RWQ Financial Management Services Inc. purchased a new stake in Netflix, Inc. (NASDAQ:NFLX - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 1,722 shares of the Internet television network's stock, valued at approximately $1,221,000. Netflix makes up 0.4% of RWQ Financial Management Services Inc.'s investment portfolio, making the stock its 18th biggest holding.

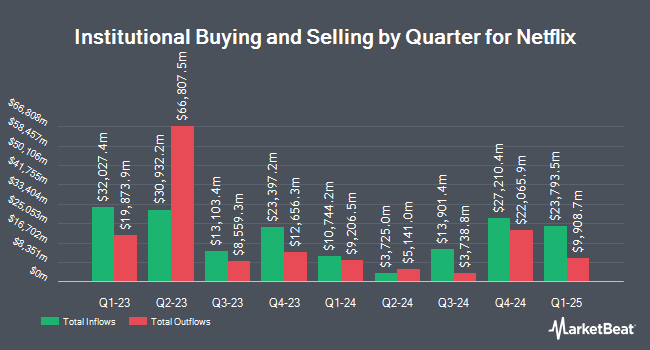

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Vanguard Group Inc. boosted its holdings in Netflix by 0.4% in the 1st quarter. Vanguard Group Inc. now owns 36,587,911 shares of the Internet television network's stock valued at $22,220,936,000 after purchasing an additional 149,341 shares during the period. Jennison Associates LLC grew its position in Netflix by 17.0% during the first quarter. Jennison Associates LLC now owns 6,381,464 shares of the Internet television network's stock worth $3,875,655,000 after buying an additional 929,193 shares in the last quarter. International Assets Investment Management LLC grew its position in Netflix by 116,620.0% during the third quarter. International Assets Investment Management LLC now owns 5,753,129 shares of the Internet television network's stock worth $4,080,522,000 after buying an additional 5,748,200 shares in the last quarter. Baillie Gifford & Co. increased its stake in Netflix by 2.3% in the 2nd quarter. Baillie Gifford & Co. now owns 4,762,069 shares of the Internet television network's stock worth $3,213,825,000 after acquiring an additional 106,756 shares during the last quarter. Finally, Legal & General Group Plc raised its holdings in shares of Netflix by 3.1% in the 2nd quarter. Legal & General Group Plc now owns 3,449,114 shares of the Internet television network's stock valued at $2,327,738,000 after acquiring an additional 104,332 shares in the last quarter. 80.93% of the stock is currently owned by institutional investors.

Insider Activity

In related news, Director Leslie J. Kilgore sold 358 shares of the company's stock in a transaction on Friday, October 18th. The stock was sold at an average price of $765.00, for a total value of $273,870.00. Following the sale, the director now directly owns 35,262 shares of the company's stock, valued at $26,975,430. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other news, Director Richard N. Barton sold 5,698 shares of the business's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $756.00, for a total value of $4,307,688.00. Following the sale, the director now directly owns 246 shares of the company's stock, valued at $185,976. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, Director Leslie J. Kilgore sold 358 shares of the company's stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $765.00, for a total value of $273,870.00. Following the completion of the sale, the director now owns 35,262 shares in the company, valued at $26,975,430. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 209,810 shares of company stock worth $142,049,542 in the last quarter. 1.76% of the stock is owned by company insiders.

Analysts Set New Price Targets

NFLX has been the topic of a number of research analyst reports. Evercore ISI increased their price target on shares of Netflix from $750.00 to $775.00 and gave the stock an "outperform" rating in a report on Friday, October 18th. Macquarie reiterated an "outperform" rating and issued a $795.00 target price on shares of Netflix in a research report on Friday, October 18th. Jefferies Financial Group raised their price target on Netflix from $780.00 to $800.00 and gave the company a "buy" rating in a research report on Friday, October 18th. China Renaissance assumed coverage on Netflix in a report on Thursday, September 5th. They issued a "hold" rating and a $680.00 price objective for the company. Finally, BMO Capital Markets reiterated an "outperform" rating and set a $825.00 price objective (up from $770.00) on shares of Netflix in a research report on Friday, October 18th. Two analysts have rated the stock with a sell rating, nine have assigned a hold rating and twenty-five have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $748.15.

Read Our Latest Analysis on Netflix

Netflix Stock Up 0.0 %

Netflix stock traded up $0.07 during trading hours on Friday, hitting $756.10. 2,996,829 shares of the stock traded hands, compared to its average volume of 3,925,487. Netflix, Inc. has a one year low of $417.10 and a one year high of $773.00. The firm's 50-day moving average price is $712.96 and its two-hundred day moving average price is $664.70. The company has a current ratio of 1.13, a quick ratio of 1.13 and a debt-to-equity ratio of 0.62. The company has a market cap of $323.20 billion, a PE ratio of 42.79, a PEG ratio of 1.46 and a beta of 1.25.

Netflix Company Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

See Also

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report