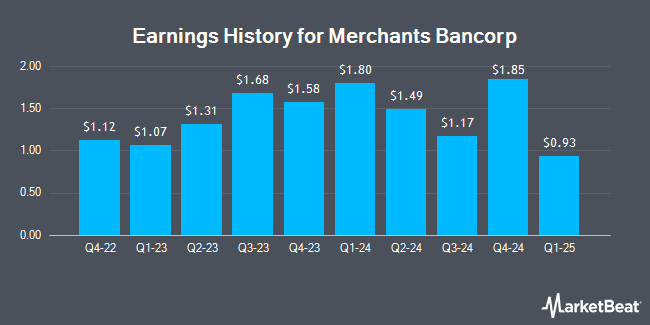

Merchants Bancorp (NASDAQ:MBIN - Get Free Report) released its earnings results on Monday. The company reported $1.17 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.42 by ($0.25), RTT News reports. The firm had revenue of $355.67 million for the quarter, compared to analyst estimates of $156.13 million. Merchants Bancorp had a return on equity of 25.54% and a net margin of 23.14%. During the same period in the previous year, the firm earned $1.68 earnings per share.

Merchants Bancorp Stock Down 17.9 %

NASDAQ MBIN traded down $7.86 during trading on Tuesday, reaching $36.03. 654,141 shares of the company's stock were exchanged, compared to its average volume of 179,420. Merchants Bancorp has a fifty-two week low of $28.99 and a fifty-two week high of $53.27. The firm has a market capitalization of $1.56 billion, a PE ratio of 6.14 and a beta of 1.09. The company has a current ratio of 1.01, a quick ratio of 0.78 and a debt-to-equity ratio of 0.81. The company's fifty day simple moving average is $44.53 and its 200-day simple moving average is $43.02.

Merchants Bancorp Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, October 1st. Shareholders of record on Friday, September 13th were given a dividend of $0.09 per share. The ex-dividend date was Friday, September 13th. This represents a $0.36 dividend on an annualized basis and a yield of 1.00%. Merchants Bancorp's payout ratio is presently 5.65%.

Analyst Ratings Changes

A number of equities analysts recently weighed in on MBIN shares. Raymond James decreased their price target on Merchants Bancorp from $58.00 to $55.00 and set an "outperform" rating for the company in a research report on Tuesday. Morgan Stanley started coverage on Merchants Bancorp in a research report on Monday, September 9th. They issued an "equal weight" rating and a $54.00 price target for the company.

View Our Latest Stock Report on Merchants Bancorp

Insiders Place Their Bets

In other news, CEO Michael R. Dury acquired 5,200 shares of the company's stock in a transaction that occurred on Monday, August 5th. The shares were purchased at an average price of $38.71 per share, for a total transaction of $201,292.00. Following the completion of the acquisition, the chief executive officer now owns 93,793 shares of the company's stock, valued at approximately $3,630,727.03. This represents a 0.00 % increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other Merchants Bancorp news, CEO Michael R. Dury bought 5,200 shares of Merchants Bancorp stock in a transaction on Monday, August 5th. The stock was purchased at an average cost of $38.71 per share, for a total transaction of $201,292.00. Following the completion of the purchase, the chief executive officer now directly owns 93,793 shares of the company's stock, valued at $3,630,727.03. The trade was a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Michael F. Petrie sold 22,050 shares of Merchants Bancorp stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $45.34, for a total transaction of $999,747.00. Following the completion of the sale, the chief executive officer now owns 1,990,545 shares of the company's stock, valued at $90,251,310.30. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 39.70% of the company's stock.

Merchants Bancorp Company Profile

(

Get Free Report)

Merchants Bancorp operates as the diversified bank holding company in the United States. It operates through three segments: Multi-family Mortgage Banking, Mortgage Warehousing, and Banking. The Multi-family Mortgage Banking segment engages in the mortgage banking, which originates and services government sponsored mortgages, including bridge financing products to refinance, acquire, or reposition multi-family housing projects, and construction lending for multi-family and healthcare facilities.

Featured Stories

Before you consider Merchants Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merchants Bancorp wasn't on the list.

While Merchants Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.