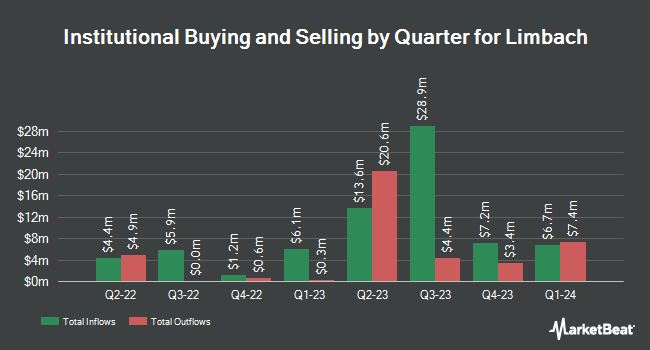

SG Americas Securities LLC purchased a new stake in shares of Limbach Holdings, Inc. (NASDAQ:LMB - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm purchased 10,479 shares of the construction company's stock, valued at approximately $794,000. SG Americas Securities LLC owned approximately 0.09% of Limbach at the end of the most recent quarter.

A number of other institutional investors have also recently added to or reduced their stakes in the company. The Manufacturers Life Insurance Company bought a new stake in Limbach in the second quarter valued at about $223,000. Brendel Financial Advisors LLC acquired a new position in Limbach in the second quarter worth $231,000. Meeder Asset Management Inc. increased its stake in Limbach by 7.7% during the second quarter. Meeder Asset Management Inc. now owns 4,072 shares of the construction company's stock valued at $232,000 after purchasing an additional 292 shares during the last quarter. Virtu Financial LLC acquired a new stake in shares of Limbach during the fourth quarter worth $235,000. Finally, PFG Advisors bought a new position in shares of Limbach in the 1st quarter worth about $253,000. Institutional investors and hedge funds own 55.85% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com downgraded Limbach from a "buy" rating to a "hold" rating in a research note on Wednesday, August 14th.

Check Out Our Latest Report on Limbach

Limbach Price Performance

NASDAQ LMB traded up $2.24 on Friday, reaching $82.11. 159,952 shares of the stock traded hands, compared to its average volume of 166,457. The firm's fifty day simple moving average is $67.99 and its 200 day simple moving average is $57.77. The company has a market cap of $918.24 million, a price-to-earnings ratio of 38.19, a P/E/G ratio of 2.68 and a beta of 0.96. Limbach Holdings, Inc. has a 12 month low of $26.76 and a 12 month high of $82.31. The company has a quick ratio of 1.63, a current ratio of 1.63 and a debt-to-equity ratio of 0.15.

Limbach (NASDAQ:LMB - Get Free Report) last issued its earnings results on Tuesday, August 6th. The construction company reported $0.50 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.37 by $0.13. Limbach had a return on equity of 21.06% and a net margin of 5.08%. The business had revenue of $122.24 million for the quarter, compared to analysts' expectations of $123.50 million. During the same period in the previous year, the firm posted $0.46 EPS. As a group, research analysts predict that Limbach Holdings, Inc. will post 2.43 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Joshua Horowitz sold 5,000 shares of the stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $64.02, for a total value of $320,100.00. Following the transaction, the director now owns 190,000 shares in the company, valued at approximately $12,163,800. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. In the last ninety days, insiders sold 40,072 shares of company stock valued at $2,418,821. Corporate insiders own 10.20% of the company's stock.

About Limbach

(

Free Report)

Limbach Holdings, Inc operates as a building systems solution company in the United States. It operates through two segments, General Contractor Relationships and Owner Direct Relationships. The company engages in the construction and renovation projects that involve primarily include mechanical, plumbing, and electrical services.

Recommended Stories

Before you consider Limbach, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Limbach wasn't on the list.

While Limbach currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.