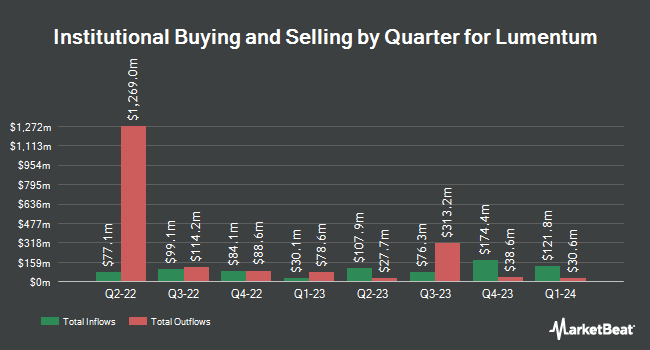

Emerald Advisers LLC boosted its stake in shares of Lumentum Holdings Inc. (NASDAQ:LITE - Free Report) by 29.1% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 378,535 shares of the technology company's stock after acquiring an additional 85,353 shares during the quarter. Emerald Advisers LLC owned 0.56% of Lumentum worth $23,992,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors also recently bought and sold shares of the stock. State of Michigan Retirement System raised its position in Lumentum by 3.1% during the 1st quarter. State of Michigan Retirement System now owns 16,528 shares of the technology company's stock valued at $783,000 after purchasing an additional 500 shares during the last quarter. Janney Montgomery Scott LLC raised its position in Lumentum by 1.8% during the 1st quarter. Janney Montgomery Scott LLC now owns 14,587 shares of the technology company's stock valued at $691,000 after purchasing an additional 260 shares during the last quarter. BNP Paribas bought a new position in Lumentum during the 1st quarter valued at approximately $238,000. Texas Permanent School Fund Corp raised its position in Lumentum by 0.9% during the 1st quarter. Texas Permanent School Fund Corp now owns 58,259 shares of the technology company's stock valued at $2,759,000 after purchasing an additional 496 shares during the last quarter. Finally, John G Ullman & Associates Inc. raised its position in Lumentum by 26.0% during the 1st quarter. John G Ullman & Associates Inc. now owns 73,973 shares of the technology company's stock valued at $3,503,000 after purchasing an additional 15,282 shares during the last quarter. 94.05% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have recently issued reports on the company. Bank of America increased their target price on Lumentum from $45.00 to $50.00 and gave the stock an "underperform" rating in a research report on Thursday, August 15th. Morgan Stanley increased their target price on Lumentum from $50.00 to $54.00 and gave the stock an "equal weight" rating in a research report on Thursday, August 15th. Raymond James increased their target price on Lumentum from $55.00 to $70.00 and gave the stock an "outperform" rating in a research report on Friday, October 4th. Rosenblatt Securities increased their target price on Lumentum from $65.00 to $69.00 and gave the stock a "buy" rating in a research report on Thursday, August 15th. Finally, Barclays increased their target price on Lumentum from $38.00 to $40.00 and gave the stock an "underweight" rating in a research report on Thursday, August 15th. Three analysts have rated the stock with a sell rating, three have issued a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $60.77.

Read Our Latest Stock Report on Lumentum

Lumentum Stock Up 2.3 %

LITE traded up $1.48 during trading on Friday, hitting $65.35. 1,451,959 shares of the company's stock traded hands, compared to its average volume of 1,389,024. The company's 50 day simple moving average is $61.75 and its two-hundred day simple moving average is $52.93. The company has a current ratio of 5.90, a quick ratio of 4.43 and a debt-to-equity ratio of 2.61. Lumentum Holdings Inc. has a 12-month low of $38.28 and a 12-month high of $71.07. The stock has a market capitalization of $4.48 billion, a price-to-earnings ratio of -8.08, a PEG ratio of 5.45 and a beta of 0.88.

Lumentum (NASDAQ:LITE - Get Free Report) last issued its earnings results on Wednesday, August 14th. The technology company reported $0.06 EPS for the quarter, beating the consensus estimate of $0.03 by $0.03. Lumentum had a negative return on equity of 4.79% and a negative net margin of 40.21%. The business had revenue of $308.30 million for the quarter, compared to the consensus estimate of $301.36 million. During the same period last year, the business posted $0.12 EPS. The company's revenue was down 16.9% compared to the same quarter last year. Analysts predict that Lumentum Holdings Inc. will post 0.2 earnings per share for the current fiscal year.

About Lumentum

(

Free Report)

Lumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Read More

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.