New York State Common Retirement Fund decreased its stake in MongoDB, Inc. (NASDAQ:MDB - Free Report) by 12.8% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 96,460 shares of the company's stock after selling 14,213 shares during the quarter. New York State Common Retirement Fund owned 0.13% of MongoDB worth $26,078,000 as of its most recent filing with the Securities and Exchange Commission.

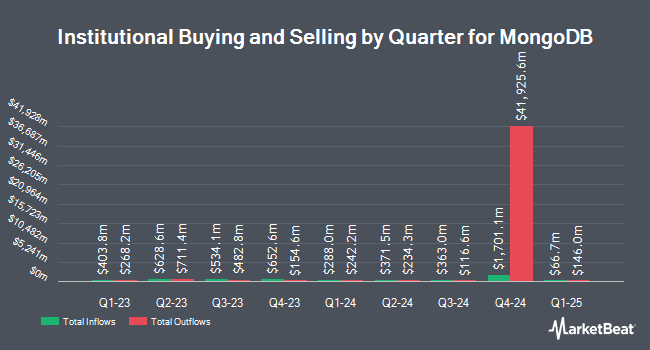

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Swedbank AB raised its position in shares of MongoDB by 156.3% in the 2nd quarter. Swedbank AB now owns 656,993 shares of the company's stock valued at $164,222,000 after acquiring an additional 400,705 shares during the period. Thrivent Financial for Lutherans boosted its position in shares of MongoDB by 1,098.1% during the second quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company's stock worth $106,084,000 after purchasing an additional 388,979 shares in the last quarter. Clearbridge Investments LLC grew its holdings in shares of MongoDB by 109.0% in the 1st quarter. Clearbridge Investments LLC now owns 445,084 shares of the company's stock valued at $159,625,000 after buying an additional 232,101 shares during the period. Point72 Asset Management L.P. bought a new stake in shares of MongoDB in the 2nd quarter valued at $52,131,000. Finally, Renaissance Technologies LLC raised its stake in MongoDB by 828.9% during the 2nd quarter. Renaissance Technologies LLC now owns 183,000 shares of the company's stock worth $45,743,000 after buying an additional 163,300 shares during the period. Institutional investors own 89.29% of the company's stock.

Insiders Place Their Bets

In related news, CFO Michael Lawrence Gordon sold 5,000 shares of the company's stock in a transaction on Monday, October 14th. The stock was sold at an average price of $290.31, for a total transaction of $1,451,550.00. Following the completion of the sale, the chief financial officer now directly owns 80,307 shares in the company, valued at $23,313,925.17. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In related news, CAO Thomas Bull sold 1,000 shares of the firm's stock in a transaction on Monday, September 9th. The stock was sold at an average price of $282.89, for a total transaction of $282,890.00. Following the sale, the chief accounting officer now owns 16,222 shares of the company's stock, valued at $4,589,041.58. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Michael Lawrence Gordon sold 5,000 shares of the company's stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $290.31, for a total value of $1,451,550.00. Following the completion of the transaction, the chief financial officer now directly owns 80,307 shares of the company's stock, valued at approximately $23,313,925.17. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 21,281 shares of company stock worth $5,848,411 over the last three months. Insiders own 3.60% of the company's stock.

MongoDB Stock Performance

NASDAQ:MDB traded down $4.46 during mid-day trading on Monday, reaching $267.39. 894,828 shares of the company's stock were exchanged, compared to its average volume of 1,436,579. MongoDB, Inc. has a one year low of $212.74 and a one year high of $509.62. The company has a debt-to-equity ratio of 0.84, a quick ratio of 5.03 and a current ratio of 5.03. The business's fifty day simple moving average is $274.71 and its two-hundred day simple moving average is $278.78. The firm has a market capitalization of $19.75 billion, a PE ratio of -88.79 and a beta of 1.15.

MongoDB (NASDAQ:MDB - Get Free Report) last released its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating analysts' consensus estimates of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to the consensus estimate of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The firm's quarterly revenue was up 12.8% on a year-over-year basis. During the same period in the previous year, the business earned ($0.63) earnings per share. Analysts anticipate that MongoDB, Inc. will post -2.39 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several brokerages have issued reports on MDB. Bank of America increased their price target on MongoDB from $300.00 to $350.00 and gave the stock a "buy" rating in a report on Friday, August 30th. Scotiabank upped their price target on shares of MongoDB from $250.00 to $295.00 and gave the company a "sector perform" rating in a report on Friday, August 30th. Stifel Nicolaus raised their price objective on shares of MongoDB from $300.00 to $325.00 and gave the stock a "buy" rating in a report on Friday, August 30th. DA Davidson upped their price target on MongoDB from $330.00 to $340.00 and gave the stock a "buy" rating in a research report on Friday, October 11th. Finally, Wedbush raised shares of MongoDB to a "strong-buy" rating in a research report on Thursday, October 17th. One analyst has rated the stock with a sell rating, five have issued a hold rating, twenty have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $337.96.

Check Out Our Latest Stock Analysis on MongoDB

About MongoDB

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report