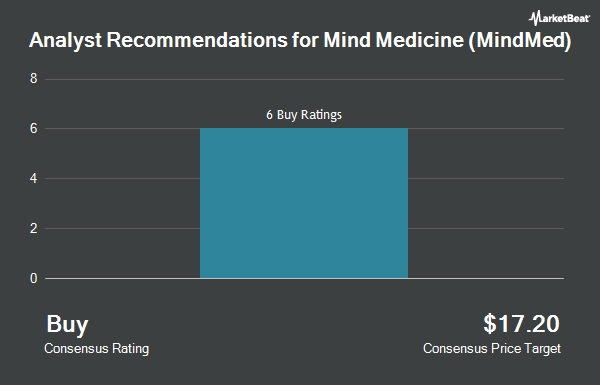

Shares of Mind Medicine (MindMed) Inc. (NASDAQ:MNMD - Get Free Report) have earned a consensus rating of "Buy" from the twelve brokerages that are currently covering the stock, MarketBeat reports. Ten equities research analysts have rated the stock with a buy recommendation and two have issued a strong buy recommendation on the company. The average 1-year price objective among analysts that have updated their coverage on the stock in the last year is $25.38.

A number of research analysts recently weighed in on MNMD shares. Royal Bank of Canada restated an "outperform" rating and set a $22.00 price objective on shares of Mind Medicine (MindMed) in a research report on Wednesday, June 5th. Canaccord Genuity Group reduced their price objective on Mind Medicine (MindMed) from $16.00 to $14.00 and set a "buy" rating for the company in a research report on Monday, September 16th. Cantor Fitzgerald restated an "overweight" rating on shares of Mind Medicine (MindMed) in a research note on Friday, June 21st. HC Wainwright increased their price objective on shares of Mind Medicine (MindMed) from $35.00 to $55.00 and gave the stock a "buy" rating in a research note on Thursday, August 29th. Finally, Roth Mkm started coverage on shares of Mind Medicine (MindMed) in a research report on Wednesday, July 24th. They set a "buy" rating and a $36.00 target price for the company.

View Our Latest Stock Report on Mind Medicine (MindMed)

Insider Buying and Selling at Mind Medicine (MindMed)

In related news, CEO Robert Barrow sold 19,771 shares of the business's stock in a transaction that occurred on Wednesday, September 25th. The stock was sold at an average price of $5.98, for a total value of $118,230.58. Following the transaction, the chief executive officer now directly owns 545,772 shares of the company's stock, valued at approximately $3,263,716.56. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other Mind Medicine (MindMed) news, CEO Robert Barrow sold 19,771 shares of the stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $5.98, for a total transaction of $118,230.58. Following the completion of the transaction, the chief executive officer now owns 545,772 shares of the company's stock, valued at approximately $3,263,716.56. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Dan Karlin sold 6,871 shares of the firm's stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $5.98, for a total value of $41,088.58. Following the transaction, the insider now owns 344,656 shares of the company's stock, valued at approximately $2,061,042.88. The disclosure for this sale can be found here. Insiders have sold a total of 28,994 shares of company stock valued at $173,384 over the last ninety days. 2.26% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of the business. Scotia Capital Inc. purchased a new stake in Mind Medicine (MindMed) during the fourth quarter valued at $441,000. Sequoia Financial Advisors LLC purchased a new stake in shares of Mind Medicine (MindMed) during the 1st quarter valued at about $168,000. Moloney Securities Asset Management LLC lifted its holdings in shares of Mind Medicine (MindMed) by 133.0% in the 1st quarter. Moloney Securities Asset Management LLC now owns 161,961 shares of the company's stock valued at $1,522,000 after acquiring an additional 92,450 shares during the last quarter. SageView Advisory Group LLC purchased a new position in Mind Medicine (MindMed) in the first quarter worth about $25,000. Finally, Blackstone Inc. bought a new stake in Mind Medicine (MindMed) during the first quarter worth approximately $11,749,000. 27.91% of the stock is owned by hedge funds and other institutional investors.

Mind Medicine (MindMed) Stock Down 1.4 %

MNMD stock traded down $0.08 on Wednesday, reaching $5.55. 320,327 shares of the company traded hands, compared to its average volume of 1,481,201. The company has a debt-to-equity ratio of 0.12, a current ratio of 5.92 and a quick ratio of 5.92. The firm has a fifty day simple moving average of $6.62 and a 200-day simple moving average of $7.93. Mind Medicine has a one year low of $2.41 and a one year high of $12.22. The company has a market cap of $398.89 million, a P/E ratio of -1.89 and a beta of 2.53.

Mind Medicine (MindMed) (NASDAQ:MNMD - Get Free Report) last released its quarterly earnings data on Tuesday, August 13th. The company reported ($0.48) EPS for the quarter, missing the consensus estimate of ($0.30) by ($0.18). Research analysts anticipate that Mind Medicine will post -1.27 earnings per share for the current year.

Mind Medicine (MindMed) Company Profile

(

Get Free ReportMind Medicine (MindMed) Inc, a clinical stage biopharmaceutical company, develops novel products to treat brain health disorders. The company's lead product candidates include MM-120, which is in phase 2 for the treatment of generalized anxiety disorder and attention deficit hyperactivity disorder; and MM-402, a R-enantiomer of 3,4-methylenedioxymethamphetamine, which is in phase I clinical trials for the treatment of core symptoms of autism spectrum disorder.

Read More

Before you consider Mind Medicine (MindMed), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mind Medicine (MindMed) wasn't on the list.

While Mind Medicine (MindMed) currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.