nCino (NASDAQ:NCNO - Get Free Report)'s stock had its "outperform" rating restated by equities research analysts at Macquarie in a note issued to investors on Wednesday, Benzinga reports. They presently have a $40.00 price objective on the stock. Macquarie's price objective would suggest a potential upside of 6.52% from the company's previous close.

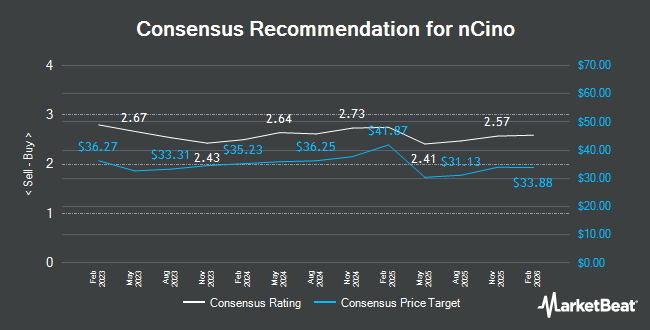

NCNO has been the topic of several other reports. JMP Securities reiterated a "market outperform" rating and issued a $43.00 price objective on shares of nCino in a research report on Wednesday, August 28th. Needham & Company LLC cut their price target on nCino from $42.00 to $40.00 and set a "buy" rating on the stock in a report on Wednesday, August 28th. Truist Financial reissued a "buy" rating and issued a $44.00 price objective (up from $37.00) on shares of nCino in a report on Monday. William Blair reaffirmed an "outperform" rating on shares of nCino in a research note on Wednesday, August 28th. Finally, Piper Sandler reiterated an "overweight" rating and set a $38.00 price target on shares of nCino in a research report on Wednesday, August 28th. Three investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. According to MarketBeat.com, nCino has an average rating of "Moderate Buy" and an average price target of $38.82.

View Our Latest Research Report on nCino

nCino Stock Performance

NCNO traded up $0.60 on Wednesday, hitting $37.55. 1,170,051 shares of the company's stock were exchanged, compared to its average volume of 1,078,191. The company has a current ratio of 1.08, a quick ratio of 1.08 and a debt-to-equity ratio of 0.09. The stock has a fifty day moving average of $32.07 and a two-hundred day moving average of $31.58. nCino has a twelve month low of $27.27 and a twelve month high of $37.86. The firm has a market cap of $4.32 billion, a PE ratio of -121.13, a P/E/G ratio of 26.59 and a beta of 0.59.

nCino (NASDAQ:NCNO - Get Free Report) last announced its quarterly earnings results on Tuesday, August 27th. The company reported $0.14 earnings per share for the quarter, topping analysts' consensus estimates of $0.13 by $0.01. nCino had a positive return on equity of 1.06% and a negative net margin of 5.78%. The business had revenue of $132.40 million for the quarter, compared to analysts' expectations of $131.06 million. During the same period in the prior year, the firm earned ($0.02) EPS. The business's quarterly revenue was up 13.0% on a year-over-year basis. On average, research analysts anticipate that nCino will post 0.05 earnings per share for the current fiscal year.

Insider Buying and Selling at nCino

In other nCino news, CFO Gregory Orenstein sold 3,885 shares of nCino stock in a transaction that occurred on Monday, October 14th. The shares were sold at an average price of $35.05, for a total value of $136,169.25. Following the transaction, the chief financial officer now owns 276,892 shares in the company, valued at approximately $9,705,064.60. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. In other nCino news, insider Sean Desmond sold 30,000 shares of the company's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $34.77, for a total transaction of $1,043,100.00. Following the completion of the sale, the insider now directly owns 341,511 shares of the company's stock, valued at approximately $11,874,337.47. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Gregory Orenstein sold 3,885 shares of nCino stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $35.05, for a total transaction of $136,169.25. Following the completion of the transaction, the chief financial officer now directly owns 276,892 shares in the company, valued at approximately $9,705,064.60. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 5,024,080 shares of company stock valued at $177,244,658. 28.40% of the stock is owned by insiders.

Institutional Investors Weigh In On nCino

Hedge funds have recently made changes to their positions in the company. Capital International Investors acquired a new stake in nCino during the 1st quarter worth about $60,703,000. Long Path Partners LP boosted its holdings in shares of nCino by 151.1% during the second quarter. Long Path Partners LP now owns 2,590,135 shares of the company's stock worth $81,460,000 after purchasing an additional 1,558,529 shares during the period. Brown Brothers Harriman & Co. purchased a new position in nCino during the second quarter valued at approximately $41,805,000. Senator Investment Group LP purchased a new position in nCino during the second quarter valued at approximately $40,885,000. Finally, ShawSpring Partners LLC acquired a new position in nCino in the 2nd quarter valued at approximately $38,663,000. Hedge funds and other institutional investors own 94.76% of the company's stock.

nCino Company Profile

(

Get Free Report)

nCino, Inc, a software-as-a-service company, provides cloud-based software applications to financial institutions in the United States and internationally. Its nCino Bank Operating System connects financial institution employees, clients and third parties on a single cloud-based platform which include client onboarding, deposit account opening, loan origination, end-to-end mortgage suite, and powerful ecosystem.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider nCino, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nCino wasn't on the list.

While nCino currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.