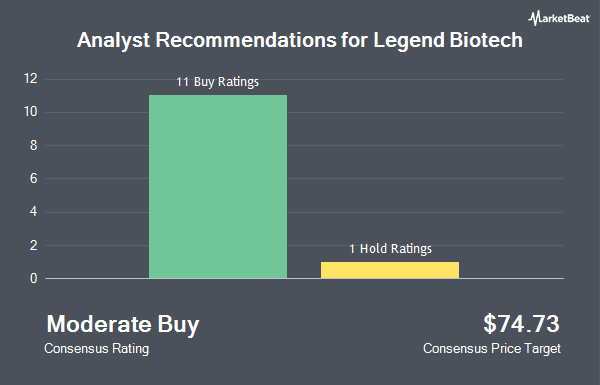

Legend Biotech Co. (NASDAQ:LEGN - Get Free Report) has been given an average recommendation of "Buy" by the fourteen ratings firms that are presently covering the firm, Marketbeat.com reports. Fourteen investment analysts have rated the stock with a buy rating. The average 12 month target price among analysts that have covered the stock in the last year is $82.08.

LEGN has been the topic of a number of research reports. TD Cowen dropped their target price on shares of Legend Biotech from $71.00 to $67.00 and set a "buy" rating on the stock in a report on Monday, July 15th. Scotiabank increased their target price on shares of Legend Biotech from $70.00 to $76.00 and gave the stock a "sector outperform" rating in a report on Monday, August 12th. HC Wainwright reissued a "buy" rating and set a $73.00 target price on shares of Legend Biotech in a report on Wednesday, October 16th. BMO Capital Markets restated an "outperform" rating and set a $90.00 price target on shares of Legend Biotech in a research report on Wednesday, July 3rd. Finally, Royal Bank of Canada restated an "outperform" rating and set a $86.00 price target on shares of Legend Biotech in a research report on Friday, September 27th.

Check Out Our Latest Report on Legend Biotech

Hedge Funds Weigh In On Legend Biotech

Several large investors have recently made changes to their positions in the business. China Universal Asset Management Co. Ltd. boosted its position in shares of Legend Biotech by 63.7% during the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 15,711 shares of the company's stock valued at $766,000 after purchasing an additional 6,114 shares in the last quarter. abrdn plc boosted its position in shares of Legend Biotech by 110.4% during the 3rd quarter. abrdn plc now owns 33,729 shares of the company's stock valued at $1,628,000 after purchasing an additional 17,696 shares in the last quarter. Diversified Trust Co bought a new position in shares of Legend Biotech during the 3rd quarter valued at about $1,730,000. Handelsbanken Fonder AB boosted its position in shares of Legend Biotech by 7.7% during the 3rd quarter. Handelsbanken Fonder AB now owns 50,500 shares of the company's stock valued at $2,461,000 after purchasing an additional 3,600 shares in the last quarter. Finally, SG Americas Securities LLC bought a new position in shares of Legend Biotech during the 3rd quarter valued at about $212,000. Institutional investors own 70.89% of the company's stock.

Legend Biotech Stock Up 1.5 %

LEGN traded up $0.68 during trading on Friday, hitting $44.74. The company had a trading volume of 1,119,951 shares, compared to its average volume of 1,061,486. The company has a market cap of $8.16 billion, a PE ratio of -34.42 and a beta of 0.10. The business has a 50-day moving average of $50.25 and a 200-day moving average of $48.97. The company has a debt-to-equity ratio of 0.25, a current ratio of 4.84 and a quick ratio of 4.78. Legend Biotech has a 1-year low of $38.60 and a 1-year high of $70.13.

Legend Biotech (NASDAQ:LEGN - Get Free Report) last issued its earnings results on Friday, August 9th. The company reported ($0.05) earnings per share for the quarter, topping analysts' consensus estimates of ($0.54) by $0.49. The company had revenue of $186.50 million for the quarter, compared to analysts' expectations of $125.25 million. Legend Biotech had a negative net margin of 62.50% and a negative return on equity of 23.20%. The firm's revenue was up 154.4% compared to the same quarter last year. During the same period in the prior year, the company earned ($0.27) earnings per share. As a group, analysts forecast that Legend Biotech will post -1.48 earnings per share for the current year.

About Legend Biotech

(

Get Free ReportLegend Biotech Corporation, a clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally. Its lead product candidate, LCAR- B38M, is a chimeric antigen receptor for the treatment of multiple myeloma (MM).

See Also

Before you consider Legend Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legend Biotech wasn't on the list.

While Legend Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.