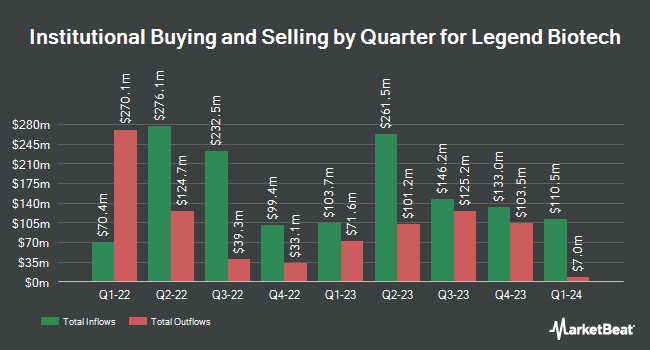

Mirae Asset Global Investments Co. Ltd. decreased its position in Legend Biotech Co. (NASDAQ:LEGN - Free Report) by 31.5% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 28,549 shares of the company's stock after selling 13,151 shares during the quarter. Mirae Asset Global Investments Co. Ltd.'s holdings in Legend Biotech were worth $1,394,000 at the end of the most recent reporting period.

Several other hedge funds also recently made changes to their positions in LEGN. Diversified Trust Co bought a new position in shares of Legend Biotech during the third quarter worth approximately $1,730,000. Handelsbanken Fonder AB increased its position in Legend Biotech by 7.7% during the 3rd quarter. Handelsbanken Fonder AB now owns 50,500 shares of the company's stock worth $2,461,000 after purchasing an additional 3,600 shares in the last quarter. SG Americas Securities LLC bought a new position in shares of Legend Biotech in the 3rd quarter valued at $212,000. Cubist Systematic Strategies LLC acquired a new position in shares of Legend Biotech in the second quarter valued at approximately $2,620,000. Finally, Point72 Asset Management L.P. bought a new stake in shares of Legend Biotech in the second quarter worth $13,487,000. 70.89% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on LEGN shares. Redburn Atlantic assumed coverage on shares of Legend Biotech in a research report on Tuesday, October 8th. They set a "buy" rating and a $86.00 price objective on the stock. TD Cowen lowered their target price on Legend Biotech from $71.00 to $67.00 and set a "buy" rating on the stock in a research note on Monday, July 15th. Scotiabank raised their target price on Legend Biotech from $70.00 to $76.00 and gave the stock a "sector outperform" rating in a research report on Monday, August 12th. HC Wainwright restated a "buy" rating and set a $73.00 target price on shares of Legend Biotech in a research report on Wednesday, October 16th. Finally, Royal Bank of Canada reissued an "outperform" rating and issued a $86.00 price target on shares of Legend Biotech in a report on Tuesday. Fourteen analysts have rated the stock with a buy rating, According to MarketBeat.com, the company currently has an average rating of "Buy" and a consensus target price of $82.08.

View Our Latest Report on Legend Biotech

Legend Biotech Stock Down 1.5 %

NASDAQ LEGN traded down $0.66 on Friday, reaching $44.36. The stock had a trading volume of 1,510,862 shares, compared to its average volume of 1,059,646. Legend Biotech Co. has a 12-month low of $38.60 and a 12-month high of $70.13. The business's 50-day moving average price is $49.29 and its 200 day moving average price is $48.69. The company has a debt-to-equity ratio of 0.25, a current ratio of 4.84 and a quick ratio of 4.78.

Legend Biotech (NASDAQ:LEGN - Get Free Report) last announced its quarterly earnings results on Friday, August 9th. The company reported ($0.05) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.54) by $0.49. The company had revenue of $186.50 million for the quarter, compared to the consensus estimate of $125.25 million. Legend Biotech had a negative net margin of 62.50% and a negative return on equity of 23.20%. The company's revenue for the quarter was up 154.4% compared to the same quarter last year. During the same quarter in the prior year, the firm earned ($0.27) earnings per share. Equities research analysts forecast that Legend Biotech Co. will post -1.48 earnings per share for the current fiscal year.

About Legend Biotech

(

Free Report)

Legend Biotech Corporation, a clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally. Its lead product candidate, LCAR- B38M, is a chimeric antigen receptor for the treatment of multiple myeloma (MM).

Read More

Before you consider Legend Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legend Biotech wasn't on the list.

While Legend Biotech currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.