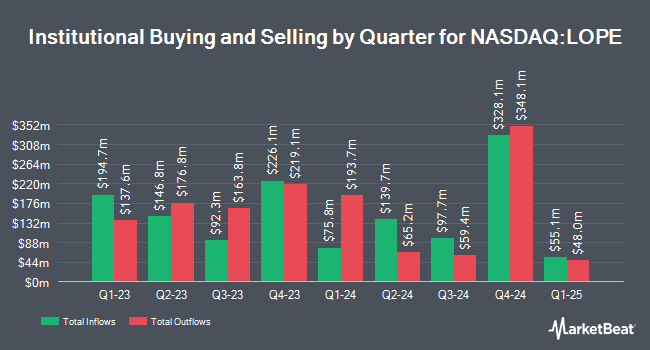

Assenagon Asset Management S.A. boosted its stake in Grand Canyon Education, Inc. (NASDAQ:LOPE - Free Report) by 19.5% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 263,381 shares of the company's stock after acquiring an additional 43,005 shares during the period. Assenagon Asset Management S.A. owned 0.89% of Grand Canyon Education worth $37,361,000 as of its most recent SEC filing.

Several other institutional investors have also recently added to or reduced their stakes in the stock. Wealth Alliance increased its position in Grand Canyon Education by 3.8% during the 2nd quarter. Wealth Alliance now owns 2,428 shares of the company's stock worth $340,000 after purchasing an additional 89 shares during the period. NBC Securities Inc. increased its position in Grand Canyon Education by 12.6% during the 3rd quarter. NBC Securities Inc. now owns 856 shares of the company's stock worth $121,000 after purchasing an additional 96 shares during the period. Capital Insight Partners LLC increased its position in Grand Canyon Education by 2.5% during the 2nd quarter. Capital Insight Partners LLC now owns 4,229 shares of the company's stock worth $592,000 after purchasing an additional 105 shares during the period. Allegheny Financial Group LTD increased its position in Grand Canyon Education by 4.3% during the 2nd quarter. Allegheny Financial Group LTD now owns 2,656 shares of the company's stock worth $372,000 after purchasing an additional 109 shares during the period. Finally, Creative Planning grew its holdings in shares of Grand Canyon Education by 2.4% in the 3rd quarter. Creative Planning now owns 4,723 shares of the company's stock worth $670,000 after acquiring an additional 109 shares during the period. Institutional investors and hedge funds own 94.17% of the company's stock.

Insider Transactions at Grand Canyon Education

In other news, CTO Dilek Marsh sold 1,500 shares of the company's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $141.23, for a total transaction of $211,845.00. Following the completion of the sale, the chief technology officer now directly owns 22,674 shares in the company, valued at $3,202,249.02. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this link. Insiders own 2.00% of the company's stock.

Analyst Ratings Changes

LOPE has been the topic of a number of research reports. StockNews.com cut Grand Canyon Education from a "buy" rating to a "hold" rating in a report on Wednesday, October 9th. BMO Capital Markets upped their price target on Grand Canyon Education from $160.00 to $162.00 and gave the stock an "outperform" rating in a report on Wednesday, August 7th. Finally, Barrington Research restated an "outperform" rating and issued a $165.00 price target on shares of Grand Canyon Education in a report on Friday, September 20th.

View Our Latest Report on Grand Canyon Education

Grand Canyon Education Stock Performance

LOPE stock traded down $0.29 on Friday, reaching $133.13. The company had a trading volume of 111,548 shares, compared to its average volume of 177,245. Grand Canyon Education, Inc. has a 1 year low of $114.12 and a 1 year high of $157.53. The company has a market cap of $3.92 billion, a P/E ratio of 18.12, a PEG ratio of 1.10 and a beta of 0.69. The company's fifty day moving average is $139.60 and its 200 day moving average is $140.68.

Grand Canyon Education (NASDAQ:LOPE - Get Free Report) last released its quarterly earnings data on Tuesday, August 6th. The company reported $1.27 EPS for the quarter, topping analysts' consensus estimates of $1.10 by $0.17. The business had revenue of $227.50 million during the quarter, compared to the consensus estimate of $223.56 million. Grand Canyon Education had a return on equity of 31.49% and a net margin of 21.88%. The business's revenue for the quarter was up 8.0% on a year-over-year basis. During the same period in the prior year, the firm posted $1.01 EPS. On average, sell-side analysts predict that Grand Canyon Education, Inc. will post 7.98 earnings per share for the current year.

Grand Canyon Education Company Profile

(

Free Report)

Grand Canyon Education, Inc provides education services to colleges and universities in the United States. It offers technology services, including learning management system, internal administration, infrastructure, and support services; academic services, such as program and curriculum, faculty and related training and development, class scheduling, and skills and simulation lab sites; and counseling services and support services comprising admission, financial aid, and field experience and other counseling services.

Featured Articles

Before you consider Grand Canyon Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grand Canyon Education wasn't on the list.

While Grand Canyon Education currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.