Masimo (NASDAQ:MASI - Get Free Report) is set to issue its quarterly earnings data after the market closes on Tuesday, November 5th. Analysts expect the company to announce earnings of $0.84 per share for the quarter. Persons interested in registering for the company's earnings conference call can do so using this link.

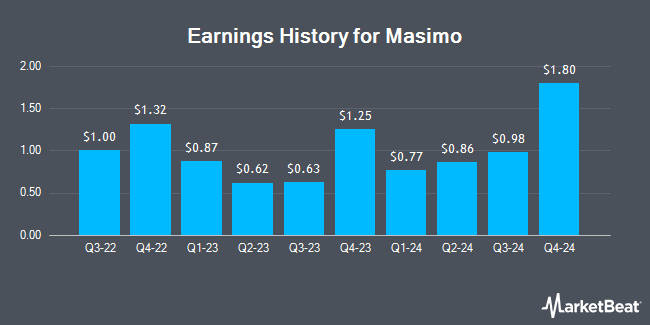

Masimo (NASDAQ:MASI - Get Free Report) last released its quarterly earnings results on Tuesday, August 6th. The medical equipment provider reported $0.86 earnings per share for the quarter, beating the consensus estimate of $0.77 by $0.09. Masimo had a net margin of 3.94% and a return on equity of 14.07%. The business had revenue of $496.30 million for the quarter, compared to analysts' expectations of $493.92 million. During the same quarter in the previous year, the business posted $0.62 earnings per share. The firm's revenue for the quarter was up 9.0% compared to the same quarter last year. On average, analysts expect Masimo to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Masimo Trading Up 0.2 %

Shares of NASDAQ:MASI traded up $0.34 on Tuesday, hitting $141.05. The company had a trading volume of 273,214 shares, compared to its average volume of 674,227. The firm's 50-day simple moving average is $127.74 and its two-hundred day simple moving average is $124.99. The firm has a market capitalization of $7.50 billion, a price-to-earnings ratio of 95.72 and a beta of 0.99. The company has a quick ratio of 1.15, a current ratio of 2.09 and a debt-to-equity ratio of 0.55. Masimo has a 1 year low of $75.36 and a 1 year high of $153.93.

Analysts Set New Price Targets

A number of research analysts have weighed in on MASI shares. BTIG Research upped their target price on Masimo from $166.00 to $170.00 and gave the stock a "buy" rating in a report on Monday, October 14th. Needham & Company LLC reiterated a "hold" rating on shares of Masimo in a report on Friday, September 20th. Finally, Piper Sandler restated an "overweight" rating on shares of Masimo in a report on Friday, October 18th. Four equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, Masimo currently has an average rating of "Moderate Buy" and an average target price of $145.33.

Read Our Latest Report on Masimo

Masimo Company Profile

(

Get Free Report)

Masimo Corporation develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide. The company offers masimo signal extraction technology (SET) pulse oximetry with measure-through motion and low perfusion pulse oximetry monitoring to address the primary limitations of conventional pulse oximetry; Masimo rainbow SET platform, including rainbow SET Pulse CO-Oximetry products that allows noninvasive monitoring of carboxyhemoglobin, methemoglobin, hemoglobin concentration, fractional arterial oxygen saturation, oxygen content, pleth variability index, rainbow pleth variability index, respiration rate from the pleth, and oxygen reserve index, as well as acoustic respiration monitoring, SedLine brain function monitoring, NomoLine capnography and gas monitoring, and regional oximetry.

See Also

Before you consider Masimo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masimo wasn't on the list.

While Masimo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.