Donald Smith & CO. Inc. grew its holdings in Navient Co. (NASDAQ:NAVI - Free Report) by 27.8% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 3,581,311 shares of the credit services provider's stock after purchasing an additional 779,973 shares during the quarter. Navient comprises 1.3% of Donald Smith & CO. Inc.'s portfolio, making the stock its 28th biggest holding. Donald Smith & CO. Inc. owned approximately 3.20% of Navient worth $55,833,000 at the end of the most recent quarter.

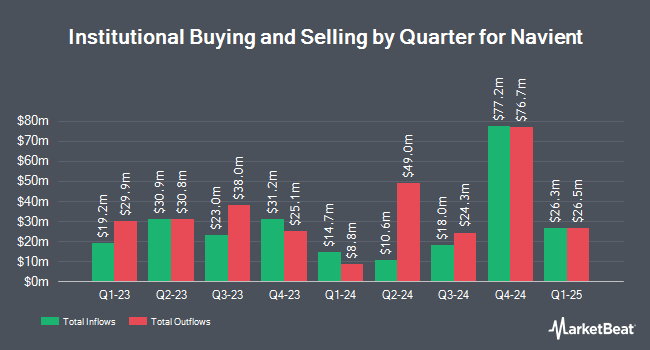

A number of other institutional investors have also made changes to their positions in the business. Allspring Global Investments Holdings LLC bought a new stake in Navient during the first quarter worth about $36,000. IAG Wealth Partners LLC acquired a new stake in shares of Navient in the second quarter valued at approximately $50,000. Signaturefd LLC boosted its position in Navient by 22.1% in the 2nd quarter. Signaturefd LLC now owns 4,797 shares of the credit services provider's stock valued at $70,000 after buying an additional 869 shares during the last quarter. nVerses Capital LLC acquired a new position in Navient during the 3rd quarter valued at about $87,000. Finally, Covestor Ltd grew its position in shares of Navient by 23.1% during the 1st quarter. Covestor Ltd now owns 6,245 shares of the credit services provider's stock worth $109,000 after buying an additional 1,173 shares during the period. 97.14% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research firms have weighed in on NAVI. Bank of America began coverage on Navient in a research note on Monday, September 30th. They issued a "neutral" rating and a $17.00 target price on the stock. JPMorgan Chase & Co. lifted their target price on Navient from $15.00 to $16.00 and gave the stock a "neutral" rating in a report on Monday, October 7th. Barclays raised their price target on Navient from $10.00 to $11.00 and gave the stock an "underweight" rating in a research report on Tuesday, October 8th. Finally, Keefe, Bruyette & Woods raised their target price on shares of Navient from $15.00 to $16.00 and gave the stock a "market perform" rating in a report on Thursday, July 25th. Three research analysts have rated the stock with a sell rating and seven have issued a hold rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $15.78.

Get Our Latest Research Report on NAVI

Navient Price Performance

Shares of NASDAQ NAVI traded up $0.05 during midday trading on Wednesday, hitting $15.19. 1,041,732 shares of the company's stock were exchanged, compared to its average volume of 783,680. The business's fifty day moving average price is $15.65 and its two-hundred day moving average price is $15.31. The company has a market cap of $1.66 billion, a price-to-earnings ratio of 9.74 and a beta of 1.39. The company has a current ratio of 9.99, a quick ratio of 9.99 and a debt-to-equity ratio of 17.30. Navient Co. has a 12-month low of $13.95 and a 12-month high of $19.68.

Navient Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, September 20th. Stockholders of record on Friday, September 6th were issued a $0.16 dividend. The ex-dividend date was Friday, September 6th. This represents a $0.64 annualized dividend and a dividend yield of 4.21%. Navient's dividend payout ratio is currently 41.03%.

Navient Profile

(

Free Report)

Navient Corporation provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States. It operates through three segments: Federal Education Loans, Consumer Lending, and Business Processing. The company owns Federal Family Education Loan Program (FFELP) loans that are insured or guaranteed by state or not-for-profit agencies; and performs servicing on its portfolios, as well as federal education loans held by other institutions.

Featured Stories

Before you consider Navient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Navient wasn't on the list.

While Navient currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.