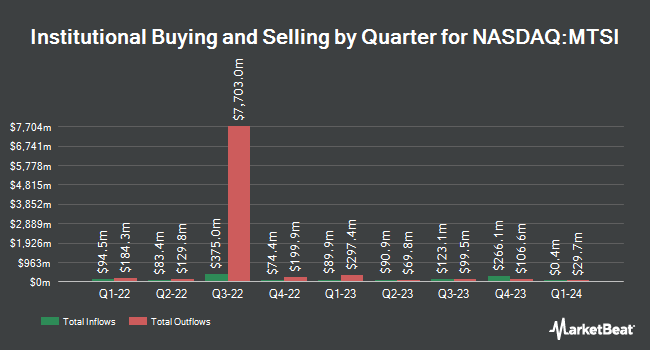

China Universal Asset Management Co. Ltd. acquired a new stake in MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) in the 3rd quarter, according to the company in its most recent filing with the SEC. The fund acquired 15,500 shares of the semiconductor company's stock, valued at approximately $1,725,000.

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Opal Wealth Advisors LLC purchased a new stake in shares of MACOM Technology Solutions in the second quarter worth $39,000. GAMMA Investing LLC lifted its position in MACOM Technology Solutions by 153.0% during the second quarter. GAMMA Investing LLC now owns 468 shares of the semiconductor company's stock valued at $52,000 after purchasing an additional 283 shares during the period. Allspring Global Investments Holdings LLC bought a new position in MACOM Technology Solutions in the third quarter worth approximately $66,000. Fidelis Capital Partners LLC bought a new stake in MACOM Technology Solutions during the first quarter valued at about $77,000. Finally, FSC Wealth Advisors LLC bought a new position in MACOM Technology Solutions in the 2nd quarter worth approximately $78,000. Institutional investors own 76.14% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts recently commented on MTSI shares. Barclays increased their price target on MACOM Technology Solutions from $115.00 to $120.00 and gave the company an "overweight" rating in a research note on Friday, August 2nd. Piper Sandler raised their target price on shares of MACOM Technology Solutions from $100.00 to $115.00 and gave the company a "neutral" rating in a report on Friday. Stifel Nicolaus upped their price target on shares of MACOM Technology Solutions from $115.00 to $135.00 and gave the company a "buy" rating in a research note on Thursday, July 18th. Needham & Company LLC increased their price objective on shares of MACOM Technology Solutions from $110.00 to $120.00 and gave the company a "buy" rating in a research report on Friday, August 2nd. Finally, JPMorgan Chase & Co. boosted their target price on shares of MACOM Technology Solutions from $105.00 to $110.00 and gave the stock a "neutral" rating in a report on Friday, August 2nd. Two research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $120.00.

View Our Latest Report on MTSI

Insider Buying and Selling

In other news, SVP Robert Dennehy sold 6,915 shares of MACOM Technology Solutions stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $101.38, for a total value of $701,042.70. Following the sale, the senior vice president now owns 19,481 shares in the company, valued at $1,974,983.78. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In other news, SVP Donghyun Thomas Hwang sold 4,375 shares of the company's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $104.57, for a total value of $457,493.75. Following the transaction, the senior vice president now owns 37,148 shares of the company's stock, valued at $3,884,566.36. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, SVP Robert Dennehy sold 6,915 shares of the business's stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $101.38, for a total transaction of $701,042.70. Following the completion of the sale, the senior vice president now owns 19,481 shares in the company, valued at approximately $1,974,983.78. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 654,861 shares of company stock valued at $69,430,533 over the last quarter. 22.75% of the stock is currently owned by company insiders.

MACOM Technology Solutions Trading Up 1.7 %

Shares of MTSI stock traded up $2.04 on Tuesday, reaching $119.58. 278,017 shares of the company's stock were exchanged, compared to its average volume of 564,909. The company's fifty day simple moving average is $107.88 and its 200 day simple moving average is $105.15. MACOM Technology Solutions Holdings, Inc. has a 52 week low of $68.58 and a 52 week high of $122.60. The company has a current ratio of 8.18, a quick ratio of 6.33 and a debt-to-equity ratio of 0.45. The stock has a market capitalization of $8.63 billion, a PE ratio of 121.78, a P/E/G ratio of 4.63 and a beta of 1.70.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last announced its quarterly earnings results on Thursday, August 1st. The semiconductor company reported $0.66 earnings per share for the quarter, hitting the consensus estimate of $0.66. MACOM Technology Solutions had a net margin of 10.59% and a return on equity of 12.59%. The firm had revenue of $190.50 million during the quarter, compared to analysts' expectations of $190.42 million. During the same quarter in the prior year, the company earned $0.42 EPS. The company's revenue was up 5.0% compared to the same quarter last year. As a group, analysts forecast that MACOM Technology Solutions Holdings, Inc. will post 1.89 EPS for the current year.

MACOM Technology Solutions Company Profile

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Featured Articles

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.