Lmcg Investments LLC lifted its holdings in Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 16.0% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 134,525 shares of the semiconductor company's stock after purchasing an additional 18,545 shares during the period. Lmcg Investments LLC's holdings in Marvell Technology were worth $9,702,000 as of its most recent filing with the SEC.

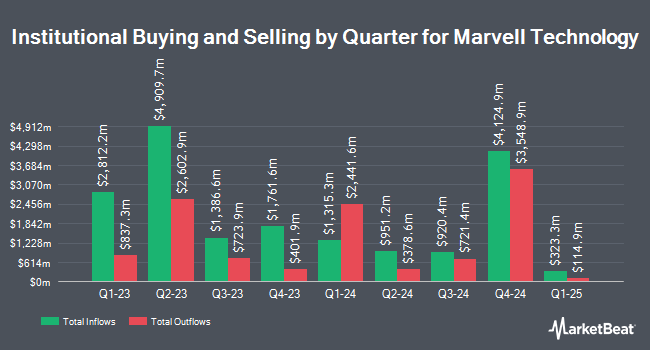

Several other large investors have also made changes to their positions in MRVL. Davidson Kempner Capital Management LP boosted its holdings in Marvell Technology by 26.5% in the 2nd quarter. Davidson Kempner Capital Management LP now owns 250,000 shares of the semiconductor company's stock valued at $17,482,000 after purchasing an additional 52,365 shares during the period. Diversified Trust Co acquired a new stake in Marvell Technology during the second quarter worth about $932,000. Orion Portfolio Solutions LLC grew its position in Marvell Technology by 47.1% during the first quarter. Orion Portfolio Solutions LLC now owns 32,191 shares of the semiconductor company's stock worth $2,282,000 after buying an additional 10,306 shares in the last quarter. WD Rutherford LLC increased its stake in Marvell Technology by 182.5% during the third quarter. WD Rutherford LLC now owns 18,266 shares of the semiconductor company's stock valued at $1,317,000 after acquiring an additional 11,801 shares during the period. Finally, abrdn plc raised its holdings in Marvell Technology by 1.3% in the 3rd quarter. abrdn plc now owns 1,530,125 shares of the semiconductor company's stock valued at $109,037,000 after acquiring an additional 19,794 shares in the last quarter. Institutional investors and hedge funds own 83.51% of the company's stock.

Insider Activity at Marvell Technology

In other Marvell Technology news, CEO Matthew J. Murphy sold 6,000 shares of Marvell Technology stock in a transaction on Monday, September 16th. The shares were sold at an average price of $73.29, for a total transaction of $439,740.00. Following the completion of the sale, the chief executive officer now owns 208,915 shares of the company's stock, valued at approximately $15,311,380.35. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, CEO Matthew J. Murphy purchased 13,000 shares of the business's stock in a transaction that occurred on Monday, October 14th. The shares were acquired at an average cost of $77.63 per share, for a total transaction of $1,009,190.00. Following the transaction, the chief executive officer now directly owns 221,915 shares of the company's stock, valued at approximately $17,227,261.45. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a filing with the SEC, which is available at this link. Also, CEO Matthew J. Murphy sold 6,000 shares of the business's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $73.29, for a total transaction of $439,740.00. Following the transaction, the chief executive officer now owns 208,915 shares of the company's stock, valued at approximately $15,311,380.35. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 261,000 shares of company stock worth $20,330,835 over the last ninety days. Company insiders own 0.33% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on MRVL shares. Barclays boosted their price objective on Marvell Technology from $80.00 to $85.00 and gave the company an "overweight" rating in a research report on Friday, August 30th. StockNews.com cut shares of Marvell Technology from a "hold" rating to a "sell" rating in a research note on Friday, October 18th. KeyCorp lifted their target price on shares of Marvell Technology from $90.00 to $95.00 and gave the company an "overweight" rating in a research report on Tuesday, July 9th. TD Cowen raised shares of Marvell Technology to a "strong-buy" rating in a research report on Monday, September 16th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and set a $85.00 price objective on shares of Marvell Technology in a report on Friday, August 30th. One research analyst has rated the stock with a sell rating, one has assigned a hold rating, twenty have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Marvell Technology has an average rating of "Moderate Buy" and a consensus price target of $91.62.

Check Out Our Latest Analysis on MRVL

Marvell Technology Price Performance

Shares of MRVL stock traded up $4.66 during trading hours on Friday, reaching $84.77. 20,330,467 shares of the company were exchanged, compared to its average volume of 9,969,209. Marvell Technology, Inc. has a fifty-two week low of $48.44 and a fifty-two week high of $87.28. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.79 and a quick ratio of 1.26. The stock's fifty day moving average is $74.94 and its two-hundred day moving average is $71.00.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last announced its quarterly earnings data on Thursday, August 29th. The semiconductor company reported $0.30 EPS for the quarter, meeting analysts' consensus estimates of $0.30. Marvell Technology had a positive return on equity of 4.31% and a negative net margin of 18.30%. The firm had revenue of $1.27 billion for the quarter, compared to analyst estimates of $1.25 billion. During the same period last year, the company earned $0.18 EPS. The business's quarterly revenue was down 5.1% compared to the same quarter last year. On average, equities analysts anticipate that Marvell Technology, Inc. will post 0.78 EPS for the current fiscal year.

Marvell Technology Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Friday, October 11th were paid a dividend of $0.06 per share. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.28%. The ex-dividend date was Friday, October 11th. Marvell Technology's dividend payout ratio (DPR) is -21.62%.

Marvell Technology Company Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

Further Reading

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report