael J. Whitehead sold 1,100 shares of the firm's stock in a transaction dated Friday, September 6th. The stock was sold at an average price of $175.96, for a total transaction of $193,556.00. Following the sale, the senior vice president now owns 11,178 shares of the company's stock, valued at $1,966,880.88. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Company insiders own 2.63% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts recently issued reports on the company. Stifel Nicolaus increased their price objective on Lincoln Electric from $184.00 to $185.00 and gave the stock a "hold" rating in a research note on Wednesday, October 16th. StockNews.com lowered Lincoln Electric from a "buy" rating to a "hold" rating in a research note on Monday, October 14th. Finally, Robert W. Baird decreased their price objective on Lincoln Electric from $220.00 to $212.00 and set an "outperform" rating for the company in a report on Wednesday, September 4th. One investment analyst has rated the stock with a sell rating, three have given a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat.com, Lincoln Electric presently has an average rating of "Hold" and an average price target of $221.67.

Get Our Latest Report on LECO

About Lincoln Electric

(

Get Free Report)

Lincoln Electric Holdings, Inc, through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide. The company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. It offers brazing and soldering filler metals, arc welding equipment, plasma and oxyfuel cutting systems, wire feeding systems, fume control equipment, welding accessories, and specialty gas regulators, and education solutions, as well as a portfolio of automated solutions for joining, cutting, material handling, module assembly, and end of line testing, as well as involved in brazing and soldering alloys, and in the retail business in the United States.

Featured Articles

Before you consider Lincoln Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lincoln Electric wasn't on the list.

While Lincoln Electric currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.