LifeVantage (NASDAQ:LFVN - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Tuesday, October 29th. LifeVantage has set its FY 2025 guidance at 0.700-0.800 EPS.Investors that are interested in participating in the company's conference call can do so using this link.

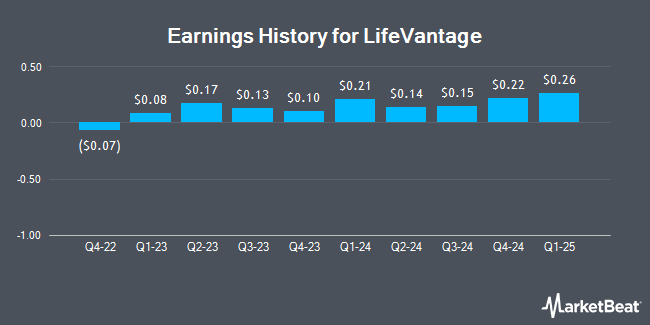

LifeVantage (NASDAQ:LFVN - Get Free Report) last announced its quarterly earnings data on Wednesday, August 28th. The company reported $0.14 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.21 by ($0.07). The company had revenue of $48.93 million during the quarter. LifeVantage had a return on equity of 27.85% and a net margin of 1.47%.

LifeVantage Trading Up 3.7 %

NASDAQ:LFVN traded up $0.44 during trading hours on Tuesday, hitting $12.43. 74,646 shares of the company traded hands, compared to its average volume of 56,585. LifeVantage has a twelve month low of $4.20 and a twelve month high of $13.71. The firm has a 50-day moving average of $10.27 and a 200 day moving average of $8.06. The stock has a market capitalization of $157.87 million, a price-to-earnings ratio of 44.39 and a beta of 0.84.

LifeVantage Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, September 17th. Stockholders of record on Monday, September 9th were given a dividend of $0.04 per share. This represents a $0.16 dividend on an annualized basis and a dividend yield of 1.29%. The ex-dividend date of this dividend was Monday, September 9th. LifeVantage's dividend payout ratio is currently 57.14%.

About LifeVantage

(

Get Free Report)

LifeVantage Corporation engages in the identification, research, development, formulation, and sale of advanced nutrigenomic activators, dietary supplements, nootropics, pre- and pro-biotics, weight management, skin and hair care, bath and body, and targeted relief products. It offers Protandim, a dietary supplement; LifeVantage Omega+, a dietary supplement that combines DHA and EPA Omega-3 fatty acids, Omega-7 fatty acids, and vitamin D3; LifeVantage ProBio, a dietary supplement to support gut health; PhysIQ, a weight management system; LifeVantage IC Bright, a supplement to support eye and brain health, reduce eye fatigue and strain, supports cognitive functions, and support normal sleep patterns; Petandim for Dogs, a supplement to combat oxidative stress in dogs; and Axio, a nootropic energy drink mix.

Featured Articles

Before you consider LifeVantage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LifeVantage wasn't on the list.

While LifeVantage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.