Landstar System (NASDAQ:LSTR - Get Free Report) had its price target cut by investment analysts at Susquehanna from $165.00 to $160.00 in a research note issued to investors on Friday, Benzinga reports. The brokerage presently has a "neutral" rating on the transportation company's stock. Susquehanna's target price suggests a potential downside of 9.71% from the company's previous close.

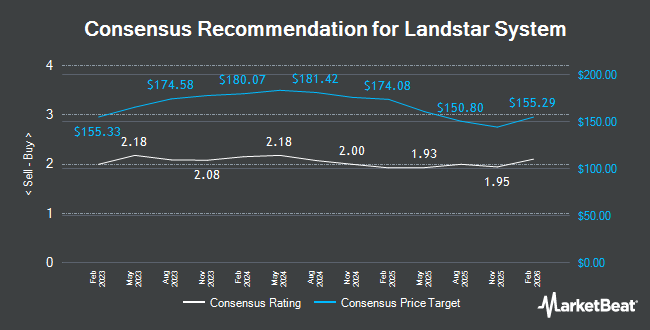

A number of other equities research analysts have also commented on the company. UBS Group upped their price target on Landstar System from $184.00 to $186.00 and gave the company a "neutral" rating in a research report on Wednesday. The Goldman Sachs Group reduced their price target on Landstar System from $165.00 to $158.00 and set a "sell" rating on the stock in a research report on Wednesday, October 9th. Raymond James dropped their price objective on Landstar System from $205.00 to $195.00 and set an "outperform" rating on the stock in a research note on Wednesday, July 31st. Benchmark reissued a "hold" rating on shares of Landstar System in a research note on Wednesday, July 31st. Finally, Morgan Stanley dropped their price objective on Landstar System from $147.00 to $145.00 and set an "equal weight" rating on the stock in a research note on Monday, July 8th. One research analyst has rated the stock with a sell rating, eleven have issued a hold rating and one has given a buy rating to the company. Based on data from MarketBeat.com, Landstar System currently has an average rating of "Hold" and an average target price of $174.25.

Read Our Latest Report on LSTR

Landstar System Price Performance

LSTR stock traded up $1.43 during midday trading on Friday, reaching $177.20. 196,742 shares of the stock were exchanged, compared to its average volume of 259,902. The stock has a market capitalization of $6.28 billion, a PE ratio of 30.24 and a beta of 0.80. Landstar System has a 52 week low of $165.39 and a 52 week high of $201.40. The company has a debt-to-equity ratio of 0.04, a current ratio of 2.21 and a quick ratio of 2.17. The company has a fifty day moving average price of $183.19 and a 200 day moving average price of $182.36.

Landstar System (NASDAQ:LSTR - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The transportation company reported $1.41 EPS for the quarter, missing analysts' consensus estimates of $1.46 by ($0.05). Landstar System had a net margin of 4.32% and a return on equity of 20.68%. The company had revenue of $1.21 billion during the quarter, compared to the consensus estimate of $1.22 billion. During the same quarter last year, the firm posted $1.71 EPS. The company's quarterly revenue was down 5.8% on a year-over-year basis. As a group, analysts expect that Landstar System will post 5.77 EPS for the current fiscal year.

Hedge Funds Weigh In On Landstar System

Several institutional investors have recently modified their holdings of the business. Vanguard Group Inc. grew its holdings in Landstar System by 0.7% during the first quarter. Vanguard Group Inc. now owns 3,480,039 shares of the transportation company's stock valued at $670,812,000 after purchasing an additional 25,387 shares during the period. Quantbot Technologies LP grew its holdings in Landstar System by 415.1% during the first quarter. Quantbot Technologies LP now owns 5,223 shares of the transportation company's stock valued at $1,007,000 after purchasing an additional 4,209 shares during the period. Van ECK Associates Corp grew its holdings in Landstar System by 36.5% during the first quarter. Van ECK Associates Corp now owns 16,177 shares of the transportation company's stock valued at $3,118,000 after purchasing an additional 4,327 shares during the period. Sei Investments Co. grew its holdings in Landstar System by 17.9% during the first quarter. Sei Investments Co. now owns 72,248 shares of the transportation company's stock valued at $13,926,000 after purchasing an additional 10,978 shares during the period. Finally, Tidal Investments LLC grew its holdings in Landstar System by 125.4% during the first quarter. Tidal Investments LLC now owns 12,796 shares of the transportation company's stock valued at $2,467,000 after purchasing an additional 7,118 shares during the period. 97.95% of the stock is owned by institutional investors.

About Landstar System

(

Get Free Report)

Landstar System, Inc provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally. It operates through two segments: Transportation Logistics and Insurance. The Transportation Logistics segment offers a range of transportation services, including truckload and less-than-truckload transportation, rail intermodal, air cargo, ocean cargo, expedited ground and air delivery of time-critical freight, heavy-haul/specialized, U.S.-Canada and U.S.-Mexico cross-border, intra-Mexico, intra-Canada, project cargo, and customs brokerage, as well as offers transportation services to other transportation companies, such as third party logistics and less-than-truckload services.

See Also

Before you consider Landstar System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Landstar System wasn't on the list.

While Landstar System currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.