Van ECK Associates Corp decreased its position in shares of MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 3.5% during the third quarter, according to its most recent filing with the SEC. The firm owned 1,764,239 shares of the financial services provider's stock after selling 63,816 shares during the period. Van ECK Associates Corp owned about 4.66% of MarketAxess worth $451,998,000 at the end of the most recent quarter.

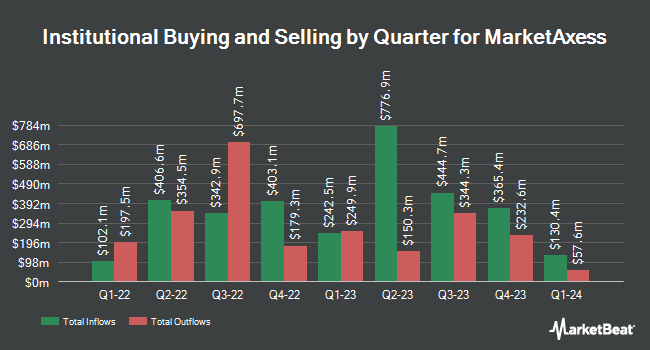

A number of other hedge funds and other institutional investors have also recently made changes to their positions in MKTX. Tokio Marine Asset Management Co. Ltd. grew its holdings in shares of MarketAxess by 12.3% during the 1st quarter. Tokio Marine Asset Management Co. Ltd. now owns 1,142 shares of the financial services provider's stock worth $250,000 after acquiring an additional 125 shares during the period. Larson Financial Group LLC grew its holdings in shares of MarketAxess by 2,428.6% during the 1st quarter. Larson Financial Group LLC now owns 177 shares of the financial services provider's stock worth $39,000 after acquiring an additional 170 shares during the period. Geneva Capital Management LLC grew its holdings in shares of MarketAxess by 2.9% during the 1st quarter. Geneva Capital Management LLC now owns 5,921 shares of the financial services provider's stock worth $1,298,000 after acquiring an additional 167 shares during the period. SG Americas Securities LLC grew its holdings in shares of MarketAxess by 174.2% during the 1st quarter. SG Americas Securities LLC now owns 6,743 shares of the financial services provider's stock worth $1,478,000 after acquiring an additional 4,284 shares during the period. Finally, Retirement Planning Co of New England Inc. grew its holdings in shares of MarketAxess by 18.0% during the 1st quarter. Retirement Planning Co of New England Inc. now owns 1,522 shares of the financial services provider's stock worth $334,000 after acquiring an additional 232 shares during the period. Hedge funds and other institutional investors own 99.01% of the company's stock.

Insider Activity

In other news, insider Christophe Pierre Danie Roupie sold 617 shares of the stock in a transaction on Thursday, August 8th. The stock was sold at an average price of $231.63, for a total transaction of $142,915.71. Following the transaction, the insider now directly owns 7,409 shares of the company's stock, valued at $1,716,146.67. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Insiders own 2.66% of the company's stock.

MarketAxess Stock Down 0.7 %

MKTX stock traded down $2.02 during midday trading on Friday, hitting $287.40. The company's stock had a trading volume of 271,739 shares, compared to its average volume of 308,488. The company has a market cap of $10.85 billion, a PE ratio of 41.41, a P/E/G ratio of 9.10 and a beta of 1.05. MarketAxess Holdings Inc. has a 12 month low of $192.42 and a 12 month high of $297.97. The company has a current ratio of 2.91, a quick ratio of 2.91 and a debt-to-equity ratio of 0.01. The firm's 50-day moving average is $266.65 and its 200-day moving average is $230.88.

MarketAxess (NASDAQ:MKTX - Get Free Report) last released its quarterly earnings data on Tuesday, August 6th. The financial services provider reported $1.72 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.68 by $0.04. The business had revenue of $197.70 million for the quarter, compared to analysts' expectations of $198.07 million. MarketAxess had a return on equity of 20.43% and a net margin of 33.71%. The firm's quarterly revenue was up 9.9% on a year-over-year basis. During the same period in the prior year, the firm posted $1.63 EPS. On average, equities research analysts forecast that MarketAxess Holdings Inc. will post 7.26 earnings per share for the current fiscal year.

MarketAxess announced that its board has approved a stock repurchase program on Tuesday, August 6th that authorizes the company to repurchase $250.00 million in shares. This repurchase authorization authorizes the financial services provider to repurchase up to 2.8% of its stock through open market purchases. Stock repurchase programs are often a sign that the company's board of directors believes its stock is undervalued.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on MKTX. StockNews.com upgraded MarketAxess from a "sell" rating to a "hold" rating in a research note on Wednesday, August 7th. Keefe, Bruyette & Woods upped their price target on MarketAxess from $222.00 to $225.00 and gave the stock a "market perform" rating in a research note on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft upped their price target on MarketAxess from $218.00 to $223.00 and gave the stock a "hold" rating in a research note on Thursday, August 15th. Citigroup upped their price target on MarketAxess from $310.00 to $325.00 and gave the stock a "buy" rating in a research note on Friday, October 4th. Finally, The Goldman Sachs Group upped their price target on MarketAxess from $204.00 to $233.00 and gave the stock a "neutral" rating in a research note on Monday, September 30th. Two analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, MarketAxess presently has a consensus rating of "Hold" and a consensus target price of $253.30.

Check Out Our Latest Research Report on MarketAxess

MarketAxess Profile

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Recommended Stories

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.