Mobileye Global (NASDAQ:MBLY - Get Free Report) had its price target boosted by equities research analysts at TD Cowen from $15.00 to $19.00 in a research note issued to investors on Friday, Marketbeat.com reports. The brokerage currently has a "buy" rating on the stock. TD Cowen's price objective indicates a potential upside of 22.03% from the company's previous close.

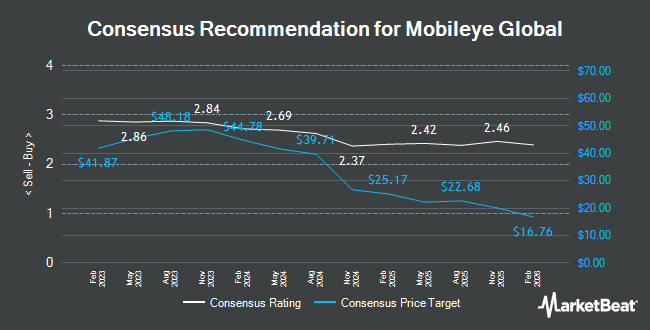

Other equities analysts have also recently issued research reports about the stock. Hsbc Global Res upgraded shares of Mobileye Global to a "strong-buy" rating in a research report on Monday, July 15th. Wolfe Research lowered Mobileye Global from an "outperform" rating to a "peer perform" rating in a research report on Thursday, September 5th. JPMorgan Chase & Co. restated an "underweight" rating and issued a $10.00 target price (down previously from $16.00) on shares of Mobileye Global in a research note on Monday, October 7th. The Goldman Sachs Group decreased their price objective on Mobileye Global from $24.00 to $20.00 and set a "buy" rating for the company in a report on Tuesday, October 1st. Finally, Evercore ISI dropped their target price on shares of Mobileye Global from $35.00 to $30.00 and set an "outperform" rating on the stock in a report on Monday, October 14th. Four investment analysts have rated the stock with a sell rating, eleven have issued a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $23.25.

View Our Latest Analysis on Mobileye Global

Mobileye Global Trading Up 14.4 %

NASDAQ MBLY traded up $1.96 on Friday, hitting $15.57. The company's stock had a trading volume of 17,089,640 shares, compared to its average volume of 4,954,566. The firm has a market cap of $12.60 billion, a P/E ratio of -55.61 and a beta of 0.08. Mobileye Global has a 52-week low of $10.48 and a 52-week high of $44.48. The company's 50-day simple moving average is $12.77 and its 200 day simple moving average is $20.82.

Mobileye Global (NASDAQ:MBLY - Get Free Report) last announced its quarterly earnings results on Thursday, August 1st. The company reported $0.09 EPS for the quarter, topping analysts' consensus estimates of $0.08 by $0.01. Mobileye Global had a positive return on equity of 1.32% and a negative net margin of 12.14%. The company had revenue of $439.00 million during the quarter, compared to analyst estimates of $424.34 million. During the same quarter last year, the firm posted $0.11 earnings per share. The firm's revenue was down 3.3% on a year-over-year basis. On average, research analysts forecast that Mobileye Global will post -0.06 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, Director Patrick P. Gelsinger purchased 6,400 shares of the company's stock in a transaction dated Monday, August 5th. The shares were purchased at an average price of $15.48 per share, with a total value of $99,072.00. Following the acquisition, the director now directly owns 139,106 shares in the company, valued at $2,153,360.88. The trade was a 0.00 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 1.80% of the stock is owned by insiders.

Hedge Funds Weigh In On Mobileye Global

Hedge funds and other institutional investors have recently modified their holdings of the company. ARK Investment Management LLC increased its position in Mobileye Global by 7.7% during the third quarter. ARK Investment Management LLC now owns 74,878 shares of the company's stock valued at $1,026,000 after acquiring an additional 5,323 shares during the last quarter. Malaga Cove Capital LLC bought a new stake in shares of Mobileye Global during the 3rd quarter valued at about $305,000. Impax Asset Management Group plc purchased a new stake in shares of Mobileye Global during the 3rd quarter valued at about $871,000. Arcadia Investment Management Corp MI lifted its stake in shares of Mobileye Global by 13.1% in the 3rd quarter. Arcadia Investment Management Corp MI now owns 139,656 shares of the company's stock worth $1,913,000 after purchasing an additional 16,190 shares during the period. Finally, Focus Financial Network Inc. boosted its holdings in shares of Mobileye Global by 41.1% in the third quarter. Focus Financial Network Inc. now owns 12,314 shares of the company's stock worth $169,000 after buying an additional 3,584 shares during the last quarter. 13.25% of the stock is owned by institutional investors.

Mobileye Global Company Profile

(

Get Free Report)

Mobileye Global Inc develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide. The company operates through Mobileye and Other segments. It offers Driver Assist comprising ADAS and autonomous vehicle solutions that covers safety features, such as real-time detection of road users, geometry, semantics, and markings to provide safety alerts and emergency interventions; Cloud-Enhanced Driver Assist, a solution for drivers with interpretations of a scene in real-time; Mobileye SuperVision Lite, a navigation and assisted driving solution; and Mobileye SuperVision, an operational point-to-point assisted driving navigation solution on various road types and includes cloud-based enhancements, such as road experience management.

See Also

Before you consider Mobileye Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mobileye Global wasn't on the list.

While Mobileye Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.