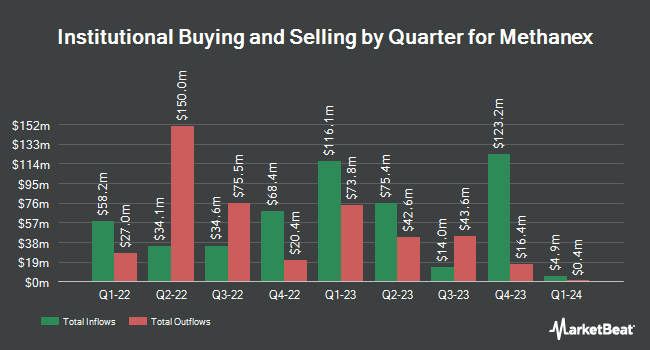

Cubist Systematic Strategies LLC lowered its stake in shares of Methanex Co. (NASDAQ:MEOH - Free Report) TSE: MX by 57.4% during the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 14,281 shares of the specialty chemicals company's stock after selling 19,240 shares during the period. Cubist Systematic Strategies LLC's holdings in Methanex were worth $689,000 at the end of the most recent quarter.

Several other large investors also recently made changes to their positions in the stock. BNP Paribas Financial Markets acquired a new stake in shares of Methanex during the first quarter worth $494,000. Duality Advisers LP bought a new stake in Methanex in the 1st quarter valued at about $779,000. M&G Plc acquired a new position in shares of Methanex during the 1st quarter worth approximately $589,459,000. Swiss National Bank increased its stake in Methanex by 0.6% during the 1st quarter. Swiss National Bank now owns 127,500 shares of the specialty chemicals company's stock worth $5,681,000 after acquiring an additional 700 shares during the period. Finally, Headlands Technologies LLC raised its holdings in Methanex by 346.5% in the 1st quarter. Headlands Technologies LLC now owns 902 shares of the specialty chemicals company's stock valued at $40,000 after acquiring an additional 700 shares in the last quarter. Institutional investors and hedge funds own 73.49% of the company's stock.

Methanex Stock Down 1.8 %

Shares of Methanex stock traded down $0.79 during trading hours on Friday, reaching $42.13. The company's stock had a trading volume of 313,177 shares, compared to its average volume of 300,964. The company has a debt-to-equity ratio of 0.80, a quick ratio of 0.87 and a current ratio of 1.25. The stock's fifty day simple moving average is $42.59 and its two-hundred day simple moving average is $47.01. The company has a market capitalization of $2.84 billion, a P/E ratio of 17.85 and a beta of 1.35. Methanex Co. has a one year low of $36.13 and a one year high of $56.43.

Methanex (NASDAQ:MEOH - Get Free Report) TSE: MX last issued its quarterly earnings data on Tuesday, July 30th. The specialty chemicals company reported $0.62 earnings per share for the quarter, beating the consensus estimate of $0.52 by $0.10. Methanex had a return on equity of 5.44% and a net margin of 4.05%. The business had revenue of $920.00 million for the quarter, compared to analysts' expectations of $954.26 million. During the same period last year, the business earned $0.60 EPS. The business's revenue was down 2.0% on a year-over-year basis. On average, research analysts forecast that Methanex Co. will post 2.41 earnings per share for the current year.

Methanex Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Monday, September 16th were paid a dividend of $0.185 per share. This represents a $0.74 dividend on an annualized basis and a dividend yield of 1.76%. The ex-dividend date of this dividend was Monday, September 16th. Methanex's payout ratio is 31.36%.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. Piper Sandler upped their price target on shares of Methanex from $51.00 to $68.00 and gave the stock an "overweight" rating in a report on Tuesday, September 10th. Raymond James dropped their target price on shares of Methanex from $62.00 to $54.00 and set an "outperform" rating for the company in a report on Wednesday, September 11th. Barclays cut shares of Methanex from an "overweight" rating to an "equal weight" rating and lowered their price objective for the stock from $56.00 to $44.00 in a research report on Tuesday, September 10th. Royal Bank of Canada restated a "sector perform" rating and issued a $55.00 target price on shares of Methanex in a research report on Tuesday, September 3rd. Finally, Scotiabank increased their price target on Methanex from $58.00 to $60.00 and gave the company a "sector outperform" rating in a research note on Wednesday, July 10th. Three equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $55.38.

Get Our Latest Analysis on MEOH

Methanex Company Profile

(

Free Report)

Methanex Corporation produces and supplies methanol in China, Europe, the United States, South America, South Korea, Canada, and Asia. The company also purchases methanol produced by others under methanol offtake contracts and on the spot market. In addition, it owns and leases storage and terminal facilities.

Featured Stories

Before you consider Methanex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Methanex wasn't on the list.

While Methanex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.