Murchinson Ltd. cut its position in Nano Dimension Ltd. (NASDAQ:NNDM - Free Report) by 50.0% during the 2nd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 7,775,000 shares of the technology company's stock after selling 7,775,000 shares during the quarter. Nano Dimension comprises 3.2% of Murchinson Ltd.'s holdings, making the stock its 5th biggest position. Murchinson Ltd. owned approximately 3.66% of Nano Dimension worth $17,105,000 at the end of the most recent quarter.

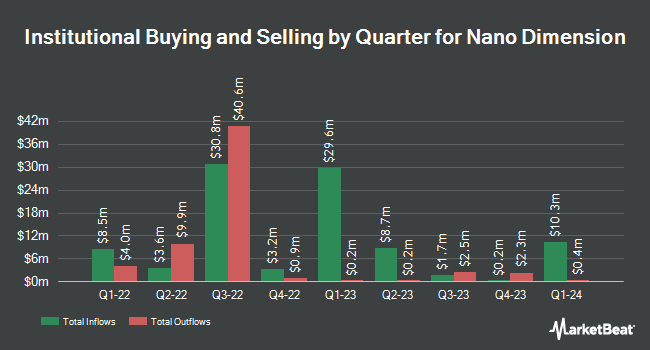

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. Keynote Financial Services LLC bought a new stake in shares of Nano Dimension during the first quarter valued at about $36,000. Virtu Financial LLC acquired a new position in shares of Nano Dimension in the 1st quarter worth $42,000. Tidal Investments LLC raised its holdings in Nano Dimension by 725.7% during the 1st quarter. Tidal Investments LLC now owns 239,519 shares of the technology company's stock worth $667,000 after buying an additional 210,510 shares during the period. California State Teachers Retirement System lifted its position in shares of Nano Dimension by 10.7% in the 1st quarter. California State Teachers Retirement System now owns 234,586 shares of the technology company's stock valued at $653,000 after acquiring an additional 22,580 shares in the last quarter. Finally, Shell Asset Management Co. acquired a new stake in Nano Dimension during the 1st quarter valued at $882,000. 33.89% of the stock is owned by institutional investors and hedge funds.

Nano Dimension Stock Up 2.8 %

Shares of NNDM traded up $0.06 during mid-day trading on Tuesday, reaching $2.21. The company's stock had a trading volume of 525,352 shares, compared to its average volume of 1,354,085. Nano Dimension Ltd. has a 1 year low of $2.04 and a 1 year high of $3.01. The company has a market cap of $469.53 million, a price-to-earnings ratio of -4.80 and a beta of 1.65. The business has a fifty day moving average of $2.21 and a 200 day moving average of $2.42.

Nano Dimension (NASDAQ:NNDM - Get Free Report) last released its earnings results on Tuesday, August 20th. The technology company reported ($0.20) earnings per share for the quarter. The business had revenue of $14.99 million for the quarter. Nano Dimension had a negative net margin of 266.36% and a negative return on equity of 14.80%.

About Nano Dimension

(

Free Report)

Nano Dimension Ltd., together with its subsidiaries, engages in additive manufacturing solutions in Israel and internationally. The company offers 3D printers, comprising AME systems, which are inkjet printers, that produces Hi-PEDs by depositing proprietary conductive and dielectric substances, as well as integrates in-situ capacitors, antennas, coils, transformers, and electromechanical components; micro additive manufacturing systems, a digital light processing printers (DLP) that achieves production-grade polymer and composite parts; and industrial additive manufacturing systems, that utilizes a patented foil system that fabricates ceramic and metal parts.

Read More

Before you consider Nano Dimension, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nano Dimension wasn't on the list.

While Nano Dimension currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.