Assenagon Asset Management S.A. bought a new stake in shares of MKS Instruments, Inc. (NASDAQ:MKSI - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund bought 8,485 shares of the scientific and technical instruments company's stock, valued at approximately $922,000.

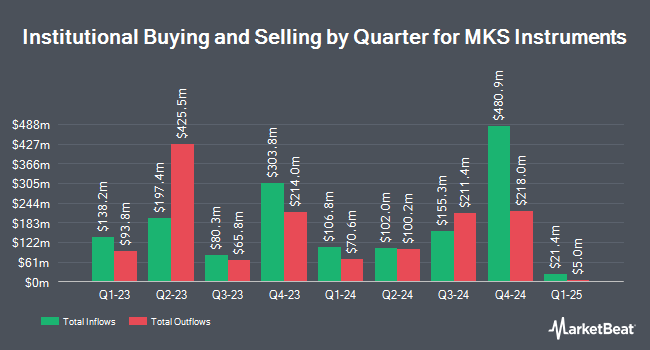

Several other institutional investors have also recently added to or reduced their stakes in the business. Allspring Global Investments Holdings LLC bought a new position in shares of MKS Instruments during the first quarter worth about $25,000. Massmutual Trust Co. FSB ADV grew its position in shares of MKS Instruments by 196.9% during the third quarter. Massmutual Trust Co. FSB ADV now owns 288 shares of the scientific and technical instruments company's stock worth $31,000 after acquiring an additional 191 shares during the last quarter. UMB Bank n.a. grew its position in shares of MKS Instruments by 53.7% during the third quarter. UMB Bank n.a. now owns 349 shares of the scientific and technical instruments company's stock worth $38,000 after acquiring an additional 122 shares during the last quarter. Key Financial Inc bought a new position in shares of MKS Instruments during the second quarter worth about $39,000. Finally, BOKF NA bought a new position in shares of MKS Instruments during the second quarter worth about $39,000. Institutional investors own 99.79% of the company's stock.

Analyst Ratings Changes

Several research firms recently weighed in on MKSI. Deutsche Bank Aktiengesellschaft reduced their price objective on shares of MKS Instruments from $140.00 to $120.00 and set a "hold" rating for the company in a report on Friday, August 9th. Wells Fargo & Company reduced their price objective on shares of MKS Instruments from $120.00 to $110.00 and set an "equal weight" rating for the company in a report on Thursday, October 3rd. Morgan Stanley began coverage on shares of MKS Instruments in a report on Monday, August 5th. They issued an "overweight" rating and a $155.00 price objective for the company. The Goldman Sachs Group began coverage on shares of MKS Instruments in a report on Tuesday, September 3rd. They issued a "neutral" rating and a $129.00 price objective for the company. Finally, Benchmark reaffirmed a "buy" rating and issued a $142.00 price objective on shares of MKS Instruments in a report on Thursday, August 8th. Five equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $141.09.

View Our Latest Report on MKS Instruments

Insider Buying and Selling at MKS Instruments

In other MKS Instruments news, EVP John Edward Williams sold 1,800 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $118.71, for a total transaction of $213,678.00. Following the completion of the sale, the executive vice president now directly owns 13 shares of the company's stock, valued at approximately $1,543.23. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, Director Elizabeth Mora sold 275 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $115.97, for a total value of $31,891.75. Following the transaction, the director now owns 17,934 shares in the company, valued at $2,079,805.98. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP John Edward Williams sold 1,800 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $118.71, for a total value of $213,678.00. Following the completion of the transaction, the executive vice president now owns 13 shares in the company, valued at $1,543.23. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 2,325 shares of company stock valued at $272,795. 0.46% of the stock is currently owned by corporate insiders.

MKS Instruments Price Performance

NASDAQ MKSI traded up $1.27 on Friday, reaching $100.60. The company's stock had a trading volume of 739,677 shares, compared to its average volume of 842,137. MKS Instruments, Inc. has a twelve month low of $63.64 and a twelve month high of $147.40. The company has a debt-to-equity ratio of 2.16, a quick ratio of 2.31 and a current ratio of 3.58. The stock has a market cap of $6.77 billion, a PE ratio of 914.55, a PEG ratio of 0.70 and a beta of 1.63. The firm's 50 day moving average is $107.71 and its two-hundred day moving average is $119.21.

MKS Instruments (NASDAQ:MKSI - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The scientific and technical instruments company reported $1.53 EPS for the quarter, beating analysts' consensus estimates of $1.02 by $0.51. MKS Instruments had a net margin of 0.25% and a return on equity of 14.91%. The company had revenue of $887.00 million during the quarter, compared to analyst estimates of $866.38 million. During the same period in the prior year, the firm earned $1.32 earnings per share. The business's quarterly revenue was down 11.6% on a year-over-year basis. As a group, sell-side analysts predict that MKS Instruments, Inc. will post 5.61 EPS for the current year.

MKS Instruments Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 6th. Shareholders of record on Monday, August 26th were paid a dividend of $0.22 per share. This represents a $0.88 dividend on an annualized basis and a yield of 0.87%. The ex-dividend date was Monday, August 26th. MKS Instruments's dividend payout ratio is presently 800.00%.

MKS Instruments Profile

(

Free Report)

MKS Instruments, Inc provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, Germany, China, South Korea, and internationally. It operates through Vacuum Solutions Division (VSD), Photonics Solutions Division (PSD), and Material Solutions Division (MSD) segments.

Recommended Stories

Before you consider MKS Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MKS Instruments wasn't on the list.

While MKS Instruments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.