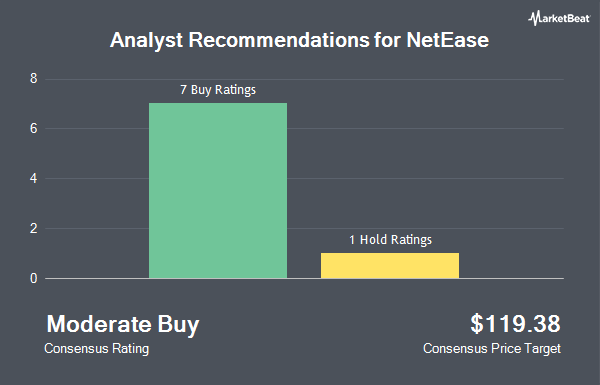

Shares of NetEase, Inc. (NASDAQ:NTES - Get Free Report) have earned an average recommendation of "Moderate Buy" from the six research firms that are covering the company, MarketBeat.com reports. Two analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $112.67.

Several research firms have commented on NTES. Bank of America lowered their price objective on shares of NetEase from $142.00 to $120.00 and set a "buy" rating for the company in a research report on Friday, August 23rd. Morgan Stanley reiterated an "equal weight" rating and set a $100.00 price objective on shares of NetEase in a research report on Friday, July 5th. Jefferies Financial Group lowered their price objective on shares of NetEase from $126.00 to $103.00 and set a "buy" rating for the company in a research report on Thursday, August 22nd. Barclays lowered their price objective on shares of NetEase from $104.00 to $82.00 and set an "equal weight" rating for the company in a research report on Monday, August 26th. Finally, StockNews.com lowered shares of NetEase from a "strong-buy" rating to a "buy" rating in a report on Saturday, July 20th.

Get Our Latest Stock Report on NetEase

NetEase Trading Up 1.5 %

NTES traded up $1.24 during trading on Tuesday, hitting $82.32. 1,220,518 shares of the company traded hands, compared to its average volume of 1,749,860. The company has a market cap of $52.86 billion, a PE ratio of 13.43, a P/E/G ratio of 1.76 and a beta of 0.55. The stock's 50-day simple moving average is $84.28 and its two-hundred day simple moving average is $90.25. NetEase has a 1 year low of $75.85 and a 1 year high of $118.89.

NetEase (NASDAQ:NTES - Get Free Report) last posted its earnings results on Thursday, August 22nd. The technology company reported $12.05 earnings per share for the quarter, beating the consensus estimate of $1.62 by $10.43. The company had revenue of $25.49 billion during the quarter, compared to analysts' expectations of $26.01 billion. NetEase had a net margin of 26.98% and a return on equity of 22.30%. NetEase's quarterly revenue was up 6.1% on a year-over-year basis. During the same period last year, the company posted $1.75 earnings per share. Equities analysts expect that NetEase will post 6.05 EPS for the current year.

NetEase Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, September 20th. Investors of record on Friday, September 6th were paid a $0.435 dividend. This represents a $1.74 annualized dividend and a yield of 2.11%. The ex-dividend date was Friday, September 6th. NetEase's dividend payout ratio is presently 28.22%.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in NTES. Mather Group LLC. increased its position in NetEase by 1,415.0% during the 2nd quarter. Mather Group LLC. now owns 303 shares of the technology company's stock valued at $31,000 after purchasing an additional 283 shares during the period. SYSTM Wealth Solutions LLC increased its position in NetEase by 55.5% during the 2nd quarter. SYSTM Wealth Solutions LLC now owns 328 shares of the technology company's stock valued at $31,000 after purchasing an additional 117 shares during the period. Ariadne Wealth Management LP purchased a new position in NetEase during the 2nd quarter valued at about $35,000. Highline Wealth Partners LLC purchased a new position in NetEase during the 3rd quarter valued at about $45,000. Finally, ORG Partners LLC purchased a new position in NetEase during the 1st quarter valued at about $50,000. Hedge funds and other institutional investors own 11.07% of the company's stock.

About NetEase

(

Get Free ReportNetEase, Inc engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally . The company operates through Games and Related Value-Added Services, Youdao, Cloud Music, and Innovative Businesses and Others segments.

Read More

Before you consider NetEase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetEase wasn't on the list.

While NetEase currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.