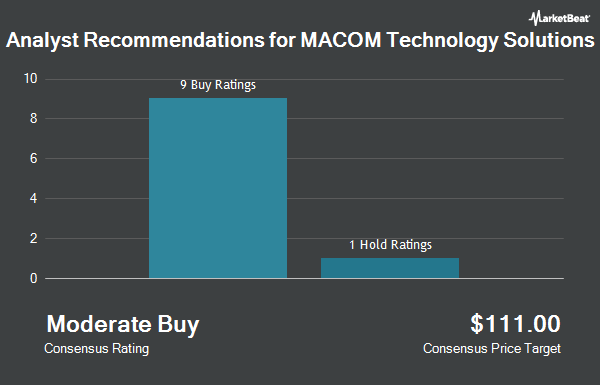

Shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the ten brokerages that are presently covering the stock, Marketbeat reports. Two investment analysts have rated the stock with a hold recommendation and eight have assigned a buy recommendation to the company. The average 1-year target price among brokerages that have updated their coverage on the stock in the last year is $120.00.

MTSI has been the subject of a number of recent analyst reports. Needham & Company LLC boosted their price objective on shares of MACOM Technology Solutions from $110.00 to $120.00 and gave the stock a "buy" rating in a report on Friday, August 2nd. Stifel Nicolaus boosted their price objective on shares of MACOM Technology Solutions from $115.00 to $135.00 and gave the stock a "buy" rating in a report on Thursday, July 18th. Barclays boosted their price objective on shares of MACOM Technology Solutions from $115.00 to $120.00 and gave the stock an "overweight" rating in a report on Friday, August 2nd. Piper Sandler boosted their target price on shares of MACOM Technology Solutions from $100.00 to $115.00 and gave the company a "neutral" rating in a research note on Friday. Finally, JPMorgan Chase & Co. boosted their target price on shares of MACOM Technology Solutions from $105.00 to $110.00 and gave the company a "neutral" rating in a research note on Friday, August 2nd.

View Our Latest Research Report on MTSI

Insider Transactions at MACOM Technology Solutions

In other news, Director Susan Ocampo sold 305,395 shares of the company's stock in a transaction on Thursday, August 15th. The stock was sold at an average price of $106.48, for a total value of $32,518,459.60. Following the completion of the sale, the director now directly owns 6,550,889 shares in the company, valued at $697,538,660.72. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. In related news, SVP Robert Dennehy sold 6,683 shares of the company's stock in a transaction on Wednesday, August 21st. The shares were sold at an average price of $106.78, for a total value of $713,610.74. Following the completion of the transaction, the senior vice president now owns 26,396 shares of the company's stock, valued at approximately $2,818,564.88. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, Director Susan Ocampo sold 305,395 shares of the company's stock in a transaction on Thursday, August 15th. The stock was sold at an average price of $106.48, for a total transaction of $32,518,459.60. Following the completion of the transaction, the director now directly owns 6,550,889 shares of the company's stock, valued at $697,538,660.72. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 654,861 shares of company stock worth $69,430,533 in the last three months. Corporate insiders own 22.75% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of MTSI. Opal Wealth Advisors LLC purchased a new stake in shares of MACOM Technology Solutions during the 2nd quarter valued at about $39,000. GAMMA Investing LLC boosted its stake in shares of MACOM Technology Solutions by 153.0% during the second quarter. GAMMA Investing LLC now owns 468 shares of the semiconductor company's stock valued at $52,000 after purchasing an additional 283 shares in the last quarter. Allspring Global Investments Holdings LLC bought a new position in shares of MACOM Technology Solutions during the third quarter valued at approximately $66,000. Fidelis Capital Partners LLC bought a new position in shares of MACOM Technology Solutions during the first quarter valued at approximately $77,000. Finally, FSC Wealth Advisors LLC bought a new position in shares of MACOM Technology Solutions during the second quarter valued at approximately $78,000. Institutional investors own 76.14% of the company's stock.

MACOM Technology Solutions Stock Up 4.0 %

Shares of MTSI traded up $4.72 during mid-day trading on Friday, reaching $121.70. The company had a trading volume of 805,568 shares, compared to its average volume of 565,994. The company has a debt-to-equity ratio of 0.45, a quick ratio of 6.33 and a current ratio of 8.18. The firm has a 50-day moving average price of $107.66 and a 200 day moving average price of $105.00. MACOM Technology Solutions has a 52 week low of $68.58 and a 52 week high of $121.86. The company has a market capitalization of $8.79 billion, a price-to-earnings ratio of 124.18, a price-to-earnings-growth ratio of 4.33 and a beta of 1.70.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last issued its quarterly earnings results on Thursday, August 1st. The semiconductor company reported $0.66 EPS for the quarter, hitting analysts' consensus estimates of $0.66. MACOM Technology Solutions had a return on equity of 12.59% and a net margin of 10.59%. The firm had revenue of $190.50 million for the quarter, compared to analysts' expectations of $190.42 million. During the same period in the previous year, the firm posted $0.42 EPS. The business's revenue for the quarter was up 5.0% compared to the same quarter last year. On average, sell-side analysts forecast that MACOM Technology Solutions will post 1.89 EPS for the current year.

MACOM Technology Solutions Company Profile

(

Get Free ReportMACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Read More

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.