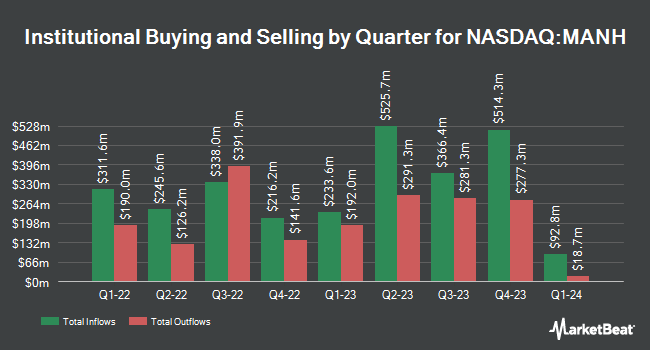

Allspring Global Investments Holdings LLC grew its stake in shares of Manhattan Associates, Inc. (NASDAQ:MANH - Free Report) by 118.8% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 173,644 shares of the software maker's stock after buying an additional 94,283 shares during the quarter. Allspring Global Investments Holdings LLC owned 0.28% of Manhattan Associates worth $48,860,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Tobam bought a new position in Manhattan Associates during the 1st quarter valued at approximately $25,000. Innealta Capital LLC bought a new stake in shares of Manhattan Associates during the 2nd quarter valued at about $26,000. International Assets Investment Management LLC bought a new stake in shares of Manhattan Associates during the 2nd quarter valued at about $27,000. DT Investment Partners LLC bought a new stake in Manhattan Associates during the 2nd quarter valued at approximately $31,000. Finally, Ashton Thomas Private Wealth LLC purchased a new position in shares of Manhattan Associates during the 2nd quarter worth approximately $31,000. 98.45% of the stock is owned by institutional investors.

Manhattan Associates Trading Down 7.2 %

NASDAQ:MANH traded down $20.96 during mid-day trading on Wednesday, reaching $271.36. The company's stock had a trading volume of 1,446,605 shares, compared to its average volume of 416,490. The firm's fifty day moving average price is $273.75 and its two-hundred day moving average price is $246.41. The stock has a market cap of $16.71 billion, a P/E ratio of 88.92 and a beta of 1.50. Manhattan Associates, Inc. has a 12-month low of $182.97 and a 12-month high of $307.50.

Manhattan Associates (NASDAQ:MANH - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The software maker reported $1.35 earnings per share for the quarter, beating analysts' consensus estimates of $1.06 by $0.29. Manhattan Associates had a net margin of 20.54% and a return on equity of 84.54%. The company had revenue of $266.70 million for the quarter, compared to the consensus estimate of $262.90 million. During the same quarter in the prior year, the firm earned $0.79 earnings per share. The firm's revenue for the quarter was up 11.9% compared to the same quarter last year. Analysts predict that Manhattan Associates, Inc. will post 3.01 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on the stock. StockNews.com cut shares of Manhattan Associates from a "buy" rating to a "hold" rating in a research report on Thursday, August 1st. Loop Capital raised their price objective on Manhattan Associates from $265.00 to $285.00 and gave the company a "buy" rating in a research report on Monday, September 16th. Truist Financial boosted their target price on Manhattan Associates from $275.00 to $310.00 and gave the stock a "buy" rating in a report on Friday, October 11th. DA Davidson lifted their price target on Manhattan Associates from $285.00 to $315.00 and gave the stock a "buy" rating in a research report on Wednesday. Finally, Raymond James upped their price target on shares of Manhattan Associates from $255.00 to $305.00 and gave the stock an "outperform" rating in a research note on Wednesday. Four investment analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $286.38.

Check Out Our Latest Stock Analysis on Manhattan Associates

Insider Activity at Manhattan Associates

In other Manhattan Associates news, EVP James Stewart Gantt sold 6,000 shares of the business's stock in a transaction dated Tuesday, July 30th. The stock was sold at an average price of $256.50, for a total transaction of $1,539,000.00. Following the completion of the sale, the executive vice president now directly owns 46,287 shares in the company, valued at $11,872,615.50. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.72% of the stock is owned by company insiders.

Manhattan Associates Company Profile

(

Free Report)

Manhattan Associates, Inc develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations. It offers Warehouse Management Solution for managing goods and information across the distribution centers; Manhattan Active Warehouse Management, a cloud native and version less application for the associate; and Transportation Management Solution for helping shippers navigate their way through the demands and meet customer service expectations at the lowest possible freight costs; Manhattan SCALE, a portfolio of logistics execution solution; and Manhattan Active Omni, which offers order management, store inventory and fulfillment, POS, and customer engagement tools for enterprises and stores.

Further Reading

Before you consider Manhattan Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manhattan Associates wasn't on the list.

While Manhattan Associates currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.