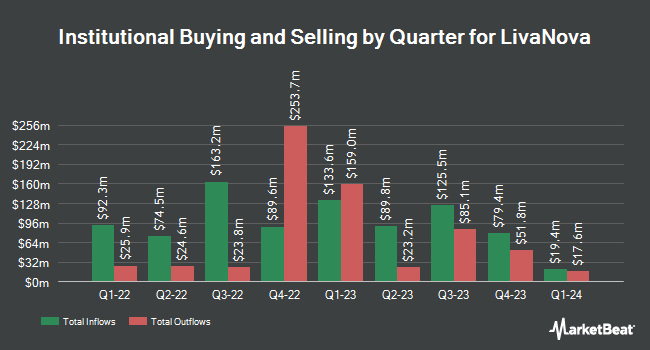

Allspring Global Investments Holdings LLC boosted its position in LivaNova PLC (NASDAQ:LIVN - Free Report) by 3.3% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 797,284 shares of the company's stock after buying an additional 25,277 shares during the period. Allspring Global Investments Holdings LLC owned approximately 1.47% of LivaNova worth $41,889,000 at the end of the most recent quarter.

A number of other institutional investors have also added to or reduced their stakes in the company. Arizona State Retirement System increased its holdings in shares of LivaNova by 2.0% during the second quarter. Arizona State Retirement System now owns 15,104 shares of the company's stock valued at $828,000 after acquiring an additional 299 shares in the last quarter. State of Michigan Retirement System lifted its stake in shares of LivaNova by 2.3% in the first quarter. State of Michigan Retirement System now owns 13,211 shares of the company's stock valued at $739,000 after buying an additional 300 shares in the last quarter. Fifth Third Bancorp lifted its stake in shares of LivaNova by 97.1% in the second quarter. Fifth Third Bancorp now owns 674 shares of the company's stock valued at $37,000 after buying an additional 332 shares in the last quarter. Hexagon Capital Partners LLC grew its holdings in shares of LivaNova by 117.8% during the second quarter. Hexagon Capital Partners LLC now owns 684 shares of the company's stock valued at $37,000 after buying an additional 370 shares during the last quarter. Finally, ProShare Advisors LLC increased its position in shares of LivaNova by 4.7% during the first quarter. ProShare Advisors LLC now owns 12,378 shares of the company's stock worth $692,000 after acquiring an additional 561 shares in the last quarter. 97.64% of the stock is owned by institutional investors and hedge funds.

LivaNova Stock Performance

NASDAQ:LIVN traded down $0.33 during trading on Wednesday, reaching $53.00. The company's stock had a trading volume of 327,767 shares, compared to its average volume of 620,612. LivaNova PLC has a 12 month low of $42.75 and a 12 month high of $64.47. The firm has a market cap of $2.87 billion, a price-to-earnings ratio of -88.88 and a beta of 1.00. The firm has a 50 day moving average of $50.12 and a 200-day moving average of $53.22. The company has a debt-to-equity ratio of 0.49, a quick ratio of 2.94 and a current ratio of 3.45.

LivaNova (NASDAQ:LIVN - Get Free Report) last posted its quarterly earnings results on Wednesday, July 31st. The company reported $0.81 earnings per share for the quarter, beating the consensus estimate of $0.66 by $0.15. The company had revenue of $318.60 million during the quarter, compared to analyst estimates of $305.05 million. LivaNova had a negative net margin of 1.37% and a positive return on equity of 13.77%. Research analysts expect that LivaNova PLC will post 2.58 EPS for the current fiscal year.

Analyst Ratings Changes

LIVN has been the subject of a number of analyst reports. Stifel Nicolaus lifted their price target on LivaNova from $70.00 to $72.00 and gave the company a "buy" rating in a research note on Thursday, July 25th. Robert W. Baird raised LivaNova from a "neutral" rating to an "outperform" rating and lifted their target price for the company from $55.00 to $66.00 in a research report on Tuesday, September 17th. Needham & Company LLC increased their price target on LivaNova from $72.00 to $75.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. Baird R W upgraded LivaNova from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, September 17th. Finally, The Goldman Sachs Group started coverage on shares of LivaNova in a research note on Friday, October 4th. They issued a "buy" rating and a $65.00 target price for the company. One analyst has rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Buy" and a consensus target price of $69.83.

Get Our Latest Stock Report on LivaNova

LivaNova Company Profile

(

Free Report)

LivaNova PLC, a medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide. The company operates through Cardiopulmonary, Neuromodulation, and Advanced Circulatory Support segments. The Cardiopulmonary segment develops, produces, and sells cardiopulmonary products, including oxygenators, heart-lung machines, autotransfusion systems, perfusion tubing systems, cannulae, connect, and other related products.

Featured Stories

Before you consider LivaNova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LivaNova wasn't on the list.

While LivaNova currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.