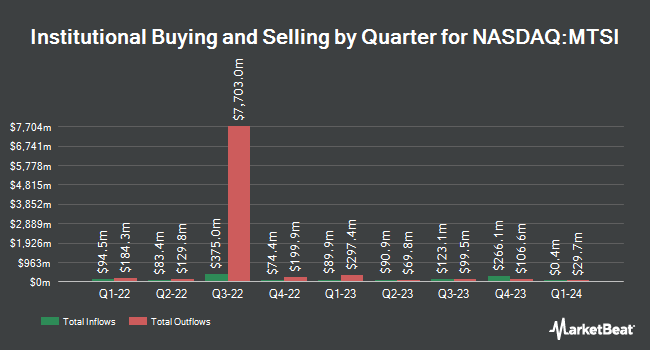

Mirae Asset Global Investments Co. Ltd. acquired a new position in shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 98,686 shares of the semiconductor company's stock, valued at approximately $11,005,000. Mirae Asset Global Investments Co. Ltd. owned about 0.14% of MACOM Technology Solutions at the end of the most recent reporting period.

A number of other institutional investors also recently added to or reduced their stakes in MTSI. Vanguard Group Inc. lifted its position in shares of MACOM Technology Solutions by 8.1% during the first quarter. Vanguard Group Inc. now owns 6,194,008 shares of the semiconductor company's stock valued at $592,395,000 after buying an additional 465,759 shares during the last quarter. Sei Investments Co. boosted its stake in MACOM Technology Solutions by 14.4% in the first quarter. Sei Investments Co. now owns 297,615 shares of the semiconductor company's stock valued at $28,464,000 after acquiring an additional 37,407 shares in the last quarter. Tidal Investments LLC grew its holdings in MACOM Technology Solutions by 175.1% in the first quarter. Tidal Investments LLC now owns 11,032 shares of the semiconductor company's stock worth $1,055,000 after purchasing an additional 7,022 shares during the last quarter. Price T Rowe Associates Inc. MD increased its position in shares of MACOM Technology Solutions by 12.5% during the first quarter. Price T Rowe Associates Inc. MD now owns 1,388,750 shares of the semiconductor company's stock worth $132,821,000 after purchasing an additional 154,066 shares in the last quarter. Finally, Thornburg Investment Management Inc. lifted its holdings in shares of MACOM Technology Solutions by 44.1% during the 1st quarter. Thornburg Investment Management Inc. now owns 94,819 shares of the semiconductor company's stock valued at $9,088,000 after purchasing an additional 29,004 shares during the last quarter. Institutional investors own 76.14% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on MTSI. Piper Sandler upped their target price on MACOM Technology Solutions from $100.00 to $115.00 and gave the company a "neutral" rating in a research report on Friday. Stifel Nicolaus upped their price objective on shares of MACOM Technology Solutions from $115.00 to $135.00 and gave the company a "buy" rating in a report on Thursday, July 18th. Needham & Company LLC lifted their target price on shares of MACOM Technology Solutions from $110.00 to $120.00 and gave the stock a "buy" rating in a research note on Friday, August 2nd. Benchmark restated a "buy" rating and set a $120.00 price target on shares of MACOM Technology Solutions in a research note on Thursday, September 12th. Finally, JPMorgan Chase & Co. raised their price target on shares of MACOM Technology Solutions from $105.00 to $110.00 and gave the stock a "neutral" rating in a report on Friday, August 2nd. Two research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $120.00.

Get Our Latest Report on MACOM Technology Solutions

MACOM Technology Solutions Stock Performance

NASDAQ MTSI traded down $4.16 on Monday, reaching $117.54. 624,265 shares of the company's stock traded hands, compared to its average volume of 423,313. MACOM Technology Solutions Holdings, Inc. has a fifty-two week low of $68.58 and a fifty-two week high of $122.60. The company has a debt-to-equity ratio of 0.45, a quick ratio of 6.33 and a current ratio of 8.18. The firm has a market cap of $8.49 billion, a price-to-earnings ratio of 119.94, a P/E/G ratio of 4.63 and a beta of 1.70. The stock has a 50 day moving average price of $107.88 and a 200-day moving average price of $105.15.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last issued its quarterly earnings data on Thursday, August 1st. The semiconductor company reported $0.66 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.66. The business had revenue of $190.50 million during the quarter, compared to analysts' expectations of $190.42 million. MACOM Technology Solutions had a return on equity of 12.59% and a net margin of 10.59%. The company's revenue for the quarter was up 5.0% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.42 EPS. Equities research analysts predict that MACOM Technology Solutions Holdings, Inc. will post 1.89 EPS for the current fiscal year.

Insider Transactions at MACOM Technology Solutions

In related news, SVP Donghyun Thomas Hwang sold 4,375 shares of the stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $104.57, for a total transaction of $457,493.75. Following the sale, the senior vice president now directly owns 37,148 shares of the company's stock, valued at approximately $3,884,566.36. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. In related news, SVP Donghyun Thomas Hwang sold 4,375 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $104.57, for a total value of $457,493.75. Following the completion of the transaction, the senior vice president now owns 37,148 shares of the company's stock, valued at approximately $3,884,566.36. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, SVP Robert Dennehy sold 6,915 shares of the firm's stock in a transaction that occurred on Tuesday, September 17th. The shares were sold at an average price of $101.38, for a total value of $701,042.70. Following the completion of the sale, the senior vice president now directly owns 19,481 shares in the company, valued at approximately $1,974,983.78. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 654,861 shares of company stock valued at $69,430,533 in the last 90 days. 22.75% of the stock is currently owned by company insiders.

MACOM Technology Solutions Profile

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Further Reading

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report