Copeland Capital Management LLC increased its position in shares of Nordson Co. (NASDAQ:NDSN - Free Report) by 3.1% during the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 125,968 shares of the industrial products company's stock after buying an additional 3,822 shares during the period. Copeland Capital Management LLC owned 0.22% of Nordson worth $33,083,000 as of its most recent filing with the SEC.

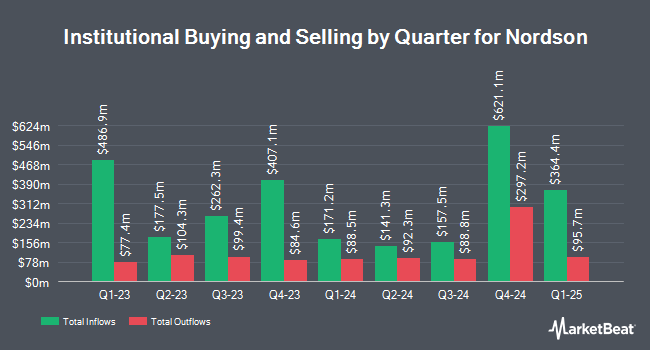

A number of other hedge funds have also recently added to or reduced their stakes in NDSN. Vanguard Group Inc. increased its position in Nordson by 0.9% during the first quarter. Vanguard Group Inc. now owns 6,122,129 shares of the industrial products company's stock worth $1,680,769,000 after purchasing an additional 52,443 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC lifted its stake in Nordson by 2.7% in the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 2,591,323 shares of the industrial products company's stock worth $601,032,000 after acquiring an additional 68,810 shares during the last quarter. Lazard Asset Management LLC raised its holdings in Nordson by 10.4% during the first quarter. Lazard Asset Management LLC now owns 942,540 shares of the industrial products company's stock worth $258,764,000 after purchasing an additional 88,966 shares in the last quarter. American Century Companies Inc. raised its holdings in Nordson by 2.7% during the second quarter. American Century Companies Inc. now owns 601,984 shares of the industrial products company's stock worth $139,624,000 after purchasing an additional 15,947 shares in the last quarter. Finally, Bank of New York Mellon Corp raised its holdings in Nordson by 2.5% during the second quarter. Bank of New York Mellon Corp now owns 490,167 shares of the industrial products company's stock worth $113,689,000 after purchasing an additional 11,809 shares in the last quarter. 72.11% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Separately, Robert W. Baird lifted their target price on shares of Nordson from $272.00 to $287.00 and gave the company an "outperform" rating in a report on Friday, August 23rd. Two equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $299.00.

View Our Latest Stock Report on NDSN

Insider Activity at Nordson

In other news, EVP Joseph P. Kelley sold 3,000 shares of the company's stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $249.98, for a total transaction of $749,940.00. Following the completion of the transaction, the executive vice president now owns 8,659 shares of the company's stock, valued at $2,164,576.82. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 0.86% of the stock is currently owned by corporate insiders.

Nordson Price Performance

Shares of NASDAQ NDSN traded down $2.24 during trading on Tuesday, hitting $251.11. 199,162 shares of the company were exchanged, compared to its average volume of 233,531. The company has a market cap of $14.38 billion, a price-to-earnings ratio of 29.91, a PEG ratio of 2.04 and a beta of 0.90. Nordson Co. has a 1 year low of $208.91 and a 1 year high of $279.38. The firm's fifty day moving average price is $252.70 and its 200 day moving average price is $248.11. The company has a debt-to-equity ratio of 0.49, a current ratio of 2.36 and a quick ratio of 1.52.

Nordson (NASDAQ:NDSN - Get Free Report) last released its quarterly earnings data on Wednesday, August 21st. The industrial products company reported $2.41 EPS for the quarter, topping the consensus estimate of $2.33 by $0.08. Nordson had a net margin of 17.75% and a return on equity of 19.80%. The business had revenue of $661.60 million for the quarter, compared to analyst estimates of $656.49 million. During the same period in the previous year, the firm earned $2.35 EPS. The business's revenue for the quarter was up 2.0% compared to the same quarter last year. On average, sell-side analysts expect that Nordson Co. will post 9.55 earnings per share for the current fiscal year.

Nordson Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, September 10th. Investors of record on Tuesday, August 27th were paid a $0.78 dividend. This is an increase from Nordson's previous quarterly dividend of $0.68. The ex-dividend date of this dividend was Tuesday, August 27th. This represents a $3.12 annualized dividend and a yield of 1.24%. Nordson's payout ratio is presently 37.19%.

Nordson Profile

(

Free Report)

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Recommended Stories

Before you consider Nordson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordson wasn't on the list.

While Nordson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.