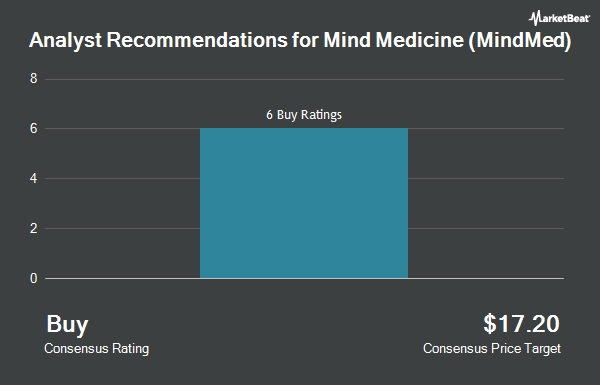

Shares of Mind Medicine (MindMed) Inc. (NASDAQ:MNMD - Get Free Report) have earned an average rating of "Buy" from the twelve brokerages that are currently covering the stock, Marketbeat reports. Nine investment analysts have rated the stock with a buy recommendation and three have issued a strong buy recommendation on the company. The average 1 year price objective among analysts that have updated their coverage on the stock in the last year is $25.38.

MNMD has been the subject of a number of recent research reports. Canaccord Genuity Group decreased their price objective on Mind Medicine (MindMed) from $16.00 to $14.00 and set a "buy" rating for the company in a report on Monday, September 16th. Leerink Partnrs upgraded Mind Medicine (MindMed) to a "strong-buy" rating in a research report on Friday, October 11th. HC Wainwright increased their target price on shares of Mind Medicine (MindMed) from $35.00 to $55.00 and gave the company a "buy" rating in a research report on Thursday, August 29th. Roth Mkm started coverage on shares of Mind Medicine (MindMed) in a research note on Wednesday, July 24th. They issued a "buy" rating and a $36.00 price objective on the stock. Finally, Leerink Partners initiated coverage on shares of Mind Medicine (MindMed) in a research note on Monday, October 14th. They set an "outperform" rating and a $20.00 target price for the company.

View Our Latest Stock Analysis on Mind Medicine (MindMed)

Insider Activity

In related news, CEO Robert Barrow sold 19,771 shares of the stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $5.98, for a total value of $118,230.58. Following the transaction, the chief executive officer now directly owns 545,772 shares in the company, valued at $3,263,716.56. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other news, insider Dan Karlin sold 6,871 shares of the firm's stock in a transaction that occurred on Wednesday, September 25th. The stock was sold at an average price of $5.98, for a total value of $41,088.58. Following the transaction, the insider now owns 344,656 shares in the company, valued at $2,061,042.88. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Robert Barrow sold 19,771 shares of the company's stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $5.98, for a total value of $118,230.58. Following the sale, the chief executive officer now owns 545,772 shares of the company's stock, valued at $3,263,716.56. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 28,994 shares of company stock worth $173,384 over the last quarter. 2.26% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Mind Medicine (MindMed)

A number of hedge funds have recently bought and sold shares of the company. SageView Advisory Group LLC bought a new position in shares of Mind Medicine (MindMed) during the first quarter valued at about $25,000. Bridgewealth Advisory Group LLC bought a new position in shares of Mind Medicine (MindMed) during the 2nd quarter worth approximately $72,000. Wealth Enhancement Advisory Services LLC purchased a new position in shares of Mind Medicine (MindMed) in the 3rd quarter worth approximately $58,000. Wealth Alliance bought a new position in shares of Mind Medicine (MindMed) in the second quarter valued at approximately $79,000. Finally, Arizona State Retirement System bought a new stake in Mind Medicine (MindMed) during the second quarter worth $114,000. 27.91% of the stock is owned by hedge funds and other institutional investors.

Mind Medicine (MindMed) Trading Down 1.0 %

Shares of MNMD stock traded down $0.06 during mid-day trading on Friday, reaching $6.05. 363,432 shares of the stock traded hands, compared to its average volume of 1,410,052. The stock's fifty day simple moving average is $5.98 and its two-hundred day simple moving average is $7.40. Mind Medicine has a 1-year low of $2.41 and a 1-year high of $12.22. The company has a quick ratio of 5.92, a current ratio of 5.92 and a debt-to-equity ratio of 0.12. The company has a market cap of $434.83 million, a price-to-earnings ratio of -2.06 and a beta of 2.52.

Mind Medicine (MindMed) (NASDAQ:MNMD - Get Free Report) last posted its earnings results on Tuesday, August 13th. The company reported ($0.48) earnings per share for the quarter, missing analysts' consensus estimates of ($0.30) by ($0.18). On average, research analysts anticipate that Mind Medicine will post -1.27 EPS for the current fiscal year.

Mind Medicine (MindMed) Company Profile

(

Get Free ReportMind Medicine (MindMed) Inc, a clinical stage biopharmaceutical company, develops novel products to treat brain health disorders. The company's lead product candidates include MM-120, which is in phase 2 for the treatment of generalized anxiety disorder and attention deficit hyperactivity disorder; and MM-402, a R-enantiomer of 3,4-methylenedioxymethamphetamine, which is in phase I clinical trials for the treatment of core symptoms of autism spectrum disorder.

Further Reading

Before you consider Mind Medicine (MindMed), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mind Medicine (MindMed) wasn't on the list.

While Mind Medicine (MindMed) currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.