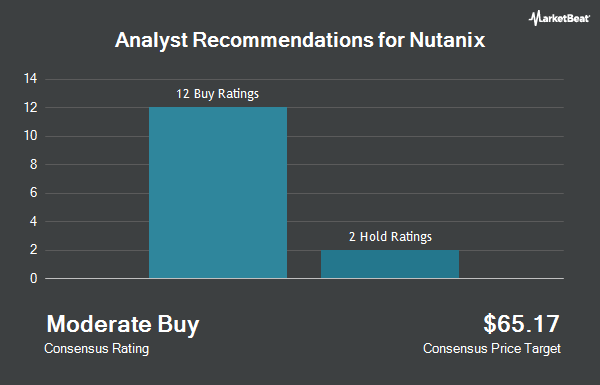

Shares of Nutanix, Inc. (NASDAQ:NTNX - Get Free Report) have received a consensus rating of "Moderate Buy" from the fifteen ratings firms that are currently covering the firm, MarketBeat.com reports. Four investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. The average twelve-month target price among brokerages that have issued ratings on the stock in the last year is $72.00.

A number of research firms have recently weighed in on NTNX. Morgan Stanley cut their price target on shares of Nutanix from $72.00 to $62.00 and set an "equal weight" rating on the stock in a report on Friday, June 21st. Barclays reduced their target price on Nutanix from $81.00 to $80.00 and set an "overweight" rating for the company in a report on Thursday, May 30th. Northland Capmk cut shares of Nutanix from a "strong-buy" rating to a "hold" rating in a research note on Thursday, May 30th. Needham & Company LLC raised their target price on shares of Nutanix from $72.00 to $80.00 and gave the company a "buy" rating in a research note on Thursday, May 30th. Finally, Raymond James lifted their price objective on Nutanix from $72.00 to $76.00 and gave the stock an "outperform" rating in a research note on Thursday, May 30th.

Get Our Latest Research Report on Nutanix

Nutanix Stock Performance

Shares of NASDAQ NTNX traded up $0.66 during mid-day trading on Friday, reaching $49.82. The company had a trading volume of 1,846,167 shares, compared to its average volume of 2,746,511. The stock has a fifty day moving average of $52.79 and a two-hundred day moving average of $59.08. The company has a market capitalization of $12.29 billion, a price-to-earnings ratio of -711.71, a PEG ratio of 4.45 and a beta of 1.16. Nutanix has a 12-month low of $29.18 and a 12-month high of $73.69.

Nutanix (NASDAQ:NTNX - Get Free Report) last issued its earnings results on Wednesday, May 29th. The technology company reported $0.01 EPS for the quarter, beating analysts' consensus estimates of ($0.11) by $0.12. Nutanix had a negative return on equity of 7.74% and a negative net margin of 0.57%. The firm had revenue of $524.58 million for the quarter, compared to the consensus estimate of $516.13 million. Sell-side analysts forecast that Nutanix will post 0.12 earnings per share for the current fiscal year.

Insider Buying and Selling at Nutanix

In other Nutanix news, CEO Rajiv Ramaswami sold 23,986 shares of the stock in a transaction on Tuesday, June 18th. The stock was sold at an average price of $54.19, for a total transaction of $1,299,801.34. Following the completion of the transaction, the chief executive officer now directly owns 407,045 shares in the company, valued at $22,057,768.55. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, COO David Sangster sold 10,384 shares of the business's stock in a transaction that occurred on Tuesday, June 18th. The stock was sold at an average price of $54.19, for a total value of $562,708.96. Following the transaction, the chief operating officer now directly owns 64,333 shares of the company's stock, valued at approximately $3,486,205.27. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Rajiv Ramaswami sold 23,986 shares of the firm's stock in a transaction on Tuesday, June 18th. The shares were sold at an average price of $54.19, for a total value of $1,299,801.34. Following the sale, the chief executive officer now directly owns 407,045 shares of the company's stock, valued at $22,057,768.55. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 46,936 shares of company stock valued at $2,531,273. 0.46% of the stock is currently owned by corporate insiders.

Institutional Trading of Nutanix

Several large investors have recently made changes to their positions in NTNX. GAMMA Investing LLC lifted its position in Nutanix by 35.2% during the 2nd quarter. GAMMA Investing LLC now owns 933 shares of the technology company's stock worth $53,000 after buying an additional 243 shares in the last quarter. M&T Bank Corp grew its stake in shares of Nutanix by 3.6% during the fourth quarter. M&T Bank Corp now owns 9,270 shares of the technology company's stock valued at $442,000 after purchasing an additional 325 shares during the last quarter. Allspring Global Investments Holdings LLC increased its holdings in shares of Nutanix by 2.0% in the first quarter. Allspring Global Investments Holdings LLC now owns 18,433 shares of the technology company's stock valued at $1,138,000 after purchasing an additional 369 shares in the last quarter. Daiwa Securities Group Inc. raised its position in Nutanix by 9.0% in the 2nd quarter. Daiwa Securities Group Inc. now owns 4,500 shares of the technology company's stock worth $256,000 after purchasing an additional 370 shares during the last quarter. Finally, 180 Wealth Advisors LLC lifted its holdings in Nutanix by 3.6% during the 2nd quarter. 180 Wealth Advisors LLC now owns 10,854 shares of the technology company's stock worth $615,000 after buying an additional 374 shares in the last quarter. Institutional investors own 85.25% of the company's stock.

Nutanix Company Profile

(

Get Free ReportNutanix, Inc provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa. The company offers hyperconverged infrastructure software stack that converges virtualization, storage, and networking services into a turnkey solution; Acropolis Hypervisor, an enterprise-grade virtualization solution; flow virtual networking and flow network security, which offers services to visualize the network, automate common network operations, and build virtual private networks; Nutanix Kubernetes Engine for automated deployment and management of Kubernetes clusters to simplify the provisioning, operations, and lifecycle management of cloud-native environments, applications, and microservices; and Nutanix Cloud Clusters.

Featured Stories

Before you consider Nutanix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutanix wasn't on the list.

While Nutanix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.