Boston Trust Walden Corp lessened its holdings in Nordson Co. (NASDAQ:NDSN - Free Report) by 1.1% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 281,177 shares of the industrial products company's stock after selling 3,105 shares during the period. Boston Trust Walden Corp owned 0.49% of Nordson worth $73,846,000 at the end of the most recent reporting period.

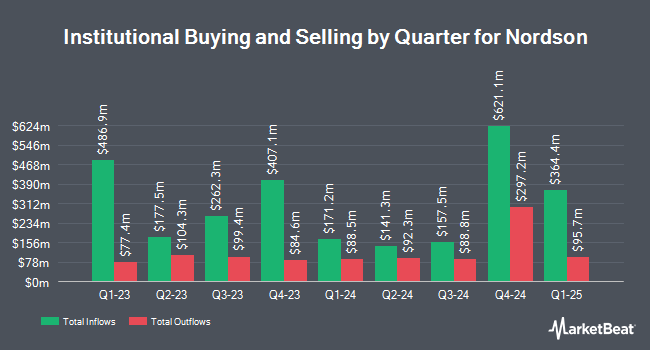

Other large investors have also recently bought and sold shares of the company. Vanguard Group Inc. lifted its position in shares of Nordson by 0.9% in the first quarter. Vanguard Group Inc. now owns 6,122,129 shares of the industrial products company's stock worth $1,680,769,000 after buying an additional 52,443 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC boosted its position in Nordson by 2.7% during the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 2,591,323 shares of the industrial products company's stock worth $601,032,000 after purchasing an additional 68,810 shares during the period. Lazard Asset Management LLC boosted its position in Nordson by 10.4% during the first quarter. Lazard Asset Management LLC now owns 942,540 shares of the industrial products company's stock worth $258,764,000 after purchasing an additional 88,966 shares during the period. American Century Companies Inc. grew its holdings in Nordson by 2.7% during the second quarter. American Century Companies Inc. now owns 601,984 shares of the industrial products company's stock valued at $139,624,000 after purchasing an additional 15,947 shares during the last quarter. Finally, Bank of New York Mellon Corp raised its position in shares of Nordson by 2.5% in the second quarter. Bank of New York Mellon Corp now owns 490,167 shares of the industrial products company's stock valued at $113,689,000 after purchasing an additional 11,809 shares during the period. 72.11% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Nordson

In related news, EVP Joseph P. Kelley sold 3,000 shares of the firm's stock in a transaction on Wednesday, October 9th. The stock was sold at an average price of $249.98, for a total value of $749,940.00. Following the completion of the transaction, the executive vice president now directly owns 8,659 shares of the company's stock, valued at $2,164,576.82. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 0.86% of the company's stock.

Nordson Stock Performance

NASDAQ NDSN traded down $0.79 during trading on Friday, hitting $248.10. The company's stock had a trading volume of 135,266 shares, compared to its average volume of 233,815. Nordson Co. has a 52 week low of $208.91 and a 52 week high of $279.38. The firm has a market cap of $14.21 billion, a P/E ratio of 29.57, a price-to-earnings-growth ratio of 2.02 and a beta of 0.90. The firm has a 50 day moving average price of $253.58 and a 200 day moving average price of $247.83. The company has a quick ratio of 1.52, a current ratio of 2.36 and a debt-to-equity ratio of 0.49.

Nordson (NASDAQ:NDSN - Get Free Report) last announced its earnings results on Wednesday, August 21st. The industrial products company reported $2.41 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.33 by $0.08. The business had revenue of $661.60 million for the quarter, compared to analyst estimates of $656.49 million. Nordson had a net margin of 17.75% and a return on equity of 19.80%. Nordson's revenue was up 2.0% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $2.35 earnings per share. Equities research analysts forecast that Nordson Co. will post 9.55 earnings per share for the current fiscal year.

Nordson Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 10th. Investors of record on Tuesday, August 27th were paid a dividend of $0.78 per share. This represents a $3.12 annualized dividend and a yield of 1.26%. This is a positive change from Nordson's previous quarterly dividend of $0.68. The ex-dividend date was Tuesday, August 27th. Nordson's payout ratio is currently 37.19%.

Analyst Ratings Changes

Separately, Robert W. Baird upped their price objective on shares of Nordson from $272.00 to $287.00 and gave the stock an "outperform" rating in a report on Friday, August 23rd. Two analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat.com, Nordson currently has a consensus rating of "Moderate Buy" and a consensus target price of $299.00.

Get Our Latest Stock Report on Nordson

Nordson Company Profile

(

Free Report)

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Recommended Stories

Before you consider Nordson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordson wasn't on the list.

While Nordson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.