SG Americas Securities LLC lowered its stake in shares of Neumora Therapeutics, Inc. (NASDAQ:NMRA - Free Report) by 62.5% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 21,581 shares of the company's stock after selling 36,026 shares during the quarter. SG Americas Securities LLC's holdings in Neumora Therapeutics were worth $285,000 at the end of the most recent reporting period.

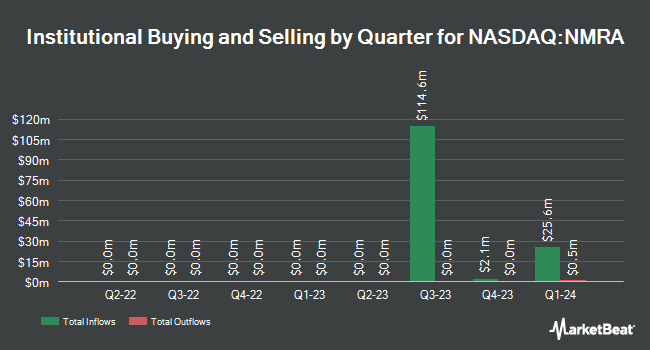

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Quarry LP acquired a new stake in shares of Neumora Therapeutics during the 2nd quarter worth approximately $98,000. The Manufacturers Life Insurance Company increased its stake in shares of Neumora Therapeutics by 79.5% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 111,828 shares of the company's stock valued at $1,099,000 after purchasing an additional 49,527 shares during the last quarter. Marshall Wace LLP acquired a new position in shares of Neumora Therapeutics during the 2nd quarter worth $1,323,000. Callan Capital LLC lifted its position in shares of Neumora Therapeutics by 222.6% during the 2nd quarter. Callan Capital LLC now owns 661,194 shares of the company's stock worth $6,500,000 after buying an additional 456,207 shares during the last quarter. Finally, SkyOak Wealth LLC acquired a new stake in Neumora Therapeutics in the second quarter valued at about $147,000. 47.65% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Neumora Therapeutics

In related news, Director Matthew K. Fust sold 14,049 shares of the company's stock in a transaction dated Friday, October 18th. The stock was sold at an average price of $17.03, for a total transaction of $239,254.47. Following the sale, the director now owns 20,100 shares in the company, valued at $342,303. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In other Neumora Therapeutics news, CFO Joshua Pinto sold 28,496 shares of the firm's stock in a transaction on Thursday, August 22nd. The shares were sold at an average price of $11.63, for a total value of $331,408.48. Following the completion of the sale, the chief financial officer now directly owns 210,469 shares in the company, valued at approximately $2,447,754.47. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Matthew K. Fust sold 14,049 shares of Neumora Therapeutics stock in a transaction on Friday, October 18th. The shares were sold at an average price of $17.03, for a total transaction of $239,254.47. Following the completion of the sale, the director now directly owns 20,100 shares of the company's stock, valued at approximately $342,303. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 110,538 shares of company stock worth $1,390,513 over the last quarter. Company insiders own 26.40% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on NMRA. Mizuho started coverage on shares of Neumora Therapeutics in a report on Monday, July 8th. They issued an "outperform" rating and a $20.00 target price for the company. Royal Bank of Canada reissued an "outperform" rating and issued a $29.00 price objective on shares of Neumora Therapeutics in a research note on Wednesday, September 4th. Needham & Company LLC reaffirmed a "buy" rating and set a $23.00 target price on shares of Neumora Therapeutics in a research note on Friday. Finally, HC Wainwright initiated coverage on shares of Neumora Therapeutics in a report on Tuesday, October 1st. They set a "buy" rating and a $30.00 price target for the company. One analyst has rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $22.83.

View Our Latest Report on NMRA

Neumora Therapeutics Stock Performance

Shares of NMRA stock traded down $2.44 on Monday, hitting $14.05. The company had a trading volume of 2,626,066 shares, compared to its average volume of 685,948. The stock's 50-day moving average is $12.79 and its two-hundred day moving average is $11.33. Neumora Therapeutics, Inc. has a twelve month low of $8.33 and a twelve month high of $21.00. The firm has a market cap of $2.24 billion and a P/E ratio of -5.49.

Neumora Therapeutics (NASDAQ:NMRA - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported ($0.37) EPS for the quarter, meeting analysts' consensus estimates of ($0.37). Equities research analysts predict that Neumora Therapeutics, Inc. will post -1.48 EPS for the current year.

Neumora Therapeutics Profile

(

Free Report)

Neumora Therapeutics, Inc, a clinical-stage biopharmaceutical company, engages in developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases. The company develops navacaprant (NMRA-140), a novel once-daily oral kappa opioid receptor antagonist, which is in phase 3 clinical trials for the treatment of major depressive disorder.

Read More

Before you consider Neumora Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neumora Therapeutics wasn't on the list.

While Neumora Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.