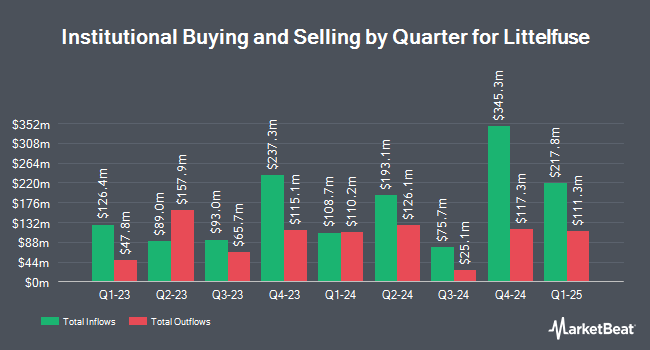

Eastern Bank bought a new stake in shares of Littelfuse, Inc. (NASDAQ:LFUS - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 1,999 shares of the technology company's stock, valued at approximately $530,000.

Several other large investors have also bought and sold shares of the company. Wealth Enhancement Advisory Services LLC boosted its stake in Littelfuse by 50.7% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 3,600 shares of the technology company's stock worth $872,000 after acquiring an additional 1,211 shares in the last quarter. Koss Olinger Consulting LLC bought a new position in shares of Littelfuse in the 1st quarter worth approximately $5,576,000. Oak Thistle LLC purchased a new position in shares of Littelfuse in the first quarter worth approximately $347,000. Allspring Global Investments Holdings LLC increased its holdings in Littelfuse by 2.3% during the first quarter. Allspring Global Investments Holdings LLC now owns 89,284 shares of the technology company's stock valued at $21,638,000 after buying an additional 2,029 shares during the last quarter. Finally, State of Michigan Retirement System increased its holdings in Littelfuse by 3.4% during the first quarter. State of Michigan Retirement System now owns 6,153 shares of the technology company's stock valued at $1,491,000 after buying an additional 200 shares during the last quarter. 96.14% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have issued reports on the company. Oppenheimer raised Littelfuse from a "market perform" rating to an "outperform" rating and set a $310.00 price target for the company in a report on Thursday, October 17th. TD Cowen raised their target price on shares of Littelfuse from $250.00 to $260.00 and gave the stock a "hold" rating in a research note on Thursday, August 1st. StockNews.com upgraded shares of Littelfuse from a "hold" rating to a "buy" rating in a research report on Friday, October 18th. Robert W. Baird raised their price objective on shares of Littelfuse from $300.00 to $315.00 and gave the company an "outperform" rating in a research report on Thursday, August 29th. Finally, Stifel Nicolaus raised shares of Littelfuse from a "hold" rating to a "buy" rating and upped their target price for the stock from $270.00 to $280.00 in a report on Tuesday, August 13th. Three analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $285.00.

Check Out Our Latest Stock Report on Littelfuse

Littelfuse Price Performance

NASDAQ LFUS traded up $2.57 on Thursday, reaching $255.69. The company had a trading volume of 93,708 shares, compared to its average volume of 129,451. The stock has a market capitalization of $6.34 billion, a PE ratio of 28.99, a price-to-earnings-growth ratio of 2.64 and a beta of 1.27. Littelfuse, Inc. has a 12 month low of $212.80 and a 12 month high of $275.58. The company has a quick ratio of 2.42, a current ratio of 3.50 and a debt-to-equity ratio of 0.32. The firm's 50 day moving average price is $259.45 and its 200 day moving average price is $254.01.

Littelfuse (NASDAQ:LFUS - Get Free Report) last posted its earnings results on Tuesday, July 30th. The technology company reported $1.97 EPS for the quarter, topping analysts' consensus estimates of $1.75 by $0.22. Littelfuse had a return on equity of 8.91% and a net margin of 8.71%. The company had revenue of $558.49 million for the quarter, compared to the consensus estimate of $540.35 million. During the same period in the previous year, the business earned $3.12 earnings per share. The firm's revenue for the quarter was down 8.7% on a year-over-year basis. As a group, equities analysts predict that Littelfuse, Inc. will post 8.18 earnings per share for the current year.

Insider Activity

In related news, CEO David W. Heinzmann sold 2,091 shares of the business's stock in a transaction on Monday, August 26th. The shares were sold at an average price of $274.65, for a total value of $574,293.15. Following the sale, the chief executive officer now owns 59,654 shares in the company, valued at approximately $16,383,971.10. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Littelfuse news, CEO David W. Heinzmann sold 2,091 shares of Littelfuse stock in a transaction on Monday, August 26th. The shares were sold at an average price of $274.65, for a total value of $574,293.15. Following the completion of the transaction, the chief executive officer now directly owns 59,654 shares of the company's stock, valued at $16,383,971.10. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, SVP Matthew Cole sold 1,436 shares of the business's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $246.02, for a total transaction of $353,284.72. Following the completion of the sale, the senior vice president now owns 5,522 shares in the company, valued at approximately $1,358,522.44. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 16,028 shares of company stock worth $4,356,035. 2.30% of the stock is currently owned by insiders.

Littelfuse Company Profile

(

Free Report)

Littelfuse, Inc designs, manufactures, and sells electronic components, modules, and subassemblies in the Americas, Asia-Pacific, and Europe. The company operates through Electronic, Transportation, and Industrial segments. The Electronics segment offers fuses and fuse accessories, positive temperature coefficient resettable fuses, electromechanical switches and interconnect solutions, polymer electrostatic discharge suppressors, varistors, reed switch based magnetic sensing products, and gas discharge tubes; and discrete transient voltage suppressor (TVS) diodes, TVS diode arrays, protection and switching thyristors, metal-oxide-semiconductor field-effect transistors and diodes, and insulated gate bipolar transistors.

See Also

Before you consider Littelfuse, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Littelfuse wasn't on the list.

While Littelfuse currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.