Lyft (NASDAQ:LYFT - Get Free Report) will be releasing its earnings data after the market closes on Wednesday, November 6th. Analysts expect Lyft to post earnings of $0.20 per share for the quarter. Investors that wish to listen to the company's conference call can do so using this link.

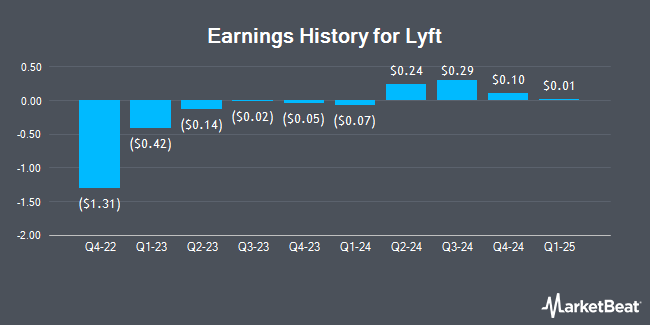

Lyft (NASDAQ:LYFT - Get Free Report) last released its earnings results on Wednesday, August 7th. The ride-sharing company reported $0.24 earnings per share for the quarter, beating the consensus estimate of $0.19 by $0.05. The business had revenue of $1.44 billion for the quarter, compared to the consensus estimate of $1.39 billion. Lyft had a negative return on equity of 8.57% and a negative net margin of 1.27%. The business's quarterly revenue was up 40.6% compared to the same quarter last year. During the same quarter last year, the business posted ($0.14) earnings per share.

Lyft Price Performance

Shares of NASDAQ LYFT traded down $0.24 during midday trading on Wednesday, hitting $13.67. The stock had a trading volume of 10,789,246 shares, compared to its average volume of 14,740,591. The company has a market capitalization of $5.52 billion, a PE ratio of -29.60 and a beta of 2.04. The stock has a 50 day simple moving average of $12.47 and a 200-day simple moving average of $13.63. Lyft has a 1 year low of $8.85 and a 1 year high of $20.82. The company has a quick ratio of 0.74, a current ratio of 0.74 and a debt-to-equity ratio of 1.00.

Insiders Place Their Bets

In other Lyft news, Director John Patrick Zimmer sold 7,188 shares of Lyft stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of $11.40, for a total transaction of $81,943.20. Following the completion of the sale, the director now directly owns 932,062 shares of the company's stock, valued at $10,625,506.80. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other news, Director John Patrick Zimmer sold 7,188 shares of the business's stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of $11.40, for a total value of $81,943.20. Following the completion of the sale, the director now directly owns 932,062 shares of the company's stock, valued at approximately $10,625,506.80. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Lindsay Catherine Llewellyn sold 4,243 shares of the business's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $12.00, for a total value of $50,916.00. Following the completion of the sale, the insider now directly owns 760,089 shares of the company's stock, valued at $9,121,068. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 32,664 shares of company stock valued at $380,048 in the last ninety days. Insiders own 3.07% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on LYFT shares. Barclays decreased their target price on Lyft from $20.00 to $14.00 and set an "equal weight" rating on the stock in a research report on Thursday, August 8th. Canaccord Genuity Group reduced their price objective on Lyft from $23.00 to $18.00 and set a "buy" rating on the stock in a research report on Thursday, August 8th. Needham & Company LLC reiterated a "hold" rating on shares of Lyft in a research report on Wednesday, August 7th. Nomura Securities upgraded Lyft from a "strong sell" rating to a "hold" rating in a research report on Friday, August 23rd. Finally, Nomura upgraded Lyft from a "reduce" rating to a "neutral" rating and reduced their price objective for the stock from $15.00 to $13.00 in a research report on Friday, August 23rd. One investment analyst has rated the stock with a sell rating, twenty-seven have issued a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $15.59.

Read Our Latest Stock Report on Lyft

About Lyft

(

Get Free Report)

Lyft, Inc operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. It operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications. The company's platform provides a ridesharing marketplace, which connects drivers with riders; Express Drive, a car rental program for drivers; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips.

Featured Articles

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.